World Liberty Financial proposes using less than 5% of WLFI in the treasury as incentives to boost the USD1 stablecoin, aiming to create growth momentum.

World Liberty Financial proposes using 5% of WLFI reserves to promote the USD1 stablecoin.

World Liberty Financial proposes using 5% of WLFI reserves to promote the USD1 stablecoin.

Use WLFI to promote the USD1 stablecoin.

- On December 18th, World Liberty Financial (WLFI), a DeFi project backed by the Trump family, officially released a key proposal to use less than 5% of WLFI Token in the Treasury as rewards to boost the USD1 stablecoin.

🚨 GOVERNANCE UPDATE 🚨

— WLFI (@worldlibertyfi) December 17, 2025

A new proposal is now LIVE for voting from the community: using a portion of the unlocked WLFI Treasury as incentives to fuel USD1 adoption.

Over the last 3 weeks alone, WLFI has:

• Bought back $10,000,000 of WLFI using USD1

• Secured major spot…

According to documents published on the forum, World Liberty Financial stated that the core objective of this proposal is to expand the supply and increase the usage of the USD1 stablecoin.

- Specifically, the project proposes using a portion of WLFI Token in the treasury as an incentive for CeFi and DeFi partners, thereby promoting new Use Case for USD1, improving liquidation across multiple blockchains, and accelerating the integration of this stablecoin into trading, payment, and yield applications.

WLFI believes that increasing the number of USD1 users will not only help scale the entire ecosystem but also enhance the economic value created on the WLFI infrastructure, thereby providing long-term benefits for the WLFI Token .

- Recently, World Liberty Financial has made several notable advancements, most recently WLFI announced the repurchase of $10 million worth of WLFI using the USD1 stablecoin, and listed WLFI Spot Trading pairs on Binance.

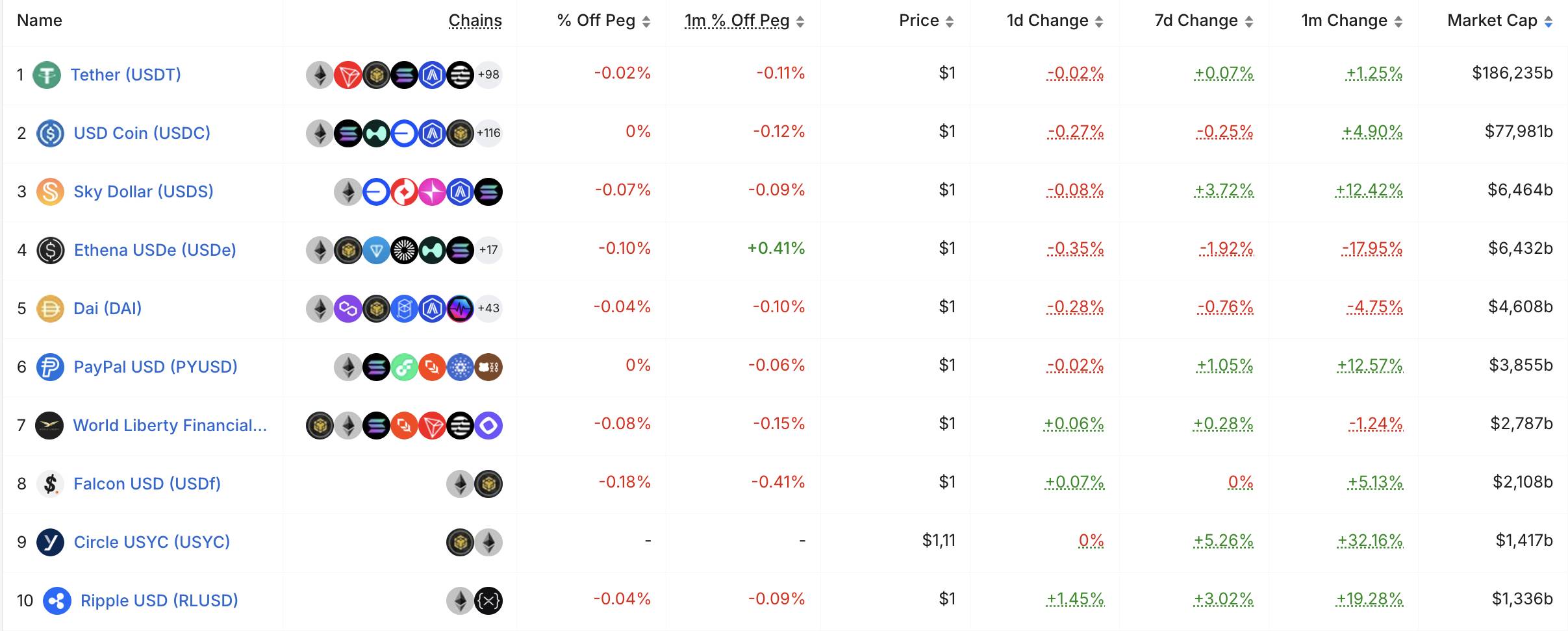

Currently, USD1 has a market Capital of approximately $2.74 billion, ranking 7th among USD- Peg stablecoins. Since March 2025, USD1's market Capital has only increased by just over $700 million, following MGX's $2 billion investment in Binance using USD1 .

