Bit (BTC) is at an important juncture in the current cycle. There are signs that it is moving differently from the past halving patterns. In previous cycles, there was a strong rally after the halving, but this time the uncertainty is greater. Bit's market movements are now largely determined by macroeconomic changes and the influence of new institutions.

Political factors such as Trump's pro-crypto stance and state-level Bit adoption have also added unexpected variables. Amidst these new dynamics, the question remains whether Bit has already reached the peak of the cycle, or if there is room for another surge beyond $100,000.

Has Bit separated from other cycles?

Currently, the Bit cycle appears different from previous cycles. Compared to past halvings, it is following a different price trajectory.

Historically, Bit has experienced strong rallies at this point. This was particularly the case in the 2012-2016 and 2016-2020 stages.

However, in this cycle, the surge began in October and December 2024, with a bottom established in January 2025 and a correction at the end of February.

This contrasts with previous cycles. Bit aggressively rallied after the halving. These differences suggest that macroeconomic factors, changes in market structure, and the influx of institutional investors are altering Bit's traditional cycle dynamics.

Unlike the speculative retail-driven booms of past halvings, Bit is now treated as a more mature asset class. This impacts its price movements.

Another key factor is that the intensity of Bit's rallies has been diminishing as the cycles progress. The exponential surges of 2012-2016 and 2016-2020 far exceeded the 2020-2024 cycle and the current one.

This is expected as Bit's market capitalization grows, but it also reflects the increasing influence of institutional investors, banks, and even governments. In the long term, this could introduce more stability and structured market behavior.

Despite these changes, previous cycles also had periods of consolidation and correction before resuming their uptrends. If Bit follows that precedent, this stage could be a temporary reset before another upward move.

However, the structural changes in the market may cause this cycle to unfold differently. Extreme volatility may decrease, and a more prolonged and sustainable price appreciation could occur instead of the explosive parabolic peaks of the past.

