The cryptocurrency and financial markets are currently experiencing a sense of déjà vu, comparing the current macroeconomic outlook to past cycles, particularly the previous Trump era's trade war.

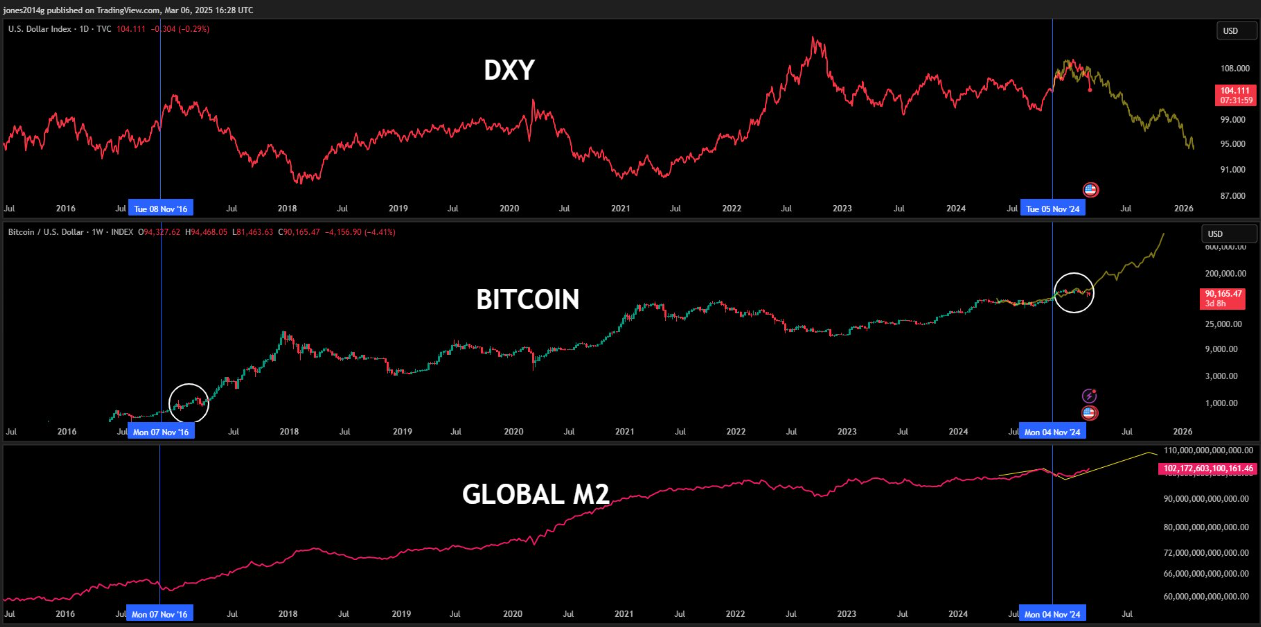

Traders and investors are closely watching the US dollar index (DXY) and M2 money supply, awaiting a recovery in the cryptocurrency market.

Bitcoin, Altcoins, Tariffs... Is a 2017-style rally ahead?

Recent charts from ZeroHedge suggest that the DXY in 2025 may follow a similar pattern to 2016, lending credibility to the idea that market trends reflect past patterns.

This similarity is garnering significant attention from investors, particularly in the cryptocurrency sector. Analysts are evaluating whether Bit and altcoins will follow a trajectory similar to the 2017 bull run.

