XRP surged 30% after being included in the US cryptocurrency reserve yesterday. This caused the price to exceed $2.90 for the first time in a month. This massive rally triggered strong upward momentum, but altcoins fell 10% in a day.

XRP is showing noticeable correction today, suggesting profit-taking is underway. Whether the price can regain upward momentum or continue the correction depends on key resistance and support levels. Traders are closely watching the $2.75 upside and $2.52 downside.

XRP RSI in neutral after overbought

XRP saw a huge surge in momentum after being included in the US cryptocurrency reserve. The price rose 30%, pushing the Relative Strength Index (RSI) up to 84.5.

RSI is a widely used momentum indicator that measures the speed and change of price movements on a scale of 0 to 100. Readings above 70 indicate the asset is overbought and may need correction. Levels below 30 suggest oversold conditions and potential buying opportunities.

XRP's RSI reaching 84.5, the highest since December 2, 2024, reflected extreme bullish sentiment, which often precedes short-term corrections.

Currently at 63, XRP's RSI has moved out of the overbought zone, reflecting the recent price correction. Readings above 60 still suggest upward momentum, but a drop from extreme levels may indicate waning buying pressure.

If the RSI continues to decline towards the neutral 50 zone, XRP could see further consolidation or deeper correction.

However, if buyers step in again to push the RSI back above 70, it could signal another attempt at new highs.

