Bit (BTC) is once again testing investor sentiment. It remains in an unstable position, hinting at the possibility of a prolonged bearish cycle.

Amidst market uncertainty, analysts and traders are evaluating the current state of the cryptocurrency market. They are discussing whether the recent downtrend is a signal of further losses or a preparatory stage for a major rebound.

Analysts Assess Crypto Market Recovery

Julio Moreno, the research director at CryptoQuant, mentioned on Wednesday that Bit (BTC) holders realized their largest single-day loss since August 2024. The total loss amounted to $1.7 billion. This massive sell-off indicates widespread fear among traders, with many choosing to reduce their losses as Bit (BTC) fell below key support levels.

"Bit (BTC) holders just realized their largest single-day loss since August 2024: $1.7 billion," Moreno stated.

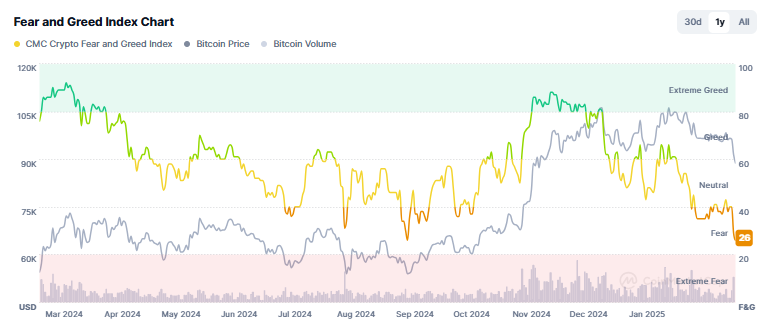

Meanwhile, market analyst Miles Deutscher emphasized that the widely-followed Crypto Fear and Greed Index has dropped to its lowest level since October 2024. In his view, the market's extreme fear could signal an impending price reversal, indicating that Bit (BTC) is approaching a crucial turning point.

"People are starting to get scared again. It's hard to believe, but that's ultimately what's needed to form a bottom," he explained.

Additionally, Deutscher observed that Bit (BTC) exchange inflows have reached their highest levels of the year amid the recent market turmoil. This suggests that traders have been hastily selling their holdings as Bit (BTC) dropped below $90,000.

However, he speculates that this fear-driven selling could set the stage for an unexpected rebound, potentially surprising those who have sold.

Mark Cullen, an analyst at AlphaBTC, offered his perspective on the situation, emphasizing the role of market makers. Cullen believes that the market makers at the Crypto.com exchange have intervened to prevent a deeper decline, recognizing that further drops could trigger a widespread capitulation event.

"They know that if Bit (BTC) goes lower, it could lead to the collapse of the entire crypto market and customers leaving with losses," he said.

Despite the intervention, Cullen suggests that a temporary rebound may occur before the next decline, maintaining a cautious stance. He does not anticipate an immediate collapse but does not rule out the possibility of another drop to the $87,000 range before a potential recovery.

M2 Money Supply Model Predicts Bit (BTC) Surge in March

Some analysts are closely watching for a potential bullish reversal in March 2025. Well-known cryptocurrency analyst Colin Talks Crypto has pointed to a strong correlation between Bit (BTC)'s price movements and the global M2 money supply.

His model suggests that Bit (BTC)'s price tends to respond to liquidity changes with a lag of approximately 46 days. According to the model, Bit (BTC) is expected to see a significant upward move around March 7, 2025, but this timeline may be accelerated due to recent trends.

The decreasing lag between M2 movements and Bit (BTC)'s response implies that the increased global liquidity could soon drive a BTC price increase. While the correlation is not perfect, it has historically been a strong directional signal for Bit (BTC)'s price trends.

"This is an astounding correlation, and in my opinion, it's too close to be a coincidence," the analyst said.

If the M2 money supply model holds true, Bit (BTC) could recover in early March. However, volatility remains a dominant theme in the short term, and traders should be prepared for potential rebounds as macroeconomic factors continue to influence institutional sentiment.

"... the price would need to recover above $96,000-$100,000 for the market to confirm it is preparing for a new growth phase. If the pressure persists, the market could enter a deeper correction phase," shared Maria Karola, CEO of StealthEx, in an interview with BeInCrypto.

Adding to the bearish pressure, Bit (BTC) ETFs have seen substantial net outflows. According to BeInCrypto, the institutional investors who played a key role in Bit (BTC)'s previous rally to new highs appear to be withdrawing funds from the market, raising concerns about further downside risks.

"This process [institutional redemptions] puts significant pressure on the BTC price as the issuer has to sell assets to meet the redemption requests," said Tracy Jin, Chief Operating Officer at MEXC, in an interview with BeInCrypto.