The Bit price has recently plummeted, breaking through an important support level and falling below $90,000. This decline occurred as Bit struggled to maintain momentum and moved further away from $100,000.

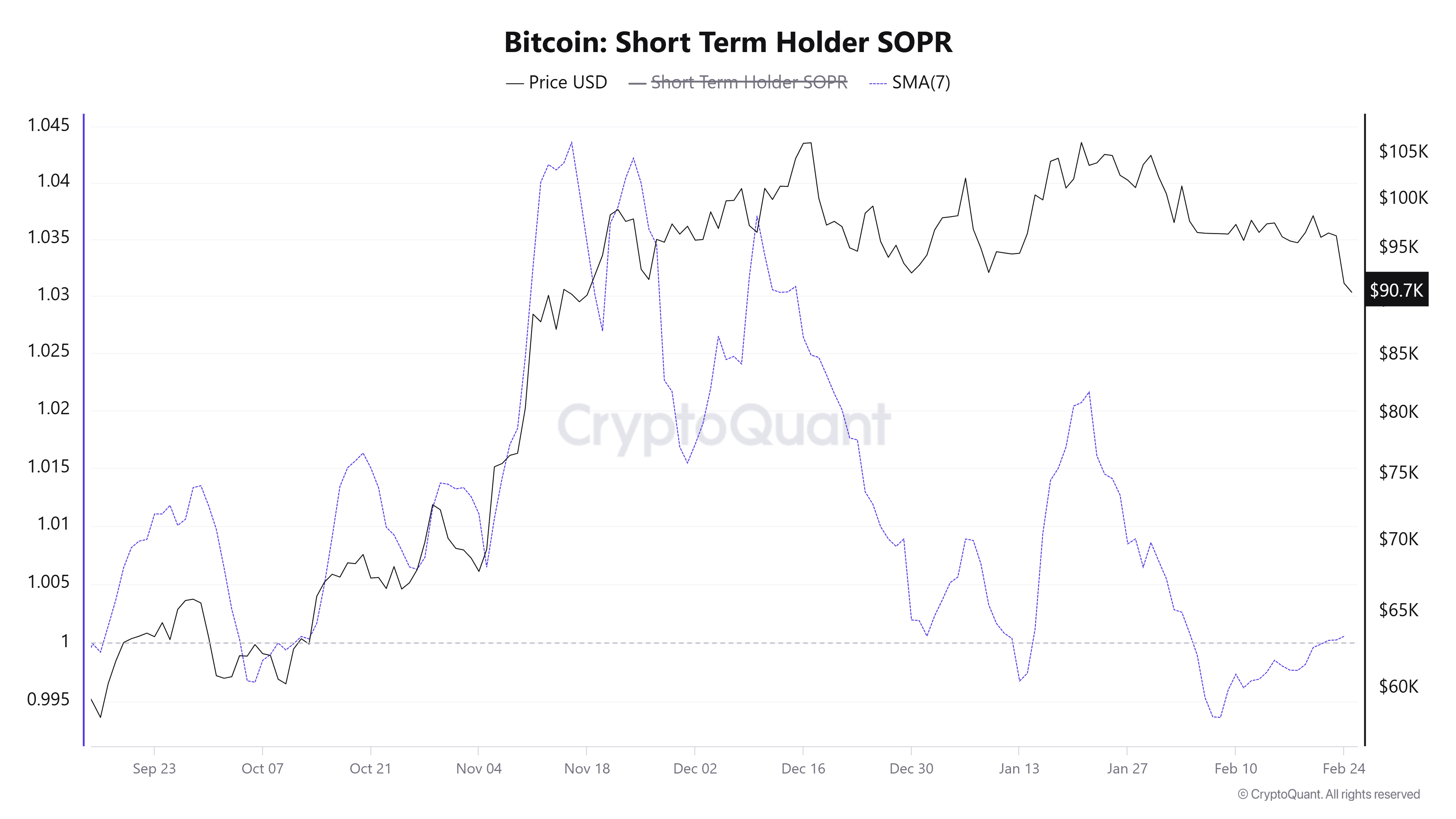

The current downtrend may be influenced by the behavior of Short-Term Holders (STHs) in response to market changes.

Bit Investors Concerned About Losses

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) indicator is having difficulty recovering above the 1.0 threshold, which would indicate that STHs are willing to realize profits and hold. If the indicator fails to reach this level, selling pressure may increase. If the SOPR remains below 1.0, more STHs are likely to sell, potentially causing additional losses for Bit investors.

The current situation is concerning. STHs are known for their rapid trading behavior. If they start selling in large quantities, the Bit price could decline rapidly. The inability of the SOPR to remain above the critical threshold suggests that bearish sentiment may be increasing, which could push the Bit price below $90,000 and extend the market downturn.

