Throughout most of February, the cryptocurrency market remained range-bound, but this week's activity has plummeted due to the impact of Donald Trump's war trade. This downward trend has triggered over $800 million in liquidations over the past 24 hours, with traders struggling with the volatility.

Despite the downtrend, crypto whales continue to accumulate some coins, positioning themselves for potential gains in March. This analysis examines some of these assets.

Bitcoin (BTC)

BTC has breached crucial support levels this week, moving out of the range it had maintained since early February to reach multi-month lows. The leading market coin is currently trading at $19,610, a price last seen in November.

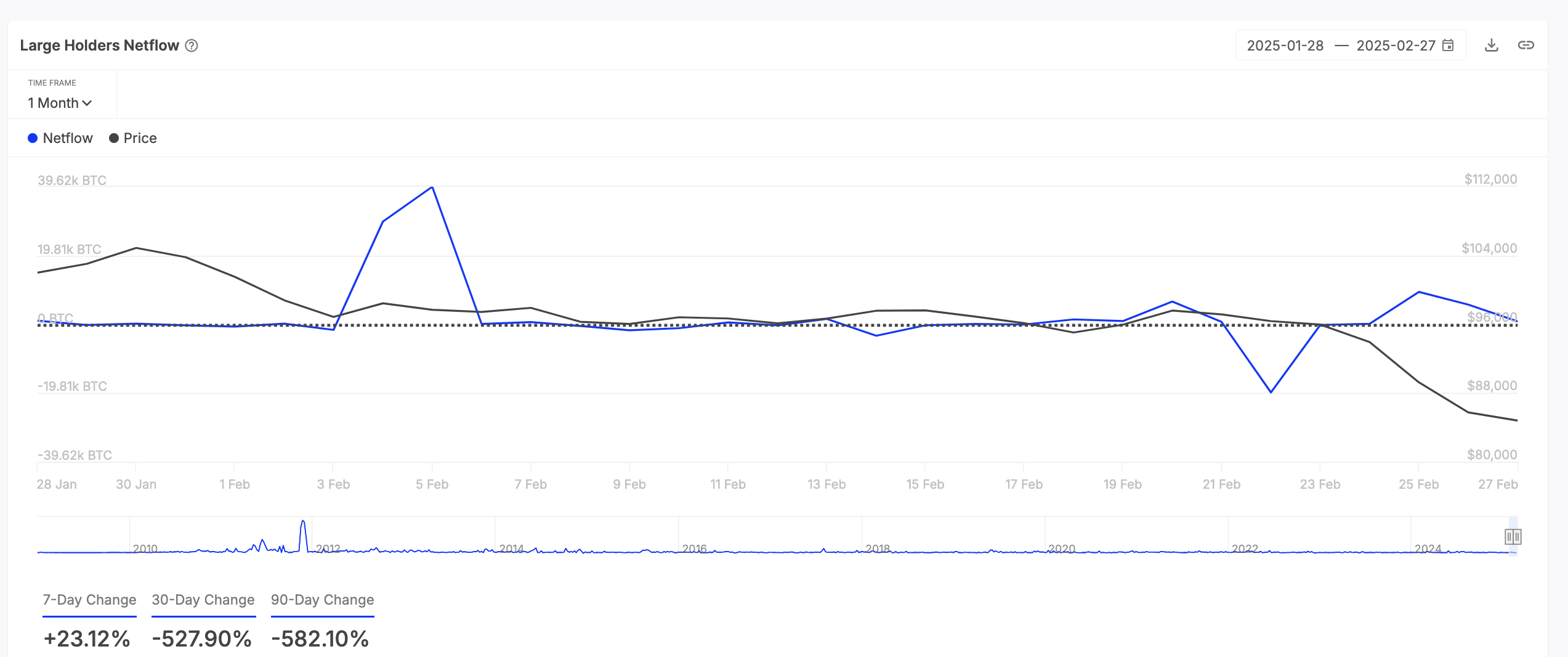

BTC whales are leveraging the discounted prices to strengthen their holdings, reflected in an increase in net inflows of large holders. According to on-chain data platform IntoTheBlock, this metric has surged 23% over the past 7 days.

Large holders are whale addresses holding at least 0.1% of the circulating supply. Their net inflows track the difference between assets flowing into and out of these major investor wallets.

This increase suggests that large holders are accumulating more of the asset, implying greater confidence and potential upward price pressure. This trend could prompt retail BTC traders to increase their buying pressure.

If this trend continues, the coin's circulating supply could decrease in March, potentially driving its value above $95,000.

The Sandbox (SAND)

The metaverse-based token SAND has also recently garnered the attention of whales, with the market anticipating a broad recovery in March. The token is currently trading at $0.29, down 43% over the past month.

