Over $30 Billion in Bitcoin and Ethereum Options Expire Today. Around $25 Billion in Bitcoin and $5 Billion in Ethereum contracts will be settled. How will the prices of the two assets react?

The expiration of these options will occur at 8:00 UTC on the cryptocurrency derivatives exchange Deribit, and could trigger volatility across the cryptocurrency market.

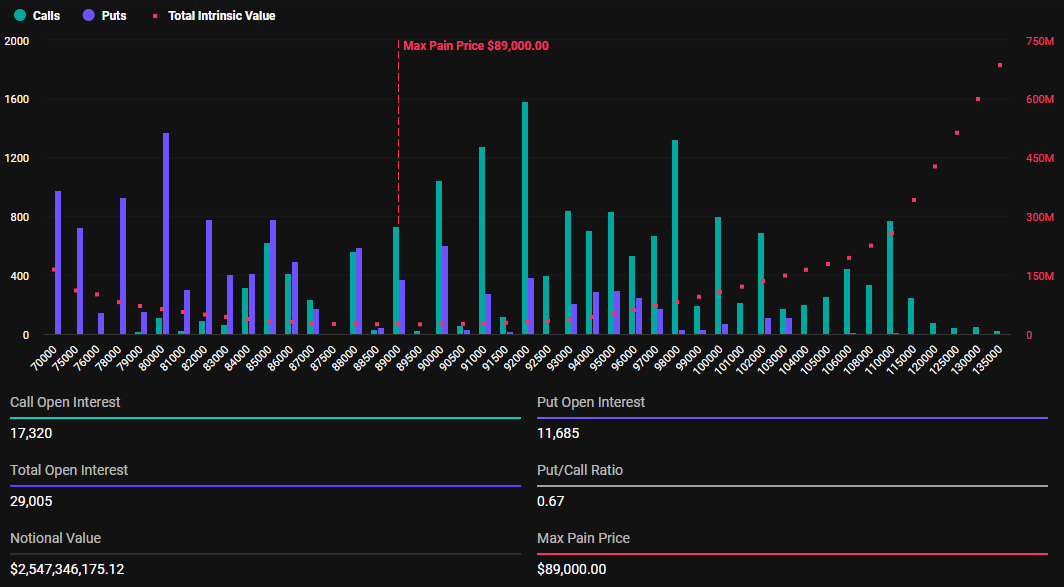

Bitcoin, $89,000 'Max Pain' Point for Today's Option Expiry

On March 7th, a nominal value of $2.54 billion in 29,005 Bitcoin contracts are set to expire. According to Deribit data, Bitcoin's put-call ratio is 0.67. The max pain point is $89,000, which is the price level that would inflict the most financial pain on option holders.

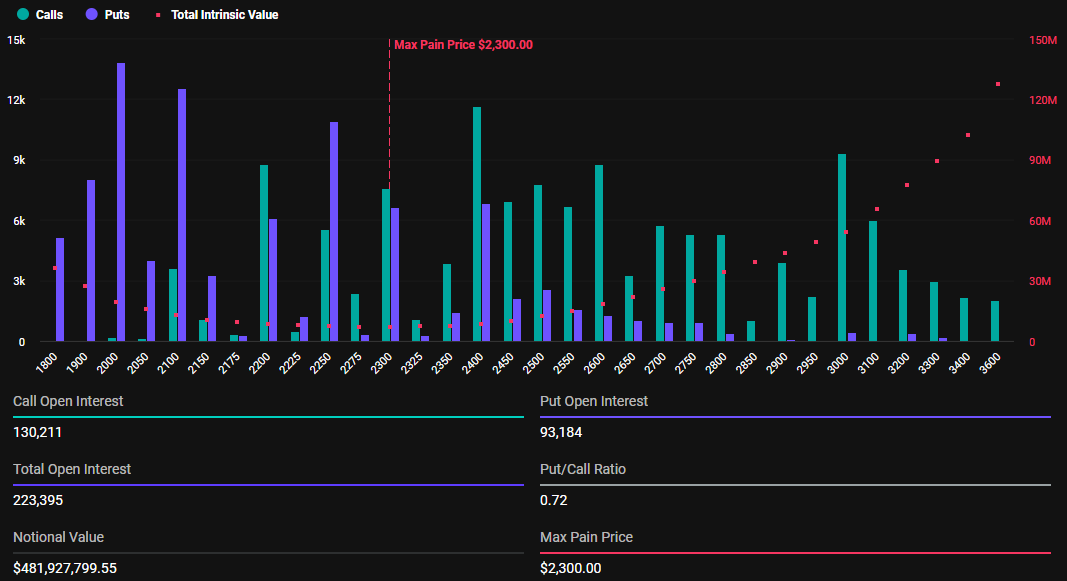

Additionally, Ethereum has $481.9 million in nominal value of 223,395 contracts expiring. The max pain point for this contract is $2,300, and the put-call ratio is 0.72.

In the cryptocurrency options market, the max pain point represents the price level that would cause the most financial inconvenience to option holders. The fact that the put-call ratios for both Bitcoin and Ethereum are less than 1 indicates that there are more call (buy) options than put (sell) options.

Greeks.live, a cryptocurrency options trading tool, provided insights into the current market sentiment. They cited an overall bearish market sentiment, mentioning traders' frustration with extreme volatility and erratic price movements.

Bitcoin's sharp intraday swings, such as the recent $6,000 move, have created what traders describe as "whipsaw" conditions. According to the analysts at Greeks.live, this makes it difficult to establish a clear directional trend.

"Most traders are viewing the $87,000-$89,000 range as a key resistance, with $82,000 being noted as the recent bottom, but there is considerable disagreement on whether a sustainable bottom has been found." – Greeks.live wrote.

Furthermore, the pronounced put skew reflects a broader bearish sentiment, with traders preferring downside protection despite occasional upward moves. The analysts also observe that traders are adjusting their strategies amid the high volatility.

"Several traders have been seen preferring to sell calls in the $89,000-$90,000 range, with one trader reporting a -260% return on low-strike calls they had purchased." – Greeks.live added.

The belief that the current market is in a liquidity-driven phase has focused traders on rapid entry and exit. With long positions vulnerable to sharp swings, this level of caution is necessary. Extrinsic macroeconomic factors, such as policy changes and tariff announcements, add to the uncertainty.

Consequently, many traders have chosen to remain on the sidelines, waiting for clear signals for new positions.

"With the market in a tense state, do you think the price movement will land above or below the max pain point?" – Deribit asked.

Nevertheless, traders should remember that option expiries can have a short-term impact on the underlying asset's price. Generally, the market soon returns to normal and may even compensate for the strong price deviations.

Traders should remain vigilant, analyzing technical indicators and market sentiment to effectively navigate the potential volatility. Meanwhile, these developments come after U.S. President Donald Trump signed an executive order on strategic Bitcoin reserves.

Notably, the order lacked specific details, and many questions are likely to be answered at the upcoming White House Crypto Summit.