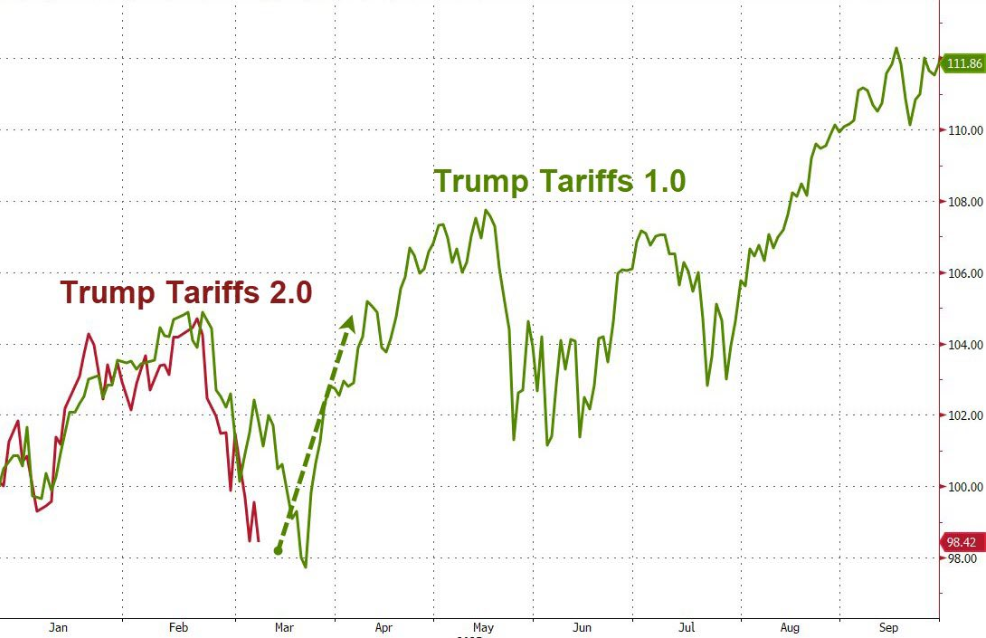

The financial market commentary The Kobeissi Letter has joined the discussion, highlighting the parallels between Trump's Tariff War 1.0 and 2.0.

The commentary acknowledges that the current macroeconomic conditions differ from the previous Trump administration, but notes the surprisingly similar technical movements across various asset classes, including stocks, gold, oil, and Bit.

Gold prices have surged over 10% this year, reflecting a shift to safe-haven assets, while Bit has declined by nearly 10%. This divergence highlights the importance of risk appetite in shaping market sentiment.

Bit's recent price action further corroborates these observations. On March 4th, Bit plummeted $2,000 in just 25 minutes, approaching the $90,000 resistance level. Market participants noted that cryptocurrency valuations can fluctuate by over $100 billion without any substantive news.

This suggests that liquidity-driven movements and technical resistance levels play a crucial role in price volatility. In this regard, The Kobeissi Letter mentioned that long-term investors who capitalized on volatility during Trump's Trade War 1.0 found excellent buying opportunities, hinting that similar conditions may arise again.

Altcoin Season Aligning with the Trump Era

Meanwhile, the narrative of an "Altcoin Season" coinciding with a "Trump Season" is gaining traction in the cryptocurrency space. Crypto investor and analyst bitcoindata21 emphasized that Bit's price movement in 2025 may resemble the 2017 cycle, further reinforcing the belief that a major altcoin rally is on the horizon.

Historical trends suggest that a Bit market rally often precedes an explosive altcoin growth, as capital rotates, increasing the likelihood that the upcoming bull cycle will reflect the altcoin boom during Trump's first term.

Elsewhere, broader economic trends also point to potential upside for Bit. BeInCrypto reports that the DXY has recently fallen below key support levels, which has historically been a bullish signal for Bit. A weakening US dollar tends to drive investors towards alternative assets like cryptocurrencies and gold.

Analysts have also highlighted the expanding global M2 money supply as another factor that could fuel a Bit rally. Historically, M2 expansion has coincided with major Bit bull markets, and experts predict a potential surge by the end of March as liquidity conditions improve.

While uncertainty remains high due to current macroeconomic factors and policy changes, history suggests that investors who strategically position themselves during volatile periods often reap substantial rewards.

If the 2017-2020 pattern repeats, Bit and altcoins could enter a new bull cycle in the coming months. However, short-term volatility remains a key characteristic of the current market environment, and traders should exercise caution.