Ethereum (ETH) fell nearly 10% on February 25. This decline caused its market capitalization to fall below $300 billion. This is the first time since early November 2024.

Several indicators such as RSI and moving averages are showing a downward trend. While ETH is experiencing this decline, market observers are looking for either continued downside or potential reversal.

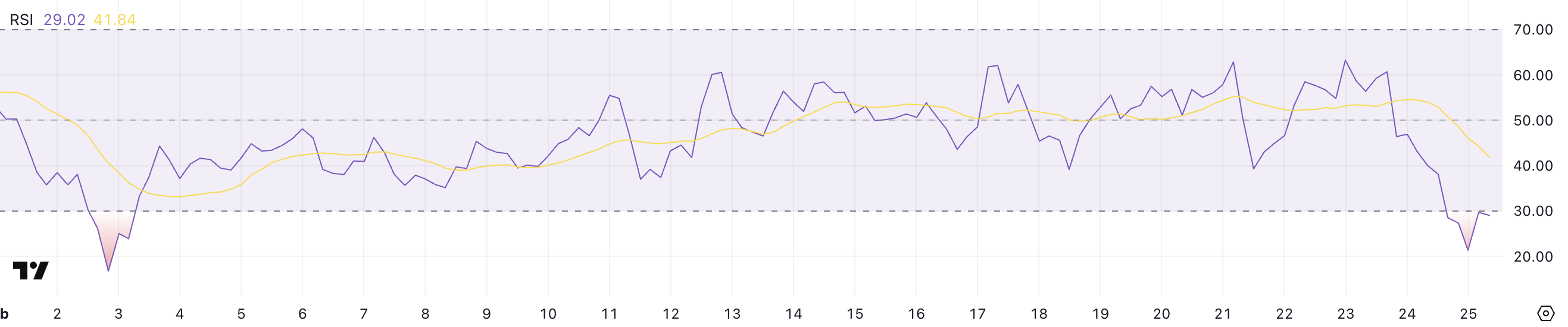

RSI, Ethereum in Oversold Territory

ETH's RSI is currently at 29, having dipped as low as 21.3 a few hours ago. This indicates that ETH has entered oversold territory for the first time since February 3, suggesting strong selling pressure.

RSI measures the speed and change of price movements to identify overbought or oversold conditions. Readings below 30 indicate the asset is oversold, while above 70 indicates it is overbought.

ETH's RSI at 29 suggests that selling momentum may be exhausted, hinting at the possibility of a short-term rebound. However, being in oversold territory does not guarantee an immediate price recovery.

If the downtrend continues, ETH could face further downward pressure until a significant reversal occurs. Conversely, if buyers step in at these oversold levels, a relief rally could follow.

