The major meme coin Shiba Inu lost nearly 10% of its value last week. SHIB is currently trading at $0.0000125.

This price decline coincides with a significant decrease in whale holdings over the same period. This indicates that the confidence of large investors is weakening amid broader market weakness.

Weakening Shiba Inu market confidence...accelerating whale selling

According to the on-chain data platform IntoTheBlock, the net inflow of SHIB's large holders decreased by 123% last week. This occurred alongside an 8% price drop in meme coins.

Large holders refer to whale addresses that hold more than 0.1% of the circulating supply. Their net inflow tracks whether they are increasing (net inflow) or decreasing (net outflow) their holdings within their wallets.

A decline in this metric indicates that whales are selling off a significant portion of their assets, which can exacerbate downward price pressure due to increased supply.

Furthermore, the decrease in SHIB whale net inflow can exacerbate the weakening of confidence among SHIB retail traders, potentially causing them to sell their coins in anticipation of further losses. This could accelerate the short-term price decline of SHIB.

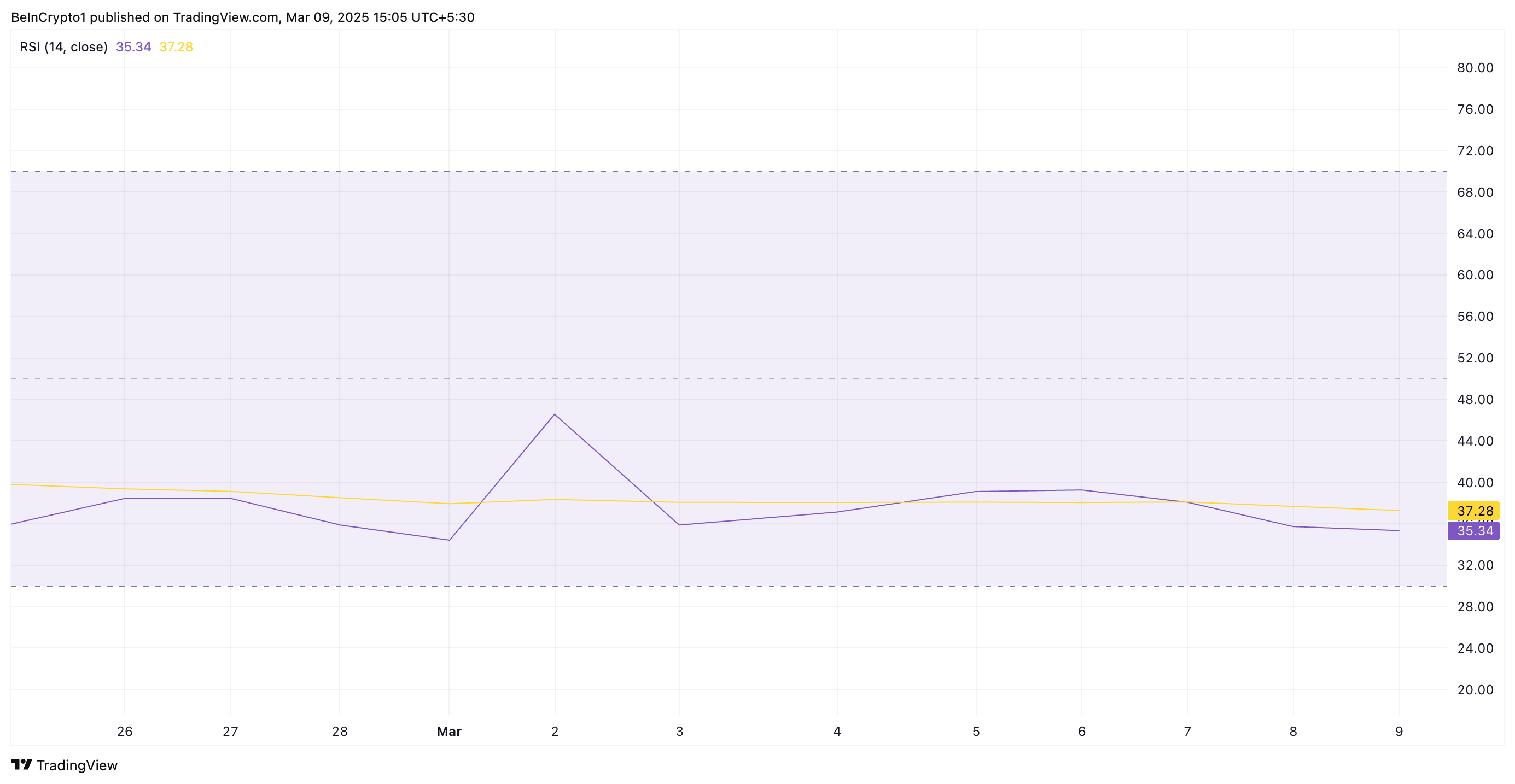

The declining Relative Strength Index (RSI) on the daily SHIB chart supports this bearish outlook. Currently, this momentum indicator is at 35.34, indicating a downtrend.

The RSI of an asset measures its overbought and oversold conditions. Ranging from 0 to 100, values above 70 indicate the asset is overbought and may be due for a decline, while values below 30 suggest the asset is oversold and may be poised for a rebound.

At 35.05, SHIB's RSI is approaching the oversold territory but has not fully entered it yet. This suggests that buying pressure is weakening, and further downside is possible unless meme coin demand increases.

Shiba Inu remains below the downtrend line

SHIB has been trading below the downtrend line since December 8th, with the price continuing to decline. This pattern forms when an asset's price consistently makes lower highs over a certain period, connecting these highs with a downward-sloping line. This indicates a bearish trend with persistent selling pressure among SHIB market participants.

If this decline continues, SHIB risks falling to a 7-month low of $0.0000107.

However, if buying pressure strengthens again, SHIB's value could be pulled up to $0.0000166.