The cryptocurrency market continues to face selling pressure as digital asset investment products record their largest weekly outflows.

Bit (BTC) is barely holding above the $90,000 level despite Donald Trump's cryptocurrency reserve policy.

Crypto Outflows Hit Record High

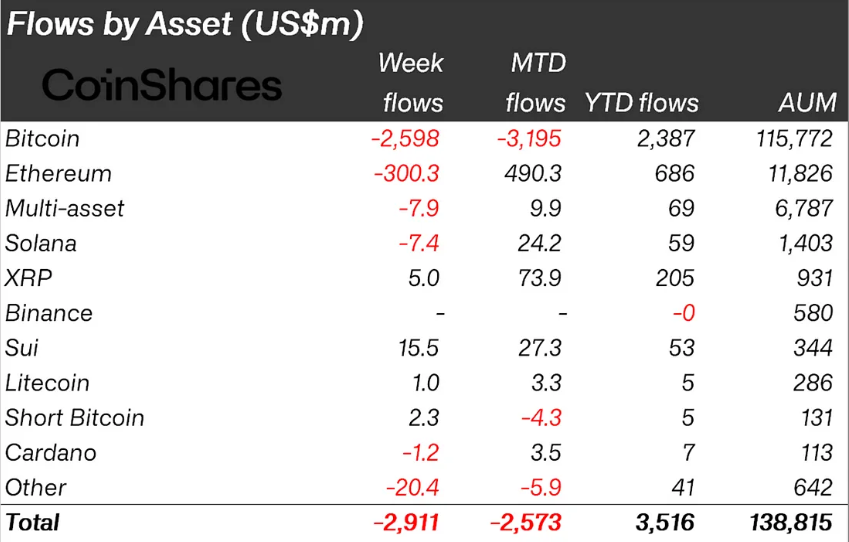

Last week, crypto outflows reached $2.9 billion, bringing the total to $3.8 billion over the past three weeks. This marks the third consecutive week of capital leaving the crypto sector, in contrast to the $29 billion that flowed into the market over the previous 19 weeks.

The latest CoinShares report attributes the negative sentiment across the crypto market as the driver of the outflows. Major events like the recent Bybit hack have contributed to the increased outflows. The hawkish stance of the Federal Reserve and broader macroeconomic concerns are also included.

"We believe the recent Bybit hack, the hawkish Fed, and the $29 billion of inflows over the prior 19 weeks have contributed to this trend. These factors are likely to have driven profit-taking and weakened sentiment across the asset class." – Report excerpt

According to BeInCrypto, the hack that saw millions stolen has shaken investor confidence, reinforcing fears about the security vulnerabilities in the crypto space. Additionally, the Federal Reserve's recent comments have signaled a cautious outlook on inflation and US GDP, leading to increased market uncertainty and a reduction in risk appetite.

In this context, CoinShares' research analyst James Butterfill emphasizes that Bit (BTC) has been the most heavily impacted by the bearish sentiment, experiencing $2.59 billion in outflows last week. Ethereum also suffered, recording its largest weekly outflow of $300 million. Other major altcoins, including Solana, saw outflows of $74 million each.

However, Bit (BTC) short positions saw a modest inflow of $2.3 million, suggesting that some investors are positioning themselves for further declines.

Despite the overall negative sentiment, some digital assets saw inflows. Sui attracted $15.5 million, the best performer, while XRP recorded $5 million in inflows. These gains indicate that certain projects continue to garner investor interest even as the market faces pressure.

In the case of XRP, the positive sentiment is maintained by the growing anticipation around the US Securities and Exchange Commission's (SEC) decision on the XRP ETF. The SEC has started the timeline to approve or deny specific ETF applications. Investors are hopeful that XRP can gain regulatory clarity. Including XRP in the Trump cryptocurrency reserve could further strengthen this sentiment.

Nevertheless, the recent outflows follow a concerning trend that has developed over the past few months. The previous week saw $508 million in crypto outflows, further exacerbating investor fears. Before that, the Federal Reserve's hawkish rhetoric and worrying Consumer Price Index (CPI) data had already triggered the first major crypto outflows of 2025, with $415 million leaving the market.

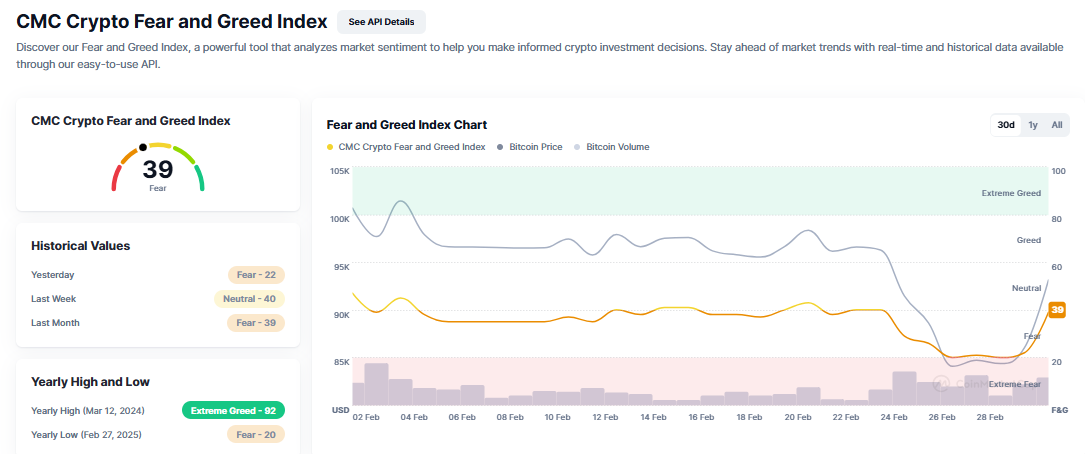

This series of events has led some analysts to point to macroeconomic factors as the primary drivers of the selling pressure, and investor sentiment remains fearful.

However, others argue that external policies, such as Donald Trump's tariffs, have contributed to the uncertain market environment, stoking inflation concerns and making risk assets like cryptocurrencies less attractive.

From a competitive perspective, structural changes, including cash and carry trading strategies, have been suggested as potentially contributing to Bit's (BTC) recent volatility.

At the time of writing, Bit (BTC) is trading at $90,395.