The cryptocurrency market is preparing for volatile days ahead of the release of major US economic data to be announced from this Tuesday. These macroeconomic events can impact the portfolio of Bitcoin (BTC) holders, making it essential for investors to adjust their trading strategies.

Economic developments are increasingly influencing Bitcoin market sentiment, heightening the potential for volatility this week.

US Economic Data, Impact on Cryptocurrencies

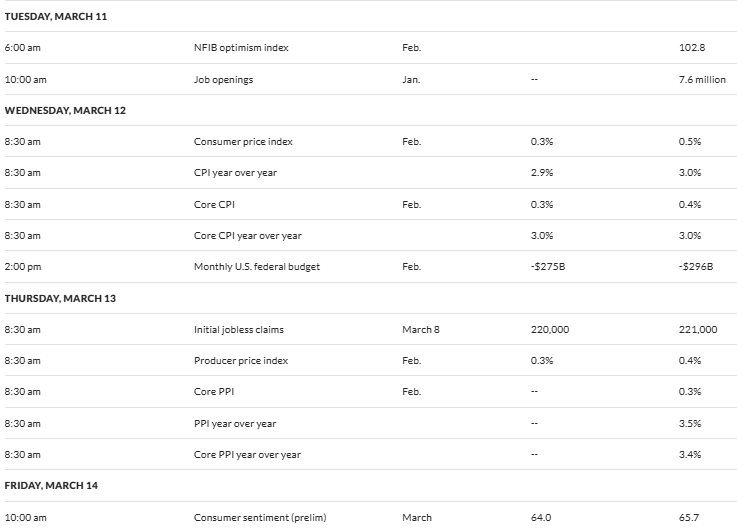

The macroeconomic data points that could impact Bitcoin sentiment this week are as follows.

Job Openings and Labor Turnover Survey (JOLTS)

The start of the list of US economic data that could impact cryptocurrencies this week is the US job openings data to be released on Tuesday, March 11. Generally known as the JOLTS, this data can provide insights into the health of the labor market and the broader economy, potentially having a significant impact on Bitcoin sentiment.

If the data indicates a strong labor market with job openings exceeding the previous 7.6 million, it could suggest continued economic strength. This could reduce expectations of Federal Reserve interest rate cuts.

Historically, a strong labor market has strengthened traditional assets like the dollar and stocks, causing investors to move away from riskier assets like Bitcoin. This could weaken Bitcoin sentiment.

Conversely, if job openings come in lower than expected, it could raise concerns about a recession or a cooling economy. This could trigger speculation about the Fed's interest rate cut intervention. This scenario could enhance Bitcoin's appeal as a "digital gold" or safe-haven asset, inducing positive sentiment and price momentum.

Consumer Price Index (CPI)

The US CPI data to be released on Wednesday, March 12 could also impact Bitcoin sentiment. This data will reflect inflation trends that influence Fed policy.

A higher-than-expected 2.9% CPI could suggest persistent inflation. This could reduce hopes for rate cuts and strengthen the dollar, weakening Bitcoin's hedge appeal. This could lead to lower sentiment and prices as investors prefer traditional assets.

However, a lower CPI could raise expectations of accommodative monetary policy and weaken the dollar, highlighting Bitcoin as a risk asset. This would boost sentiment among cryptocurrency traders.

"Wednesday CPI report - Core inflation number will come in lower than expected. BTC will rally," a user said on X.

Initial Jobless Claims

The US initial jobless claims data to be released on Thursday, March 13 could also impact Bitcoin sentiment by reflecting the strength of the labor market.

If claims fall below the expected 220,000, it could suggest a strong economy. This could strengthen the dollar and divert investor interest towards traditional assets like stocks, weakening Bitcoin's appeal as a risky asset and dampening sentiment.

On the other hand, higher-than-expected claims could indicate economic weakness, raising hopes for Fed rate cuts. This often highlights Bitcoin as a hedge against fiat currency weakness, boosting sentiment and prices.

Producer Price Index (PPI)

The US PPI data to be released on Thursday, March 13 could impact Bitcoin sentiment by revealing wholesale inflation trends.

A higher-than-expected 0.3% PPI could suggest rising producer costs and persistent inflation, reducing expectations of Fed rate cuts and strengthening the dollar, potentially pressuring Bitcoin.

However, a lower PPI could alleviate inflation concerns, increase rate cut expectations, and enhance Bitcoin's appeal as an inflation hedge, boosting sentiment.

"This is a big week for economic data - JOLTS, CPI, and PPI. We could see a strong rally to make up for the losses of the past few weeks, or confirm underlying issues and the market could continue to decline," market analyst Mark Cullen pointed out.

University of Michigan Consumer Sentiment Index

The release of the University of Michigan's US consumer sentiment index on Friday could have a significant impact on Bitcoin sentiment, reflecting the public's confidence in the economy.

A strong reading exceeding the expected 64.0, based on recent trends, could suggest optimism about economic stability. This could strengthen traditional markets and the dollar, weakening Bitcoin's appeal as a hedge against uncertainty. This could induce bearish sentiment among cryptocurrency investors.

Conversely, a weaker-than-expected reading could indicate economic unease. This could enhance Bitcoin's appeal amid fears of inflation or recession. This could reinforce the uptrend and potentially drive prices higher. As Bitcoin is sensitive to macroeconomic signals, this data could significantly shake traders' perceptions.

"The University of Michigan consumer sentiment survey can tell us how optimistic people are about the economy. This can impact consumer spending, a key driver of economic growth," the Pennyboys Trade alert post emphasized.