Statistics on the market Capital of the top 10 stablecoins. Source: defillama (December 18, 2025)

Statistics on the market Capital of the top 10 stablecoins. Source: defillama (December 18, 2025)

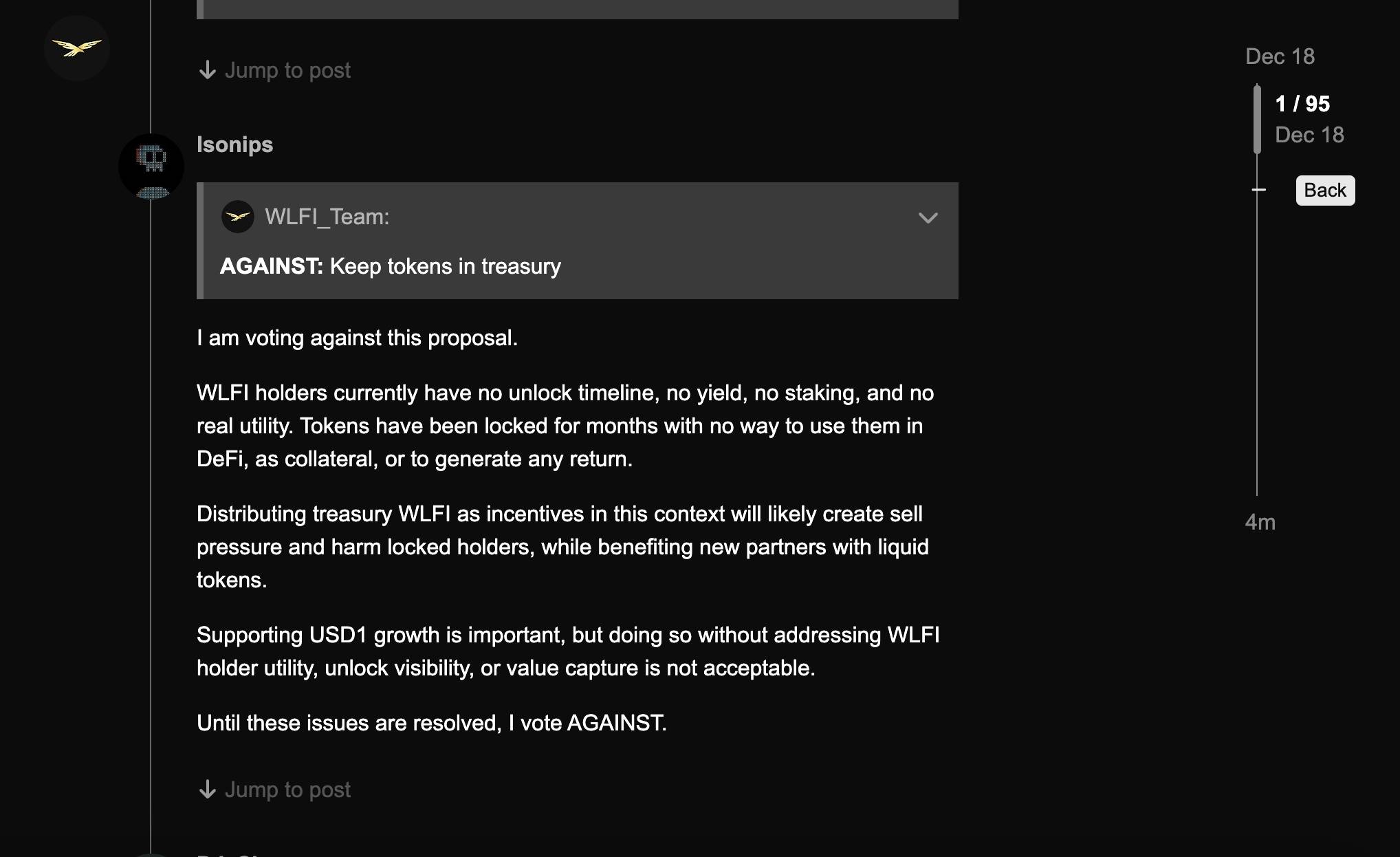

The community strongly protested.

- Although the goal of promoting the growth of USD1 is considered reasonable by many, the majority of current comments on the World Liberty Financial governance forum lean towards opposition. The focus of criticism lies in the fact that WLFI has not yet demonstrated any clear utility but has already been proposed for use as incentives.

Many holder argue that WLFI currently offers no yield, no Staking, and is almost solely for governance purposes, while the Token remains locked for months. Therefore, bringing WLFI from the treasury to the market at this time could create selling pressure, causing long-term holders to suffer losses.

- One opinion on the forum stated that distributing WLFI at this time only benefits the partners receiving the liquidation Token , while holder whose tokens are locked bear the risk.

- In addition, the community has also expressed concerns about the lack of transparency in the WLFI unlock schedule. Although the WLFI team stated that the unlock schedule is in its final stages, many investors believe that any Treasury related proposals should include specific unlock information to fully assess their impact on tokenomics.

Coin68 compilation