The total cryptocurrency market capitalization (TOTAL) and Bitcoin (BTC) have undergone a significant correction in the past 24 hours, offsetting the weekend's gains. BTC has fallen back below $85,000 and is currently trading at $84,255.

However, in a new report, an anonymous Cryptoquant analyst has suggested that this correction may be a preparation for a new uptrend. This analysis explains the reasons.

Smart Money Spotting Opportunities in Bitcoin's Decline

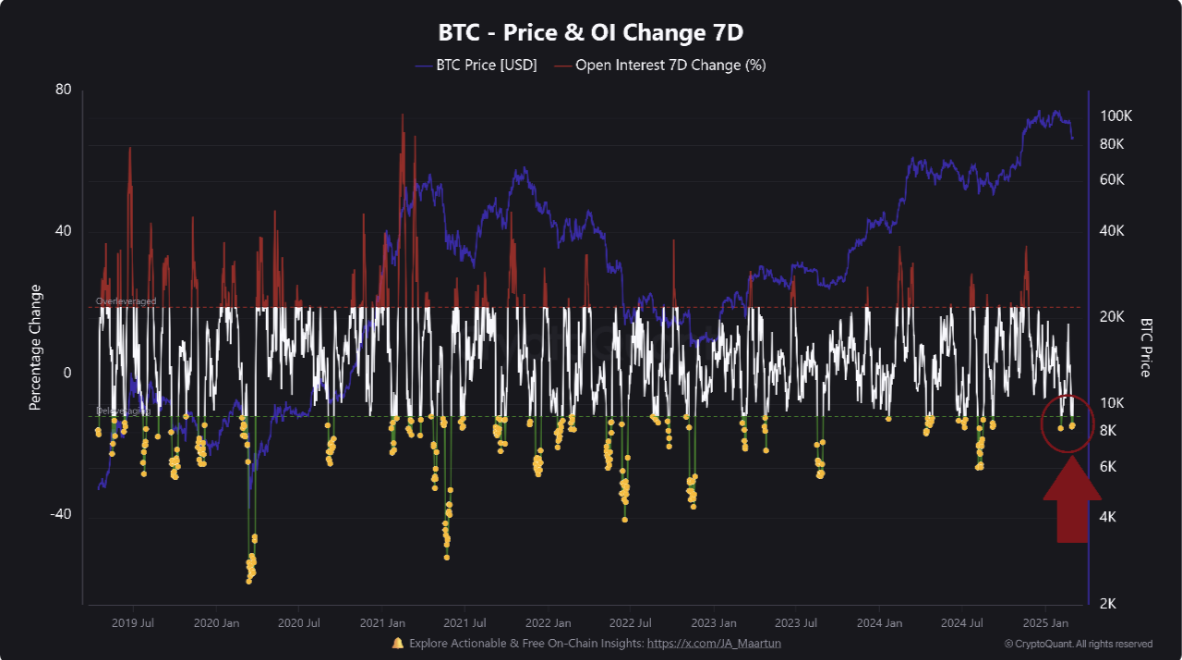

In a recently published report, an anonymous Cryptoquant analyst Banker has identified three key signals suggesting that BTC could experience a short-term price rebound. One of them is the decrease in the coin's open interest.

According to Banker, the change in BTC's open interest (7D) "decreased significantly to -14.42% on March 1."

Open interest measures the total number of outstanding derivative contracts, such as futures and options. The decrease in BTC's open interest suggests that market leverage is declining. Historically, such retreats can often provide buying opportunities for investors to re-enter at lower levels, triggering a new upward movement.

"This sharp decline signals a reduction in speculative activity and could provide a strong buying opportunity when the market declines. This may indicate the liquidation or resetting of positions," Banker wrote.

Another signal suggesting the possibility of a rebound is the decline in the Crypto Fear and Greed Index. At the time of writing, this index is at 15, indicating extreme fear among market participants. This suggests that investors have become very cautious, increasing selling activity.

Historically, such extreme fear levels indicate that the market is in an oversold state and close to the bottom. This provides buying opportunities for traders who want to "buy low and sell high."

"The recent decline suggests a cooling-off period, which could create a healthier market environment," Banker wrote.

Therefore, if BTC traders capitalize on this trend and increase their accumulation, they can set the stage for a short-term rebound. Additionally, Banker said that the anticipation of the March 7 cryptocurrency summit at the White House "could be a catalyst for short-term market movements."

This summit is hosted by White House AI and Crypto Czar David Sacks and is expected to be led by President Trump. It aims to shape cryptocurrency regulations, signaling an important shift in the U.S. digital asset policy. This emphasizes the government's pro-crypto approach and commitment to regulatory clarity.

According to Banker:

"Depending on the outcomes and announcements, there could be a small window of upside potential. For now, investors should be cautious but vigilant, as the current decline in open interest and sentiment could provide strategic entry points for those with a long-term perspective."

BTC Nears Critical RSI Level...Will It Rebound to $92,000 or Decline to $80,000?

In addition to these on-chain and macroeconomic indicators, the daily chart's Relative Strength Index (RSI) of BTC, which is close to an oversold state, confirms Banker's bullish outlook. At the time of reporting, this momentum indicator, which measures the asset's overbought and oversold conditions, is at 36.88.

This RSI level suggests that BTC is nearing oversold territory and could experience a positive price correction in the near future. If this is the case, the coin could bounce back and rise to the $92,247 resistance level.

However, if the downtrend persists, BTC's price could decline to $80,580.