According to the on-chain data analysis platform Glassnode, Bit is in a long-term distribution phase. Additionally, market momentum and capital flows have turned negative, suggesting a decrease in demand.

These changes have contributed to increased investor uncertainty and a decline in overall market sentiment and confidence.

Bit Enters Long-Term Distribution Phase

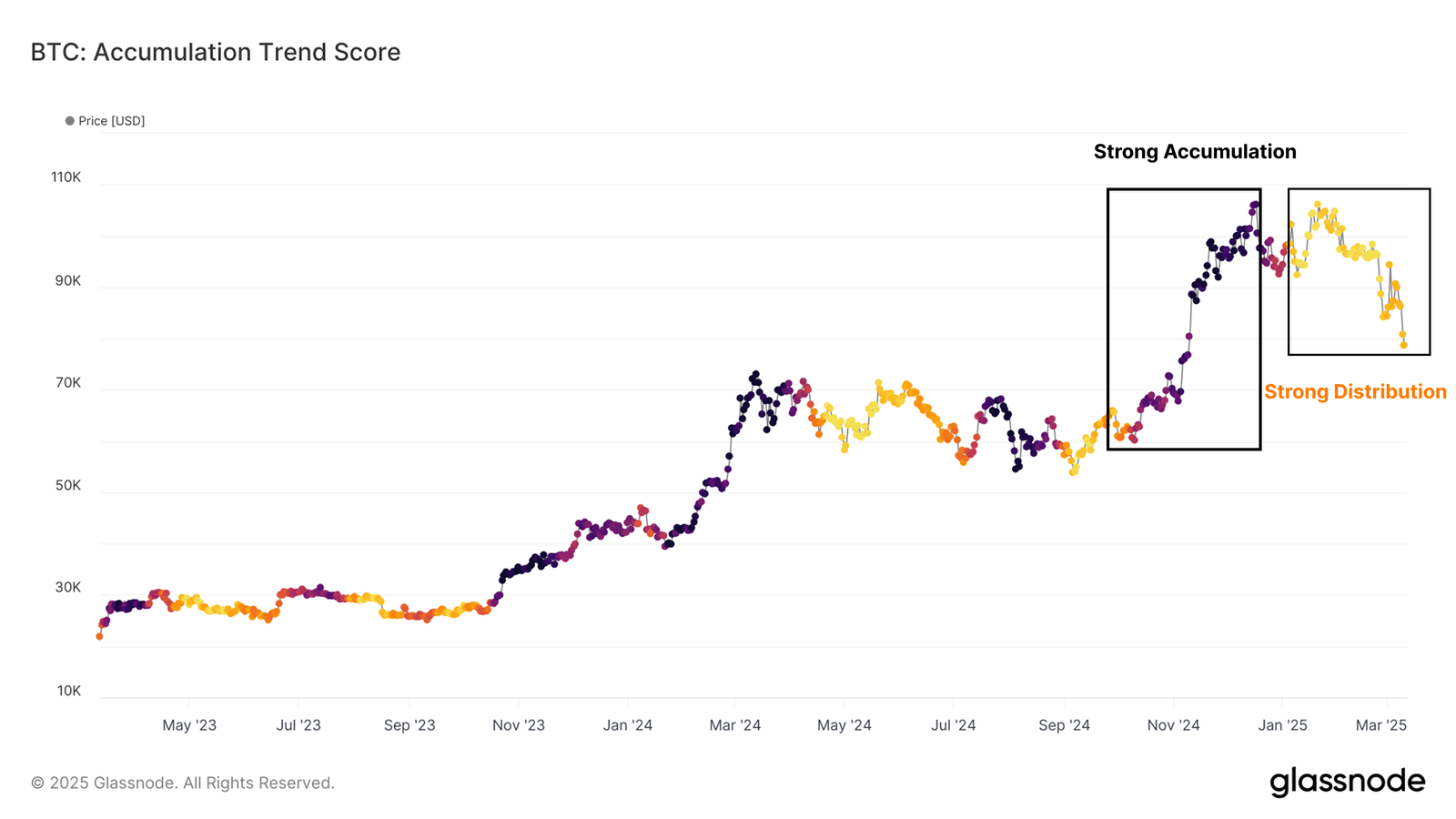

Glassnode noted in its latest weekly newsletter that the market structure of Bit has entered a distribution phase following the All-Time High (ATH). This phase represents the natural progression of Bit's cyclical behavior.

This cycle is driven by alternating periods of accumulation and distribution, with capital shifting between various investor groups over time.

"The recent distribution phase began in January 2025, coinciding with Bit's sharp correction from $108,000 to $93,000," the newsletter states.