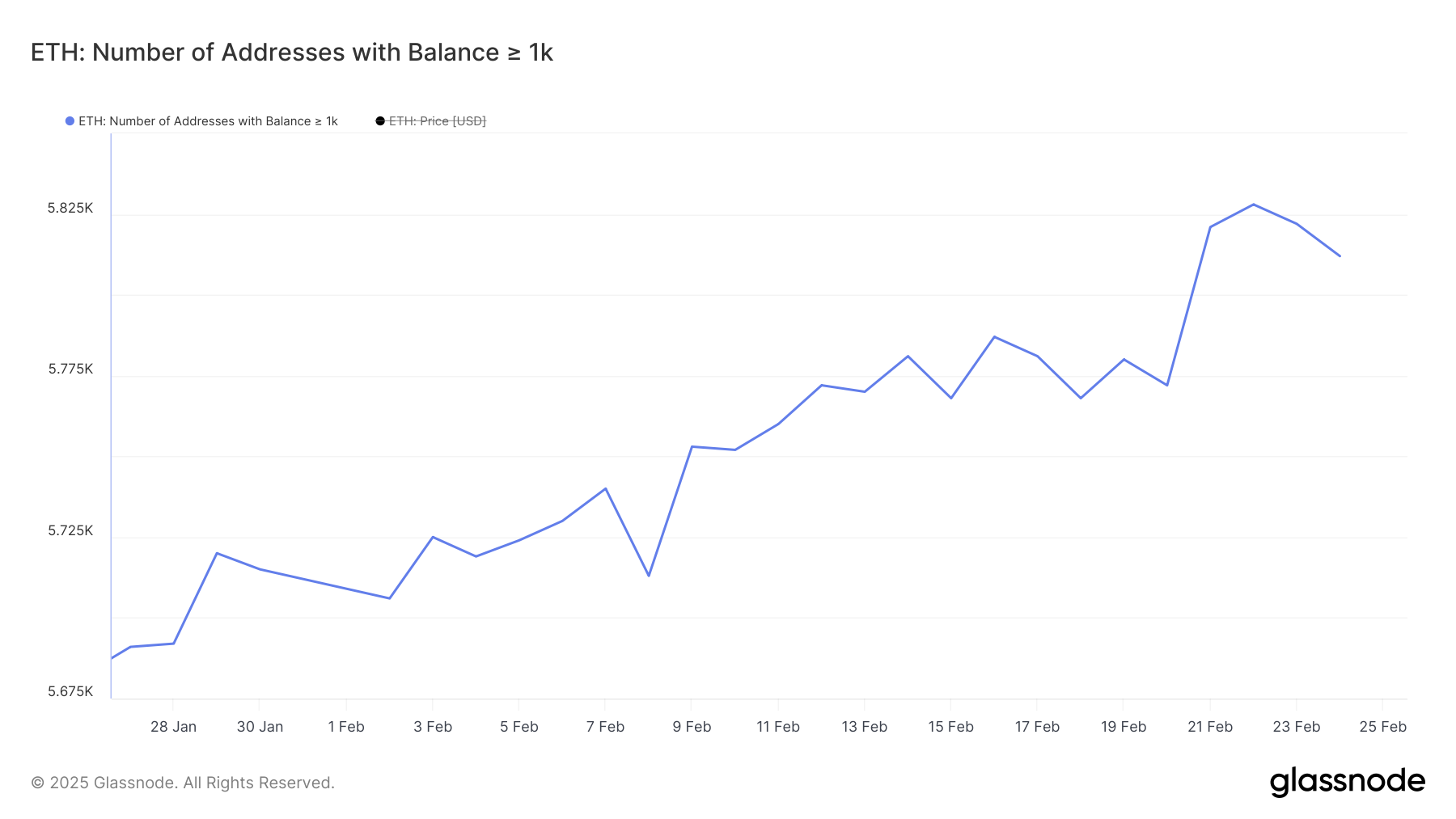

ETH Whales, Decrease from 1-Year High

The number of ETH whales - addresses holding at least 1,000 ETH - steadily increased throughout last month, peaking at 5,828 on February 22. This was the highest level since February 2024. However, this uptrend has recently reversed, with the current number slightly decreasing to 5,812.

This change suggests that some large holders may have started reducing their positions, potentially contributing to the recent selling pressure on ETH.

Tracking ETH whales is important, as they control a significant portion of the total supply and can influence price movements through their buying and selling activity. An increase in whale numbers typically indicates accumulation, which can support price stability or drive a rally. Conversely, a decrease suggests distribution, which can increase selling pressure.

The recent decline in ETH whale numbers may signal a cautious sentiment, which could imply short-term weakness.

However, the overall count is still relatively high. While some whales are selling, a significant number are still maintaining their positions, which could help mitigate a sharp decline.

