The Bit (BTC) and cryptocurrency market are under pressure as concerns about an economic downturn grow following comments from U.S. President Donald Trump.

His recent Fox News remarks unsettled investors by mentioning the possibility of a recession, triggering a sharp sell-off of risky assets, including Bit (BTC).

Bit (BTC) Decline, Panic Selling Due to Recession Fears

In a March 10 interview, Fox News asked President Trump about the possibility of a recession. He avoided making a clear prediction but acknowledged that "disruption" would be inevitable. ["There will be disruption as the country rebuilds its economic foundation." - Donald Trump, U.S. President]

His remarks suggested that the U.S. economy could face short-term challenges before achieving long-term stability.

Trump's stance seemed to indicate a willingness to endure a recession to facilitate necessary economic reforms.

"So what's driving today's acceleration? We believe the market is reacting to Trump's apparent willingness to stomach a recession," the Kobeissi Letter observed.

While potentially beneficial in the long run, this perspective has heightened short-term unease, especially among Wall Street investors and cryptocurrency traders.

As an immediate result, Bit (BTC) price fell below the psychological level of $80,000. At the time of writing, BTC is trading at $79,856, down nearly 3% since the start of Tuesday's session.

Notably, Trump's remarks align with recent comments from the Federal Reserve, warning of the possibility of a recession. This has further exacerbated market unease. The Fed's cautious stance has fueled bearish sentiment across the cryptocurrency spectrum.

A potential economic slowdown could lead to lower interest rates to stimulate growth. However, investors appear to be bracing for more near-term pain.

Bit (BTC), Stocks Linked to Economic Uncertainty

Like Bit (BTC), the traditional financial markets have also reacted swiftly. The S&P 500 has lost $5 trillion in market capitalization over 13 trading days. Meanwhile, the cryptocurrency market has shed around $1.3 trillion since its December 2024 peak.

Bit (BTC) is widely regarded as an indicator of risk appetite, and it has declined 35% in the past 3 months.

This, combined with inflation concerns and uncertainty around Federal Reserve policies, has fueled a risk-averse sentiment among investors. The Bit (BTC) decline aligns with a broad shift in investment strategies. Institutional investors are retreating from high-risk assets, reducing their exposure to tech stocks at the fastest pace since July 2024.

The so-called "Magnificent Seven" stocks, including major tech giants, have seen their lowest exposure levels since April 2023. Tesla, a stock historically associated with high-risk trading, experienced the seventh-largest single-day decline of 15.4%. This drop reflects a decline in investor confidence in speculative assets due to recession concerns.

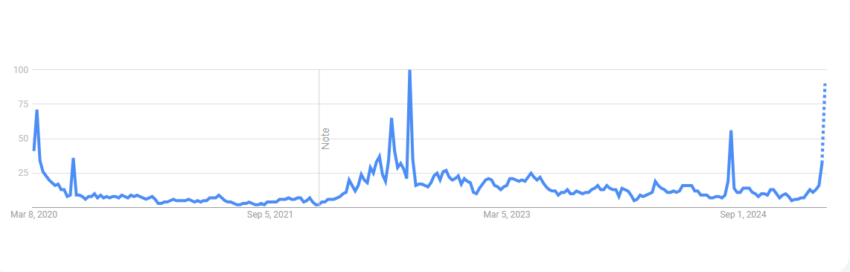

Meanwhile, Bit (BTC)'s price movements are often closely linked to macroeconomic uncertainty. Google Trends data shows that searches for "US recession" reached their highest level since August 2024, a historical signal of market volatility. Similar spikes in searches in mid-2022 and late 2024 coincided with sharp Bit (BTC) price declines.

Adding to the concerns, prediction markets like Kalshi have increased the probability of a US recession to 40%. These markets are often considered more accurate in forecasting recessions than traditional economic models, as they capture real-time investor sentiment and information.

"Prediction markets can often be more accurate than traditional economic models, as they reflect the real-time sentiment and information of traders," startup investor Rushabh Shah noted.

While some analysts believe a recession could lead to more accommodative monetary policy that could buoy Bit (BTC), the immediate outlook remains uncertain. For now, traders and investors must brace for continued volatility.