Glassnode also emphasized that the Accumulation Trend Score has remained below 0.1.

This suggests that market participants are more focused on liquidating their holdings rather than adding to their positions. Therefore, the market may continue to face downward pressure unless the trend reverses.

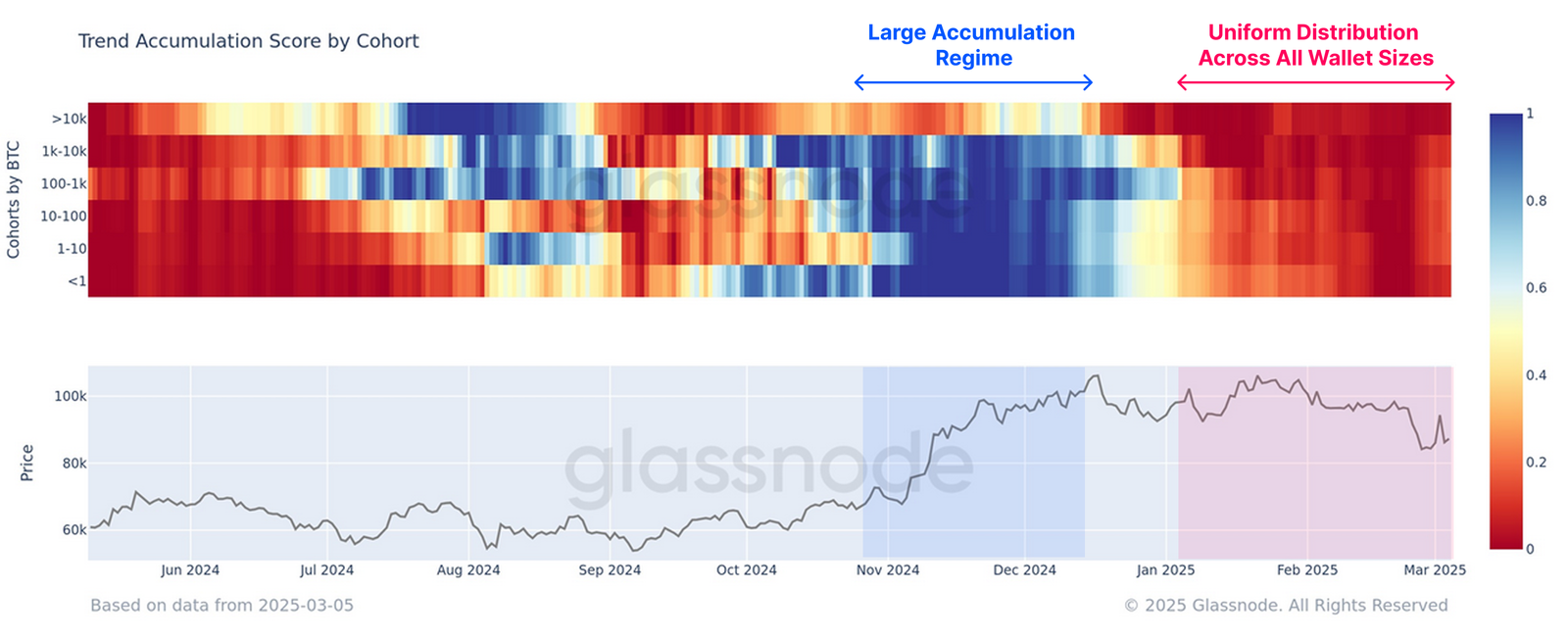

The distribution, however, is not limited to specific investor groups. Glassnode reports that all wallet size categories have been actively distributing over the past two months.

This has significantly amplified the selling pressure in the market. The newsletter also added that selling activity has become more pronounced since mid-January.

A significant portion of the selling pressure has come from coins sold at a loss, adding further strain to the overall market weakness.

"This indicates that the current market downturn has been a challenging environment for investors, with many exiting the market at prices below their cost basis under the selling pressure," Glassnode explained.

In addition to the distribution, market sentiment has also shifted. Investor sentiment has become more cautious. Glassnode attributed the decrease in accumulation to the Bybit hack, trade war tensions from the US, and growing macroeconomic uncertainty.

The analytics firm noted that investors had been buying Bit during the price declines between mid-December and February, particularly in the $95,000 to $98,000 range, believing the uptrend would continue.

However, by the end of February, liquidity had dried up, and external risks had increased, causing confidence in further accumulation to wane.

"The lack of buying at lower levels suggests an ongoing capital rotation, which could lead to a more prolonged correction or consolidation phase before the market finds a firm footing," Glassnode added.

