The so-called 'Trump Trade' is facing strong criticism as Bit, Tesla (TSLA), and the US Dollar have all seen significant declines.

The initial enthusiasm for President Donald Trump's growth-boosting policies has faded, leading to growing disappointment in the financial markets.

Bit, Tesla, and Dollar See Steep Declines

Bit reached over $100,000 amid optimism about the second Trump administration, but has now fallen below $85,310. Market analysis suggests a lack of firm support between $90,000 and $7,000, raising concerns about further declines.

This sharp drop is a reaction from traders to Donald Trump's failure to take concrete steps to ease cryptocurrency regulations, despite his initial promises. Crypto analyst and influencer Crypto Rover summarized the disappointment on social media.

"Trump promised us strategic Bit reserves. Instead, he gave us a trade war," the analyst wrote.

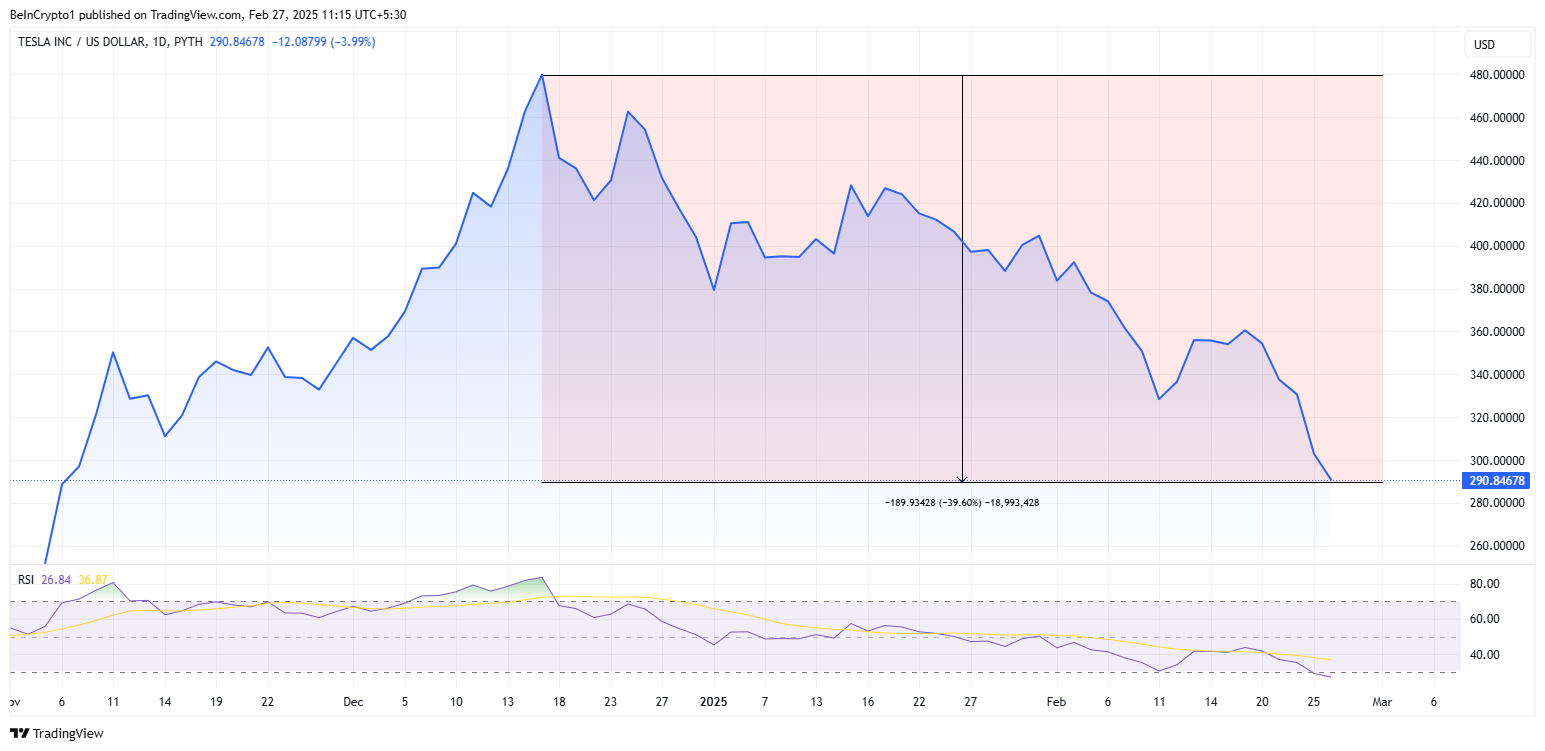

Tesla, seen as a barometer of the 'Trump Trade', has also experienced a sharp decline. TSLA stock has fallen nearly 40% from its peak after Trump's election victory. The electric vehicle giant lost almost 4% in a single day on February 26th, extending its year-to-date losses to 24%.

Investors are increasingly concerned that Tesla is being sidelined due to CEO Elon Musk's focus on federal reforms. Moreover, Musk's polarized political stance has negatively impacted Tesla's performance in Europe, where electric vehicle sales grew 37% in January but the company's sales declined 45%.

Similarly, the initially strong US Dollar and Treasury yields are also showing declines amid expectations for Trump's economic policies. Analysts are concerned that Trump's aggressive trade policies, particularly the newly announced tariffs, could reignite inflation and slow economic growth.