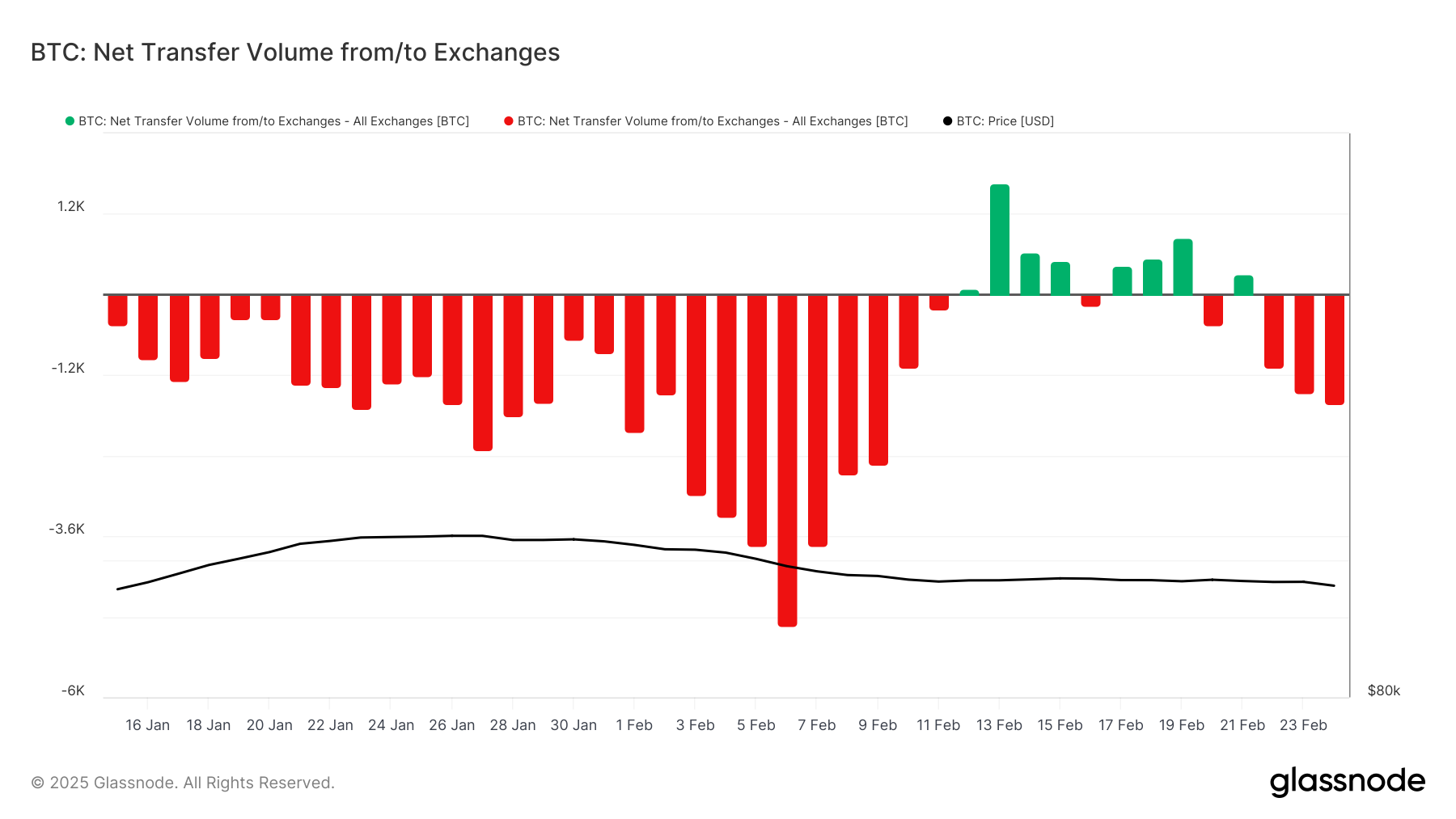

Despite the significant drop in Bit over the past 24 hours, the net outflows from exchanges suggest that a large amount of BTC did not leave the exchanges. In the last 24 hours, there was only a 157 BTC, or $14 million, outflow from the exchanges. This modest outflow does not align with the typical panic selling that often occurs after such a sharp decline.

The relatively low level of large withdrawals suggests that Short-Term Holders (STHs) have been hesitant to sell despite the recent decline. This may indicate that many investors are holding, waiting for a reversal. If there is no large wave of selling, Bit may be able to find a path to recovery as the market situation improves.

Bit Price Continues to Decline

The current Bit price is $88,449, the lowest level since November 2024. It has dropped nearly 8% in the last 24 hours. This decline has caused Bit to lose the support of the downtrend line that had been in place for over a month. If the Bit price can remain above the next major support level of $87,041, it may be able to rebound.

The Bit price is expected to test the $87,041 support level before attempting a recovery. If the support holds, Bit may have the opportunity to break through the next resistance at $89,800 and continue its journey towards $92,005. These potential movements could signal a reversal and trigger a positive trend.

However, if Bit loses the $87,041 support level, selling pressure may intensify, and Bit could drop to $85,000. Such a decline would invalidate the current recovery outlook and potentially lead to a prolonged downtrend, causing further losses for investors.