Bit is facing difficulty in maintaining its bullish momentum, remaining below $85,000 and facing persistent selling pressure. The overall market still shows a macroeconomic bullish pattern, but the short-term outlook for Bit remains bearish.

This is largely due to the psychology of a key group of investors who are uncertain about Bit's immediate future.

Bit, increasing selling volume

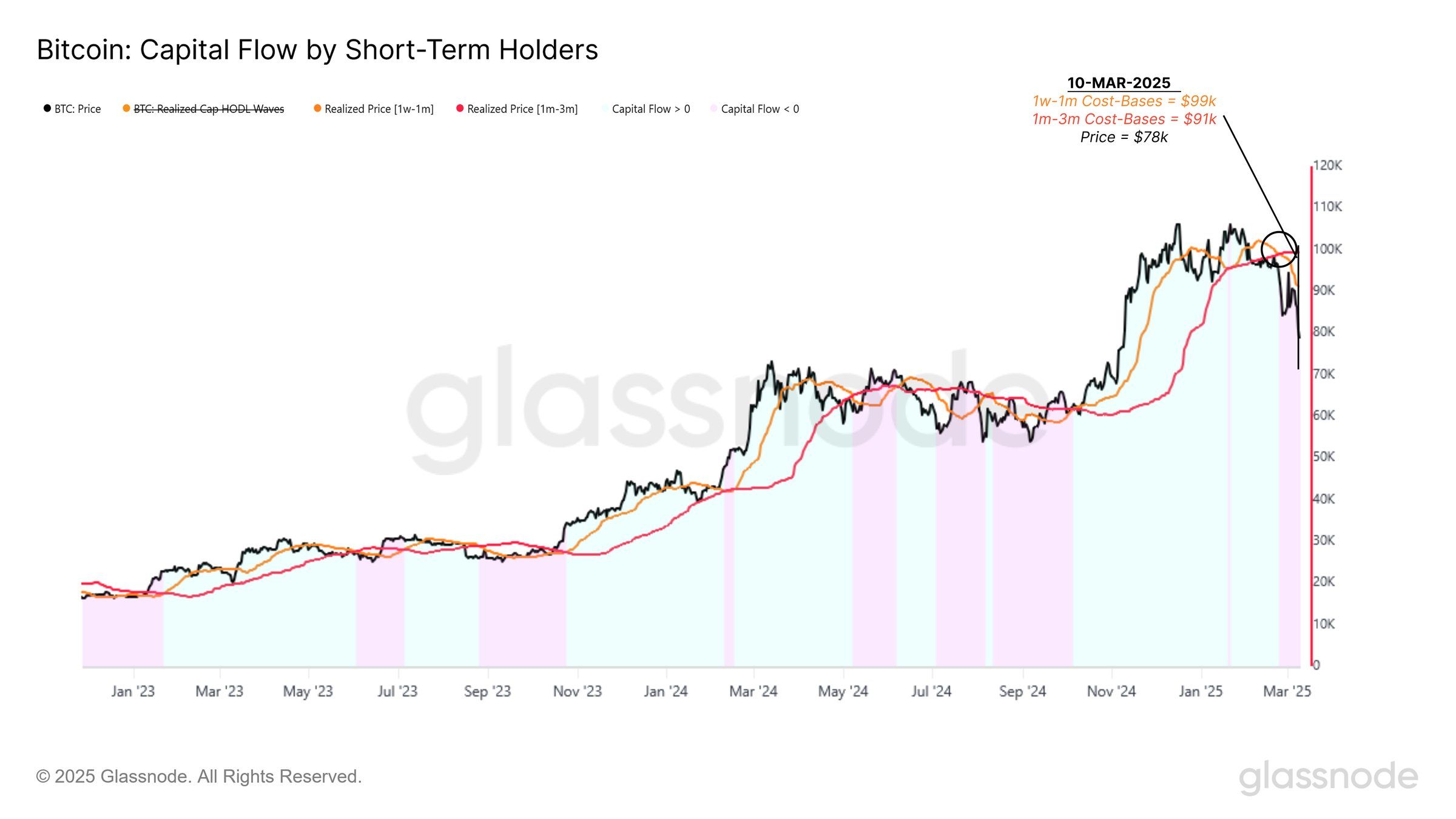

The capital outflow from Bit indicates persistent selling pressure, with recent buyers showing signs of liquidating their positions. The combination of high volatility, low demand, and limited liquidity is hindering meaningful accumulation. Without strong buying interest, Bit is at risk of further downside.

The inability to generate meaningful accumulation is increasing the market's fear, which is further exacerbated by the lack of clear bullish signals. As the selling pressure continues, Bit remains vulnerable to price declines.