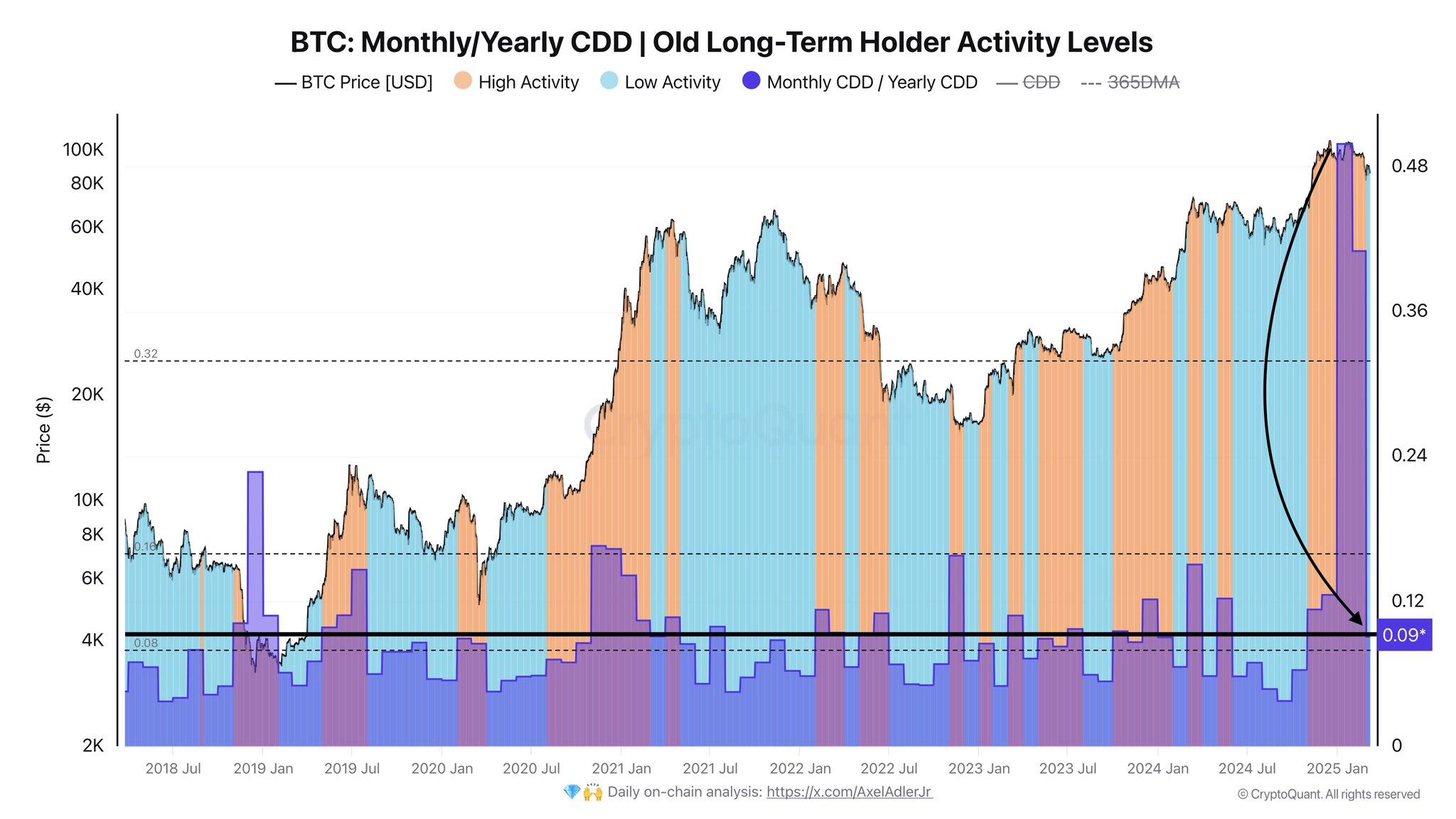

However, not everyone is pessimistic. On-chain analyst AXEL observed that the largest distribution of Bit by long-term holders appears to have ended in the past few years.

According to his analysis, the activity metrics have shifted from high selling activity to low accumulation levels. This change suggests that long-term holders are regaining confidence and could signal market stabilization or future upward movements.

"Supply reduction is generally a precursor to stabilization and a new market cycle, potentially signaling positive market signals," he posted on X.

As Bit continues to navigate this phase, the price has exhibited significant volatility. BeInCrypto reported that BTC fell below $80,000 amid recession concerns. However, it has seen a slight recovery as trade and geopolitical tensions eased.

At the time of reporting, BTC was trading at $83,424, a 2.0% increase over the previous day, according to BeInCrypto data.