"BTC, an asset that transcends political ideologies, unlike stocks"

"It will be different from stocks in a situation of legal tender liquidity crisis"

After US President Donald Trump announced that he would push ahead with his tariff policy, the three major US stock market indexes plunged on the 10th (local time) due to fears of a slowdown in the US economy. On the 10th, the Dow Jones Industrial Average, S&P500 index, and Nasdaq index closed down -2.08%, -2.70%, and -4.00% respectively.

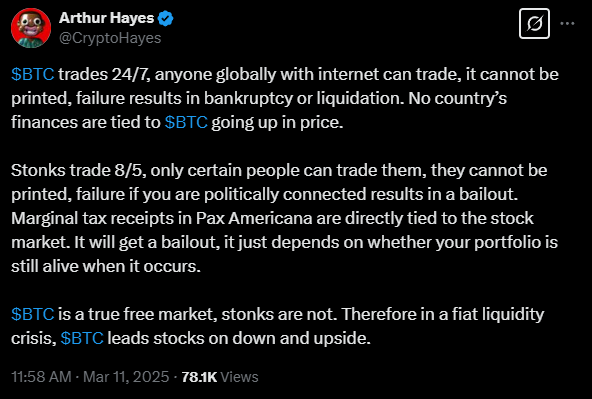

On the 11th, through his X account, Arthur Hayes predicted that BTC, as an asset that does not depend on political ideologies, will be very different from US stocks and will have an advantage in the current economic downturn.

He said, "BTC is traded 24/7 globally using the internet, and the worst-case scenario is bankruptcy or liquidation," and "No country's finances are directly related to BTC."

He also said, "Stocks have a clear market close time, can only be traded by certain people, are politically connected, and can lead to bailouts," and predicted that the current economic crisis is a crisis due to the liquidity of legal tender, and BTC will outperform stocks.

Kwon Seung-won reporter ksw@blockstreet.co.kr