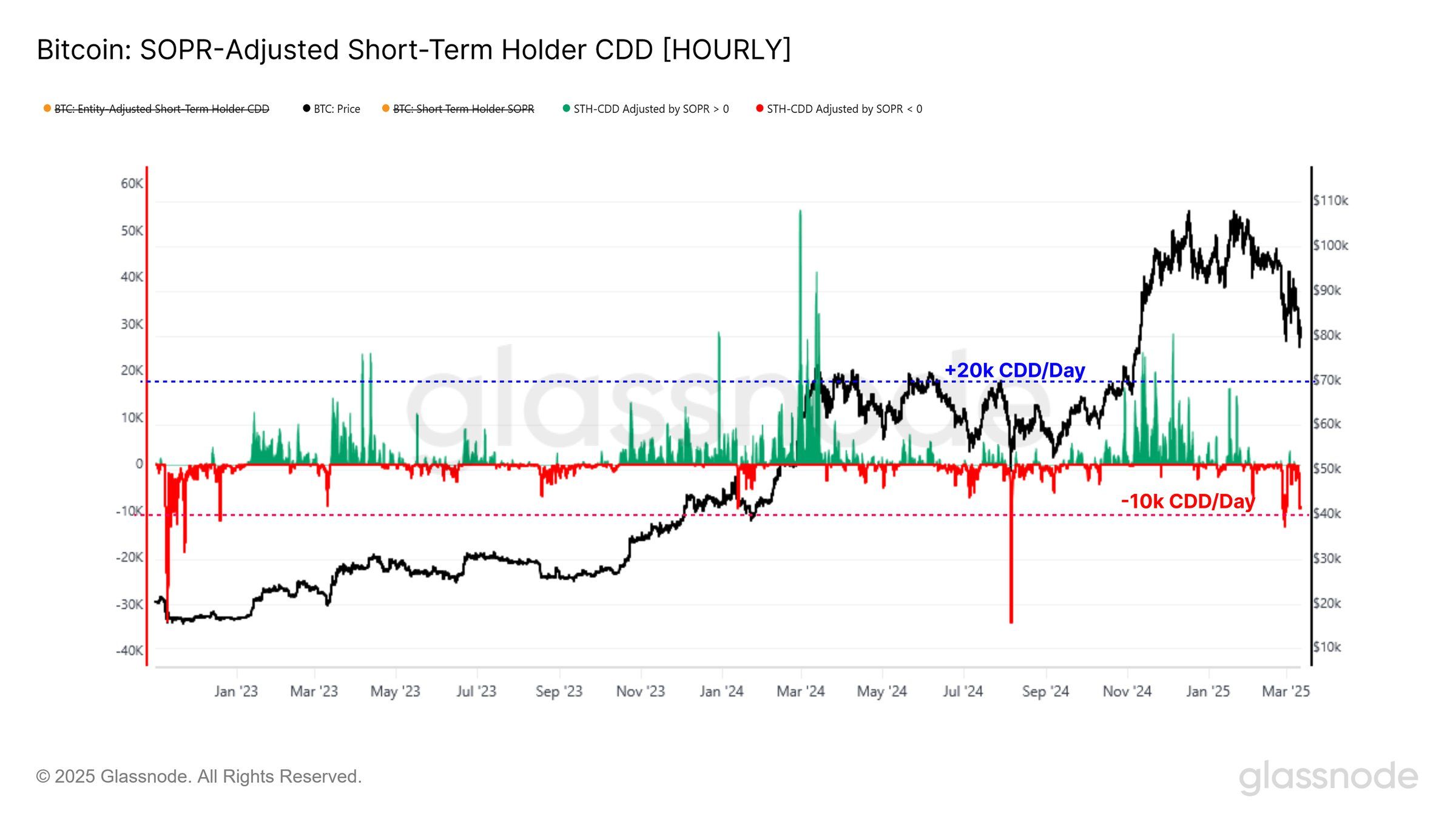

Bit's short-term holder (STH) coin days destroyed (CDD) is showing an increase in fear-driven selling. This metric tracks when short-term holders sell Bit, and the recent selling has coincided with an increase in daily Bit sales. The recent selling has allowed short-term holders to sell up to 10,000 BTC per day, the highest level since August 2024.

This behavior reflects the market's uncertainty, with many short-term holders choosing to sell during periods of heightened fear. The recent surge in selling, adjusted by the spent output profit ratio (SOPR), suggests these investors lack confidence in Bit's recovery.

BTC price, attempting to break downward

Bit is currently trading at $83,184, trapped below the crucial $85,000 resistance. While it is attempting a recovery, the current market conditions and broader economic factors may make a short-term recovery difficult. The lack of momentum and investor confidence is further hindering Bit's ability to surpass $85,000.

The persistent selling pressure may lead Bit to consolidate within the current range or potentially fall below the critical support level of $82,761. A breach of this threshold could see Bit decline to $80,000 or lower, with the losses extending and recovery efforts further delayed.

However, if Bit successfully breaks above the $85,000 resistance and maintains support at $87,041, it would confirm its exit from the current bearish trend. This would validate an expanding falling wedge pattern and signal a potential recovery rally. A move above $89,800 would invalidate the bearish narrative and set the stage for sustained bullish momentum.