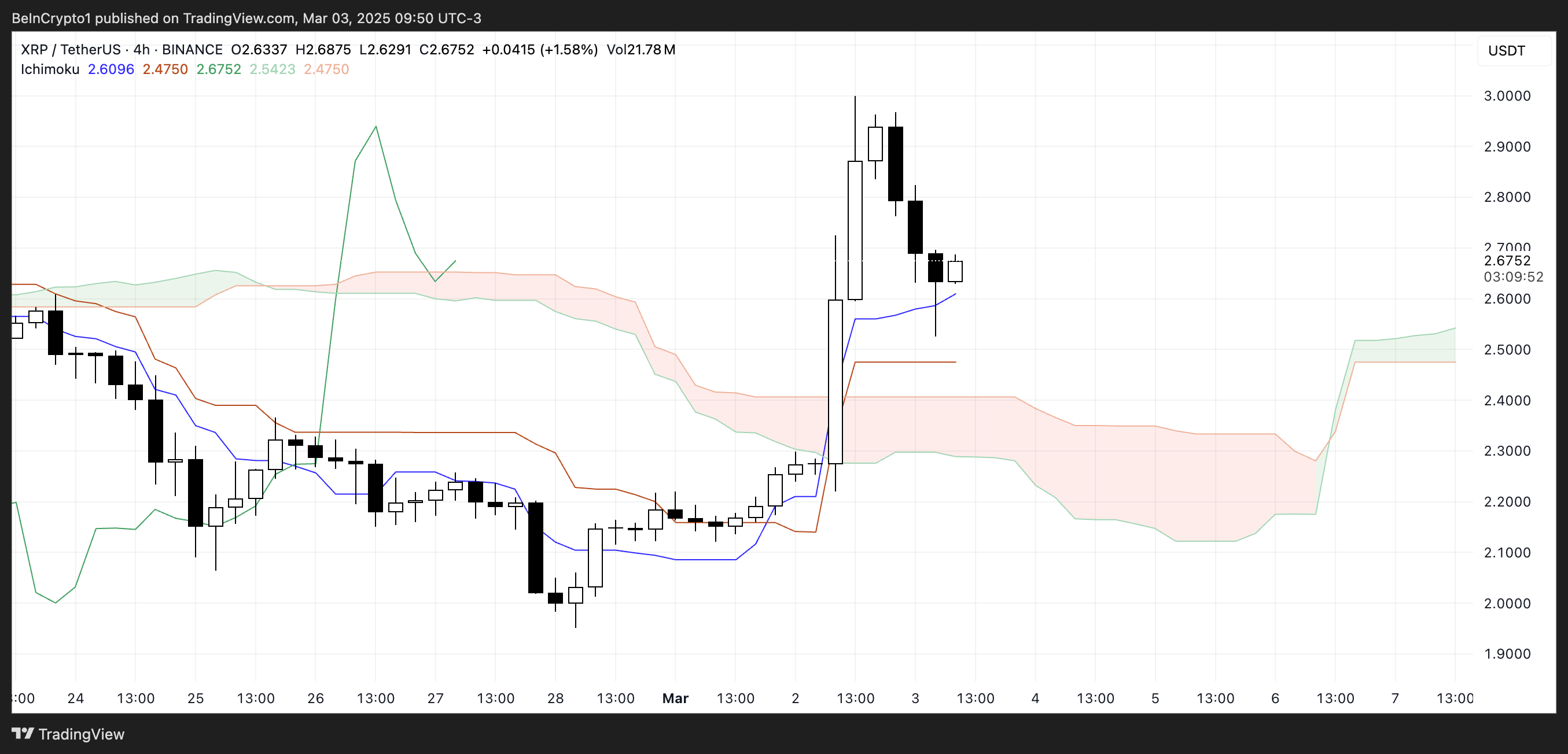

Ichimoku still bullish, but changes possible

XRP's Ichimoku Kinko Hyo chart analysis shows that the 30% surge after being included in the US cryptocurrency reserve has rapidly broken above the cloud (Kumo).

This breakout confirmed strong upward momentum, with XRP well above both the conversion line (blue) and baseline (red), indicating short-term and medium-term trend strength.

The sharp rise has pushed XRP into overbought territory. However, as seen in the last few candles, a correction has started, with the price moving closer to the baseline.

This suggests the uptrend is still intact, but the market is reassessing the recent gains, and XRP is testing short-term support.

If the price remains above the baseline, XRP could enter a correction before attempting another run at higher resistance levels.

However, if the correction deepens and XRP falls back towards the cloud, it may signal a loss of momentum. The future cloud (Senkou Span A and B) is still bullish but slightly flattening, indicating the market is at a critical juncture.

XRP price may struggle to reach $3

XRP saw a strong surge, nearly reaching $2.95, after being included in the US cryptocurrency reserve.

However, after this rapid rise, the price has started correcting within a few hours, suggesting some traders are taking profits.

The technical outlook now depends on whether the uptrend can regain strength. If buying pressure returns, XRP could retest the $2.75 resistance. Breaking above this level could then see a test of the $2.96 barrier that acted as a ceiling during yesterday's rally.

Successfully clearing this resistance could open the door for a move towards $3.15, which would be XRP's first time trading above $3 since February 1. The SEC dropping its lawsuit against XRP could provide the impetus for this.

If the downtrend continues and selling pressure increases, XRP's price could find support at $2.52. A break below this level could see the next major support at $2.36. Further declines could pull the price to $2.15 and $2.06.

This could happen if more questions are raised about assets included in the US cryptocurrency reserve. Harrison Seletzky, Director of Business Development at the digital identity platform SPACE ID, told BeInCrypto that the inclusion of such assets in the reserve is a strange choice:

"It is certainly surprising that US President Donald Trump announced a strategic cryptocurrency reserve, not just a strategic Bitcoin reserve. The asset selection is also peculiar. ETH and SOL are understandable given their strong and growing developer activity. However, the inclusion of essentially ghost chains like XRP and ADA compared to Ethereum and Solana is not clear. In fact, the TVL and stablecoin functionality of the XRPL and Cardano ecosystems are very small compared to other ecosystem participants - $80 million and $460 million respectively. To my eyes, this somewhat undermines the overall idea of mainstream cryptocurrency reserve assets like Bitcoin, Ether, and Solana." - Harrison Seletzky, Director of Business Development at SPACE ID

If the downtrend significantly strengthens, XRP could fall below the psychological $2 level, with $1.77 emerging as the next major support.