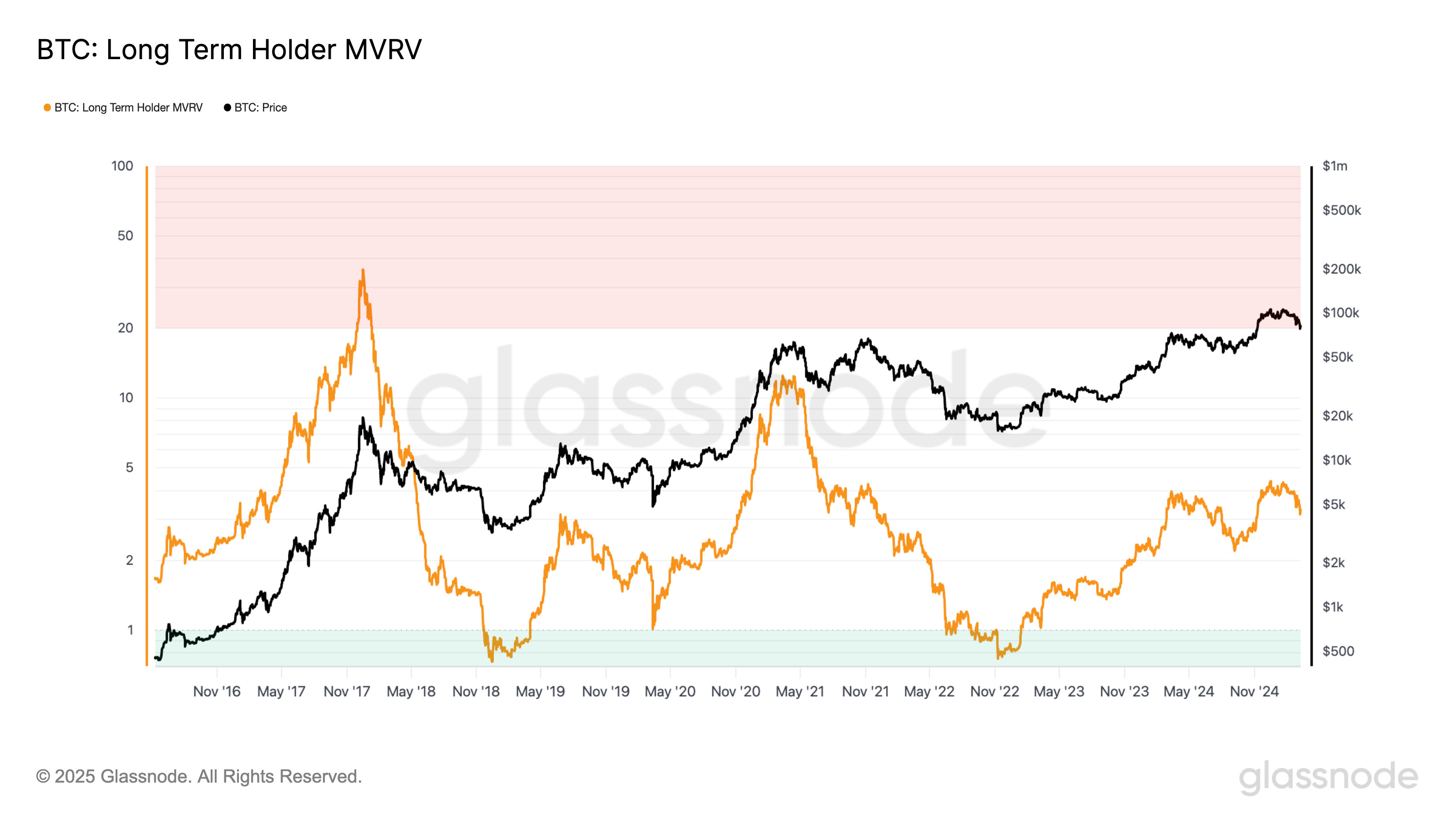

Long-term holder MVRV signals cycle changes

Bit's long-term holder (LTH) MVRV ratio clearly shows a pattern of declining profitability across the cycles. In the 2016-2020 cycle, LTH MVRV peaked at 35.8, reflecting extreme levels of unrealized gains among long-term holders before distribution began.

In the 2020-2024 cycle, this peak dropped significantly to 12.2. Despite Bit reaching new all-time highs, the overall unrealized profit multiple was lower.

In the current cycle, LTH MVRV has peaked at 4.35 so far. This indicates that long-term holders have not seen the same level of liquid profits as in past cycles.

This dramatic decline across the cycles suggests that Bit's upside potential is becoming compressed over time. This aligns with the broader trend of decreasing returns as the asset matures and the market structure evolves.

This data suggests that Bit's cyclical growth stages are becoming less explosive. This is likely due to the influx of institutional investors and a more efficient market.

As the market capitalization expands, significantly more capital inflow is required to achieve the same rate of profits seen in the early cycles.

This may signal the stabilization of Bit's long-term growth, but does not necessarily confirm that the cycle has already peaked.

Previous cycles had periods of consolidation before reaching their final highs. Additionally, institutional participation could lead to a more prolonged accumulation phase rather than sudden explosive peaks.

However, if the MVRV peaks continue to decline, it may indicate that Bit's ability to provide extreme cycle-based returns is diminishing, and this cycle may have already passed its most aggressive growth stage.

Bit's long-term outlook

Despite the differences in this cycle, experts remain optimistic about Bit's long-term prospects, particularly with the increasing state-level adoption.

Harrison Seletzky, Director of Business Development at SPACE ID, told BeInCrypto:

"There was high anticipation leading up to the White House crypto summit on Friday. However, the results were somewhat disappointing. The market did not react strongly because the US is currently holding the BTC it has seized and is not making additional purchases. But there is more to expect than what the market is reflecting. It is encouraging that President Trump signed an executive order on crypto reserves. It's unclear how this will play out in practice, but this conversation is happening at the state level. The day before the summit, the Texas Senate passed Senate Bill 21, which allows the state to establish a state-controlled crypto reserve consisting of Bit and other digital assets. A year ago, we couldn't have imagined such a thing. Texas's move could open the door for other states to follow, and could also have international implications for state and local governments."

Nick Percoco, founder of Coin Bureau, told BeInCrypto that Bit's short-term path is tied to macroeconomic conditions. He pointed out that investors have unrealistic expectations about Bit's crypto reserves in the current cycle.

Particularly, the perception that the US government will purchase tens of Bits of new BTC has grown. This would have been unthinkable from an economic or political standpoint.

It is hard to imagine Congress approving purchases that invest taxpayer money in risky assets. These unrealistic expectations have become the catalyst for the current price correction.

"The current crypto selloff reveals the disconnect between expectations and reality. Reserves will now consist only of crypto that the US government already owns, and it will not purchase new BTC from the market. It is also important that crypto or stock prices are not a key agenda item for Trump. In fact, he dismissed the stock market crash as the work of globalists. Meanwhile, the promise of an improved regulatory environment and integration with the traditional financial system will firmly establish the important role of crypto in the US financial landscape. Rather than complaining about the short-term dark backdrop, it is worth celebrating this progress." - Perklin

Based on all of this, this cycle appears different from the previous ones. Despite the recent correction, BTC may not have reached its peak yet.

New factors such as institutional adoption, Trump's stance on crypto, and geopolitical tensions make historical comparisons less reliable. Unlike past cycles, the Bitcoin price movement is not following a clear post-halving rally.

At the same time, uncertainty is higher than ever. Macroeconomic conditions, trade wars, and changing US policies add to the complexity. As Bitcoin becomes a part of the global financial system, its price no longer just responds to the halving cycle. The path ahead is uncertain, but the cycle is not necessarily over.