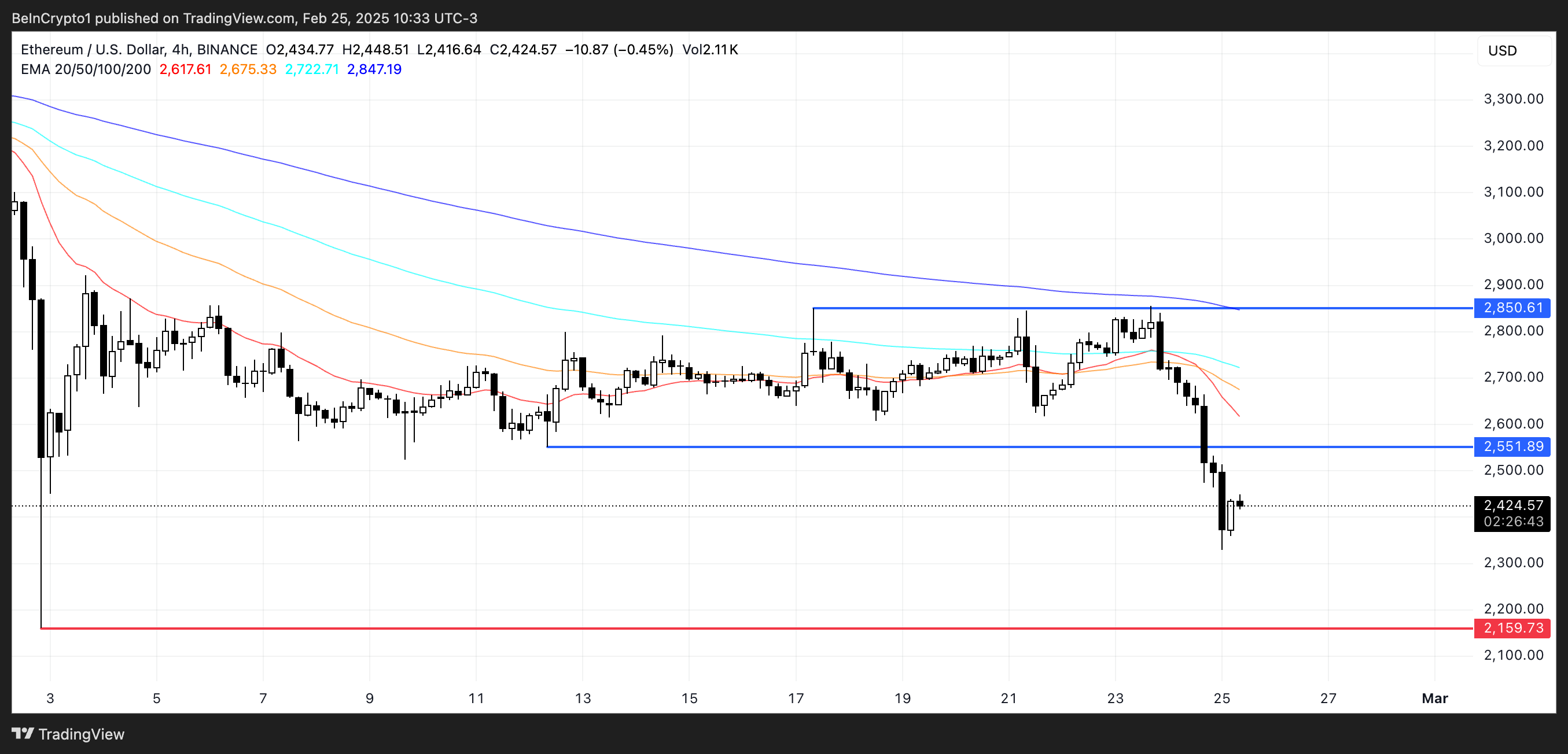

Will Ethereum Drop Below $2,200 Soon?

Ethereum's price has recently formed a death cross. This occurs when the short-term moving average crosses below the long-term moving average, indicating a bearish trend.

Following this pattern, Ethereum's price has dropped below $2,500, reflecting increased selling pressure. If this downtrend continues, ETH could fall as low as $2,159, which would be the first time it has dropped below $2,200 since December 2023. This death cross suggests that bearish momentum is dominant, and the downward pressure may persist, warranting caution.

However, if Ethereum can reverse this trend, it may attempt to break through the $2,551 resistance level. Successfully clearing this level could open the door for a rally towards $2,850.

For this reversal to occur, buying pressure would need to increase, pushing the short-term moving average back above the long-term moving average. Until then, the death cross suggests that bearish sentiment remains strong.