Bitcoin (BTC), once seen as a hedge against financial uncertainty, is struggling to maintain this title amid global economic changes. The market trajectory of Bitcoin is increasingly resembling that of traditional risk assets.

After Donald Trump's inauguration on January 20, the cryptocurrency market experienced an unprecedented decline, losing about $1 trillion in value.

Bitcoin's Changing Role in Financial Markets

Historically, Bitcoin has been considered a hedge, moving in tandem with gold during uncertain times. However, this trend has reversed since President Trump's inauguration. While gold continues to rise, Bitcoin has undergone a severe correction, suggesting a fundamental shift in market perception.

"After Trump became president on January 20, the market fell from $3.7 trillion to $2.5 trillion. This is strange. The moment Trump took office marked the local peak for cryptocurrencies. He is the most pro-crypto president, yet," - Cryptocurrency analyst Symbiote.

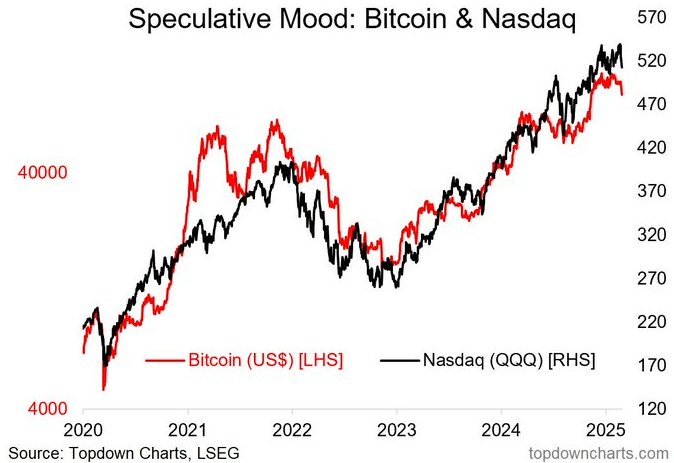

A key factor behind this change is that Bitcoin's correlation with traditional financial assets has increased. By 2024, BTC showed an approximately 88% co-movement with the NASDAQ 100 and S&P 500, in contrast to its previous role as a negatively correlated asset.

The current 30-day rolling correlation has dropped to around 40%, suggesting that Bitcoin is now trading more like a high-risk tech stock rather than a hedge against inflation or economic turmoil.

Liquidity is also a major concern. Financial markets have been pricing in reduced liquidity since 2020, which is having a severe impact on cryptocurrencies. Market observers point out that liquidity is flowing back into the dollar, the most stable asset during the trade war.

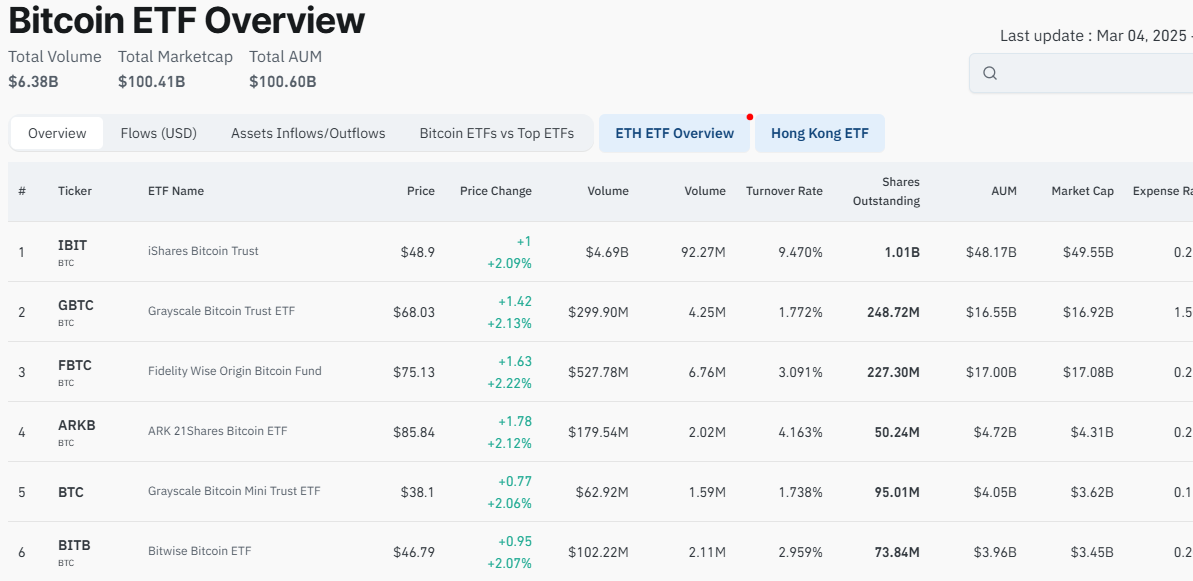

These changes have led to repeated crashes in the cryptocurrency market, increasing volatility and investor uncertainty. Coinglass data shows that Bitcoin ETF assets under management (AUM) have decreased from $120 billion to $100 billion in a matter of weeks.

Decentralized finance (DeFi) has also been impacted. DefiLlama data shows that the total value locked (TVL) has decreased from its 2025 peak of $128.7 billion to the current $93.2 billion.

Trump Trade War Concerns Impacting Crypto Sentiment

A recent Bank of America survey emphasizes the increasing fear of global trade wars. Specifically, 42% of respondents identified this as the most negative development for risk assets in 2025, up from 30% in January.

"When asked what the most negative global development would be for risk assets in 2025, 42% said a global trade war due to new tariff threats from the new Trump administration. This response was up from 30% in January who said a global trade war was the most negative," - Pensions & Investments report.

Notably, only 3% of respondents believe that Bitcoin would perform best in an all-out trade war, in stark contrast to gold and the dollar. These results highlight a significant shift in perception, as the market no longer views Bitcoin as a hedge during times of economic distress.

Amid geopolitical instability, the pioneering cryptocurrency is now seen as too volatile to provide meaningful protection against financial shocks.

Furthermore, Goldman Sachs' volatility fear index has spiked from 1.4 in December to over 9.1, with further volatility expected ahead. The widely followed financial news source, The Kobeissi Letter, suggests that Bitcoin's price movements will remain unstable as fears of a trade war intensify.

Hope for Bitcoin's Resurgence? Expert Opinions

Despite the downtrend, some experts argue that Bitcoin still has long-term potential. BeInCrypto recently reported on how Bitcoin could become a financial lifeline for the US. By embracing digital assets as part of a broader economic strategy, the US could leverage Bitcoin's decentralized nature to maintain financial resilience.

Here is the English translation: Furthermore, the ability of to provide liquidity to companies facing difficulties remains a powerful argument. BeInCrypto emphasized that are increasingly choosing as an alternative asset. "We have a good core business, but we are so small in relation to the capital markets. If we start investing more in a financial strategy, we can create more liquidity in our stocks and attract investors." - Bloomberg reported, quoting Good Food CEO Jonathan Ferrari. As corporate adoption continues to increase, may be able to regain its position as an important financial tool, rather than just a risky asset. However, one thing is clear: the role of in global finance is changing. "I understand the logic of reserves. I don't agree with it, but I understand it. We have gold reserves. is digital gold, and it's better than analog gold." - critic Peter Schiff recently acknowledged."Buying Bitcoin and voting with your dollars, sending a clear message, could be a way to save America in the long run. It's a return to the gold standard," - Coinbase CEO Brian Armstrong said.