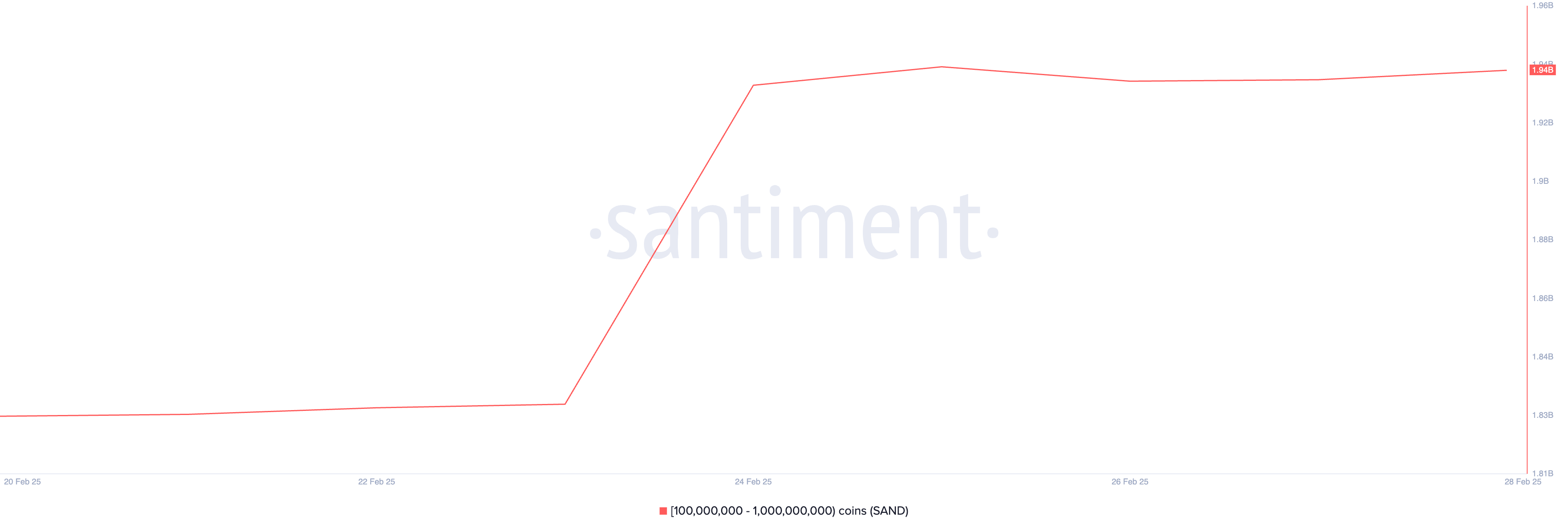

According to data from the crypto online data platform Santiment, over the past week, whales holding between 1 million and 10 million tokens have accumulated 180 million SAND, worth over $52 million at the current market price. This investor group now holds 1.93 billion SAND tokens, the highest level since June 2024.

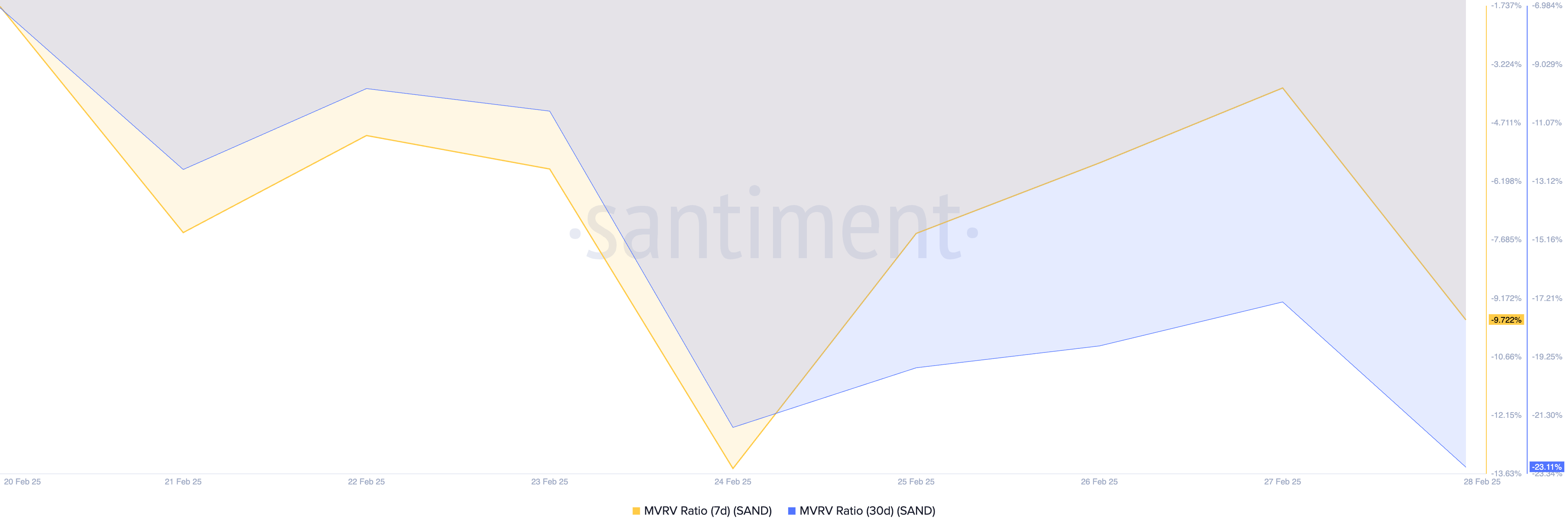

The surge in SAND whale holdings reflects the current undervalued state, as evidenced by the Market Value to Realized Value (MVRV) ratio readings. At the time of writing, the token's 7-day and 30-day MVRV ratios are -9.72 and -23.11, respectively.

Historically, negative MVRV ratios have been a buy signal, indicating that the asset is trading below its historical cost basis, providing buying opportunities in a downturn.

Therefore, if this whale accumulation continues, SAND's price could surpass $0.35 in March.

Optimism (OP)

Layer2 (L2) token OP is another asset that whales are strategically buying to position for gains in March. According to IntoTheBlock, large holder inflows have surged 240% over the past 7 days.

OP's value has declined 8% during that period, indicating that whales have increased their inflows despite the price drop.

When large holders increase their inflows, it suggests they are transferring a significant amount of the asset into their wallets. This is generally considered a positive signal, implying confidence in the asset's future price movements and potential upward momentum.

If this trend continues through March, OP's price could reach $1.52.