Shiba Inu (SHIB) has been trading below $0.000020 over the past month and fell 30% in February. The current market capitalization is $8.25 billion. Despite this decline, SHIB's technical indicators are showing mixed signals, suggesting a potential trend reversal.

The RSI has recently recovered from oversold levels, and the BBTrend has turned positive, indicating a potential shift in buying interest. However, the EMA lines are still in a bearish setup, suggesting that SHIB is struggling to establish a strong uptrend.

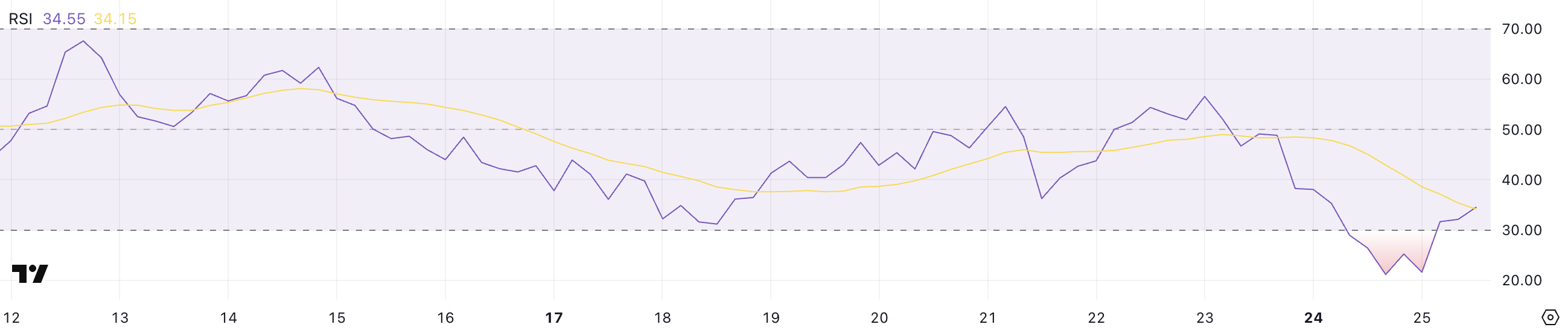

Shiba Inu RSI Neutral After Oversold

SHIB's RSI is currently at 34.5, having dropped as low as 21.6 a few hours ago. This is a sharp decline from 56.5 two days ago.

The RSI, or Relative Strength Index, helps traders identify overbought or oversold conditions by measuring the speed and change of price movements.

The indicator ranges from 0 to 100, with readings above 70 considered overbought and below 30 as oversold. SHIB's recent drop into the oversold territory is the first time since February 3, indicating strong selling pressure.

With the RSI currently at 34.5, SHIB is recovering from oversold conditions but remains in a fragile state. This level suggests that the selling momentum is slowing down, opening up the possibility of a short-term rebound.

However, the RSI is still relatively low, indicating that the bearish sentiment persists. If the RSI continues to rise above 40, it could signal a shift towards renewed buying interest.

Conversely, if it falls back below 30, SHIB could face another wave of selling pressure.

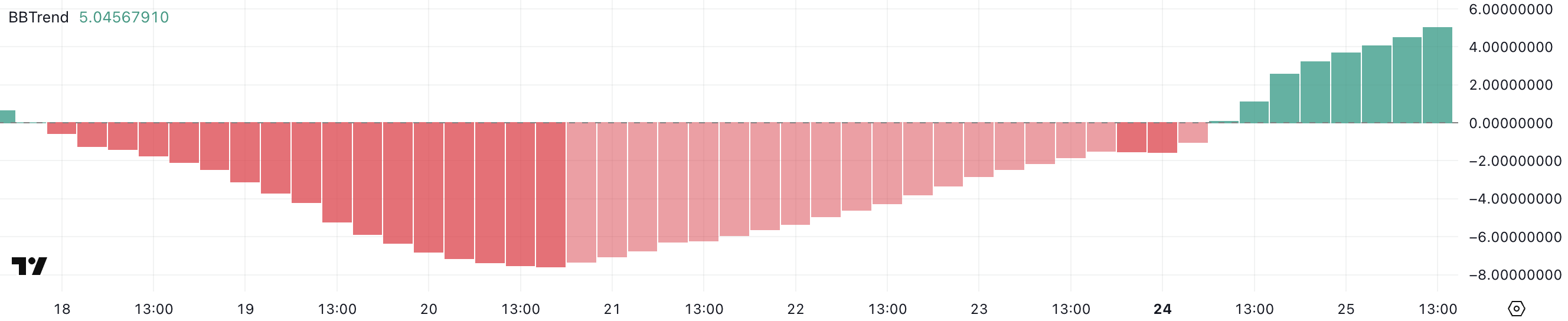

Shiba Inu BBTrend Positive...But Sustained Strength Not Yet

Shiba Inu's BBTrend has turned positive between yesterday and today, rising from -1.55 to its current level of 5. The BBTrend is a derivative of the Bollinger Bands, measuring the strength and direction of the trend.

Positive values indicate bullish momentum, while negative values suggest bearish pressure.

SHIB's BBTrend had been negative for six consecutive days, reaching a low of -7.58 on February 20. This low point reflected the strong selling pressure prior to the recent reversal.

With the BBTrend currently at 5, Shiba Inu is showing signs of renewed buying interest and potential bullish momentum. This positive shift suggests that buyers are regaining control, increasing the likelihood of a short-term uptrend.

However, while the positive turn in the BBTrend is encouraging, it is still relatively low compared to previous rallies. If the BBTrend continues to rise, it would confirm the strengthening of the bullish sentiment.

Conversely, if it starts to decline again, the buying momentum may weaken, leading to potential price corrections.

Shiba Inu Could Rally 42% on Golden Cross

Shiba Inu's price has recently fallen below $0.000014, extending its bearish trend since early February. The EMA lines remain in a bearish setup, with the short-term EMA below the long-term EMA, indicating persistent selling pressure.

If this downtrend continues, SHIB could test the $0.0000116 support level and potentially drop below $0.000012 for the first time since August 2024. The wide gap between the EMAs suggests strong bearish momentum, making it difficult for buyers to regain control.

However, if SHIB manages to reverse this trend, it could test the $0.0000146 resistance level. Breaching this level could trigger a rally towards $0.000017. Furthermore, if it clears this resistance, Shiba Inu's price could continue to rise and reach $0.0000196.

Strong buying momentum could propel the meme coin to break above $0.00002 for the first time since late January.

For this bullish scenario to materialize, the short-term moving averages would need to cross above the long-term moving averages, confirming the trend reversal. Until then, the bearish moving average setup suggests that the downward pressure may persist.