Impact of Trump's Trade War

The well-known financial analysis publication Kobeissi Letter emphasized the broad impact of Trump's aggressive trade stance. The president has recently announced comprehensive tariffs, including 25% on Canada and Mexico, 25% on the European Union, 10% on China, and up to 100% on BRICS countries.

These tariffs are expected to increase prices of goods within the US, with inflation expectations spiking and analysts warning they could double from recent lows.

"The market is now pricing in a resurgence of inflation as it expects prices to rise across many goods," the Kobeissi Letter observed.

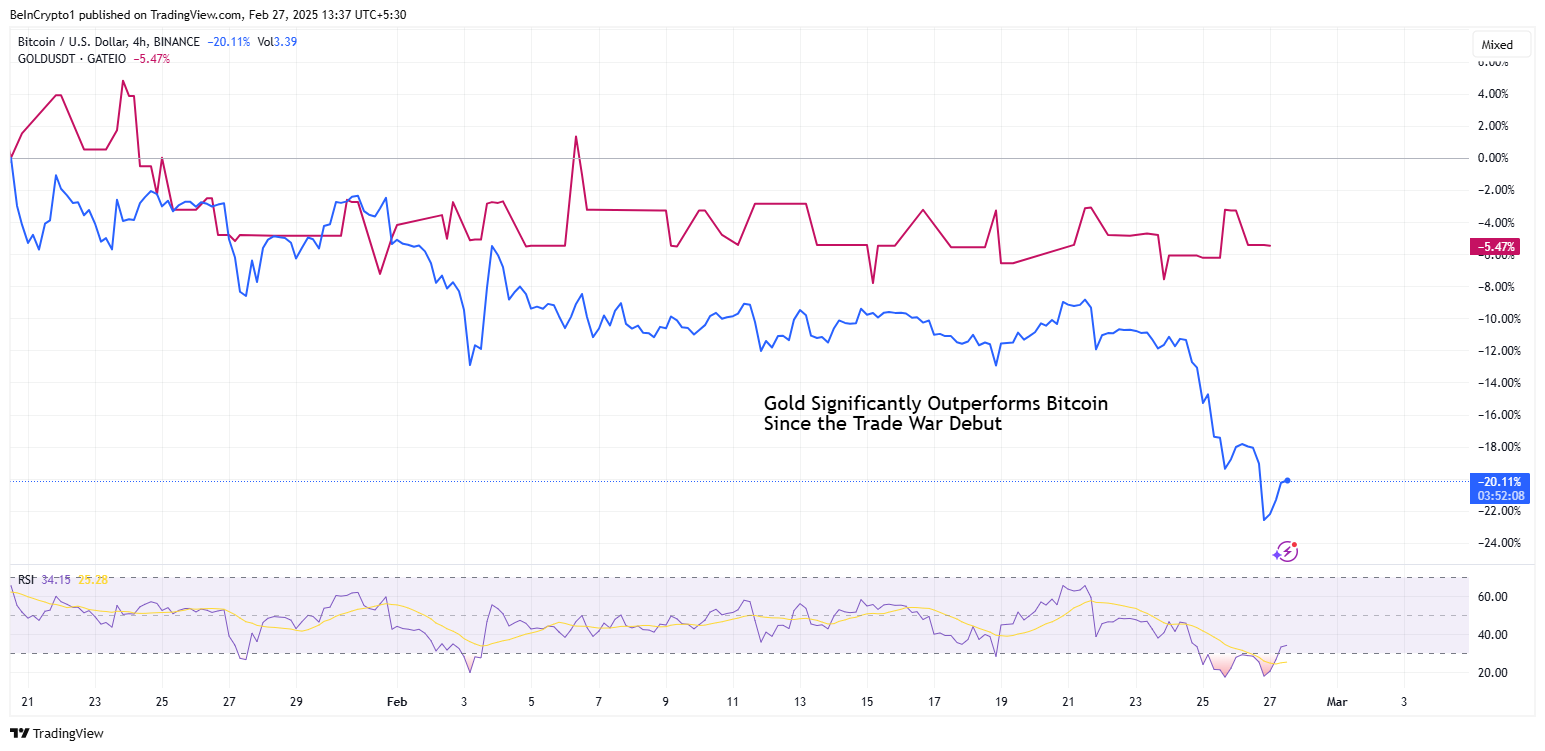

Meanwhile, one of the most striking trends in the financial markets is the sharp divergence between Bit and gold. Gold has recently risen 10%, while Bit has fallen 10%, in contrast to the historical perception of Bit as a hedge against economic uncertainty.

Amidst the market turmoil, new research from Dancing Numbers suggests that Trump's tariff plan could provide significant tax savings for Americans. The study indicates that replacing income tax with tariffs on imports could save the average American up to $325,561 in lifetime taxes.

If Trump's tariff plan eliminates federal income tax, residents of New Jersey, Connecticut, and New York could save $146,160, $149,535, and $136,215, respectively, over their lifetimes.

With many Americans struggling with high tax burdens, Trump's proposal could bring significant changes to the country's financial landscape. However, skeptics are concerned that relying solely on tariffs could increase inflation and create new economic challenges.

"This can shake up the global markets! Volatility is the new normal, and US inflation can remain elevated—no rate cuts? Not yet," user Jagadish expressed.

Investors are bracing for additional volatility as the market adjusts to Trump's policies. The 'Trump Trade' is facing its biggest test as inflation concerns grow and key assets are shaken.