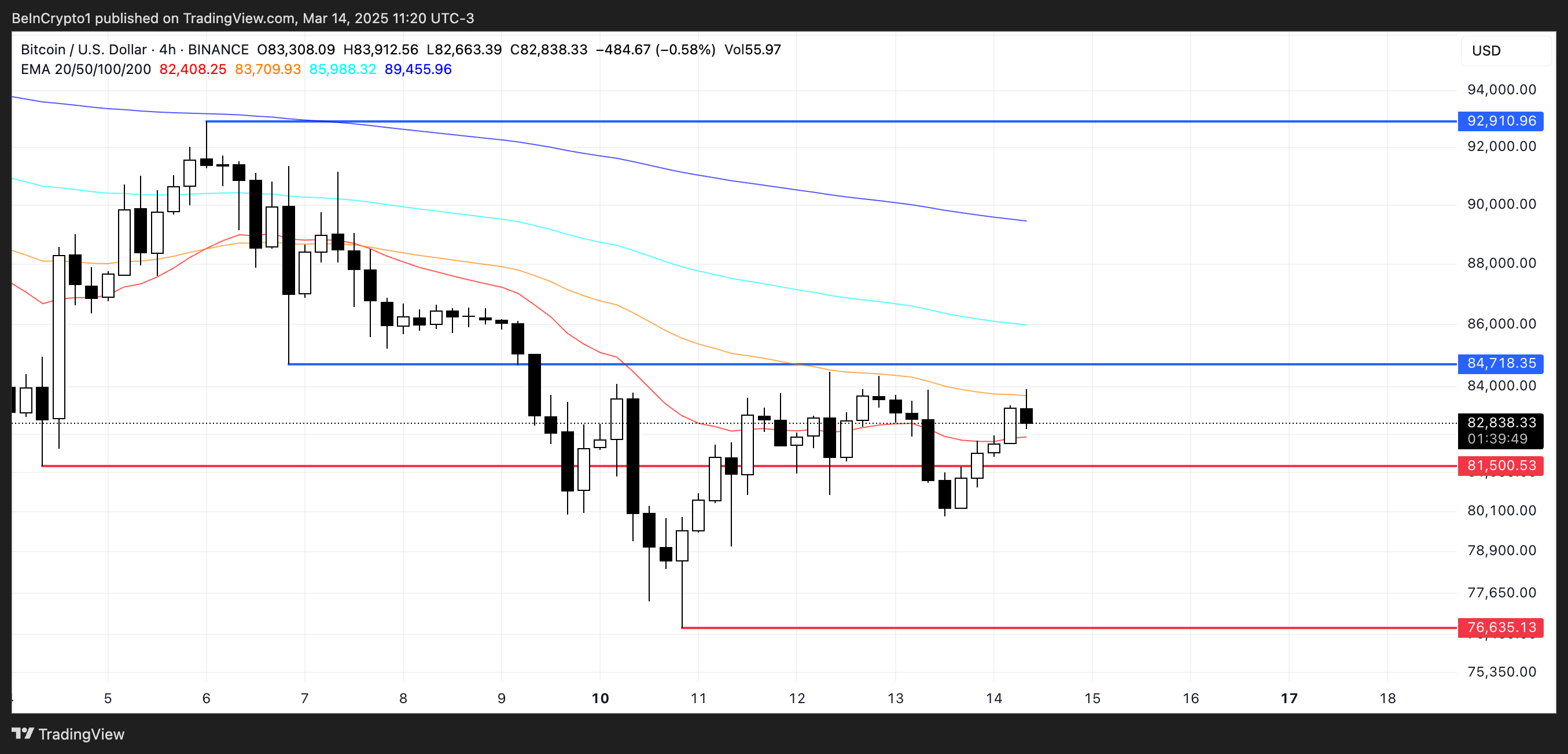

Bit (BTC) has fallen almost 5% in the last 7 days. It has been trading below $90,000 for almost a week and is struggling to regain momentum. The technical outlook remains bearish, with BTC's moving averages reinforcing the downward pressure and the key $81,500 support level at risk of being breached.

However, the DMI chart suggests that the selling momentum is weakening. If buyers intervene, a potential trend reversal could be imminent. If BTC recovers $84,800, it could signal the start of an uptrend, and it could attempt to rise to $92,910 in the upcoming sessions.

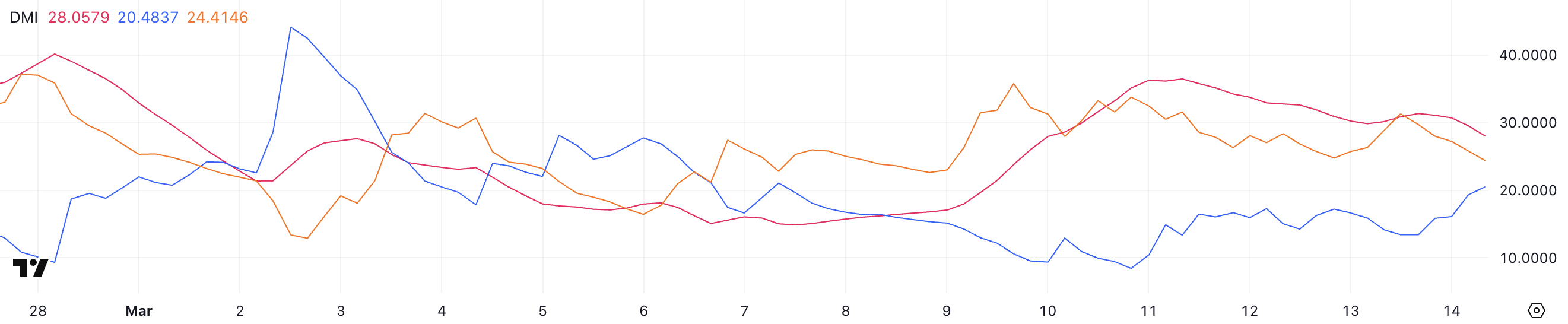

Bit DMI, Selling Pressure Dominant... Change Possible Soon

Bit's Directional Movement Index (DMI) shows that the Average Directional Index (ADX) has slightly decreased from 31 to 28, indicating that the trend strength is weakening.

ADX measures the overall strength of a trend. Values above 25 generally indicate a strong trend, while values below 20 indicate a weak or directionless market. Some analysts have raised the question of whether this cycle is different from other cycles and whether BTC has already peaked in this cycle.

When ADX declines after reaching high levels, it can mean that the current trend, whether bullish or bearish, is losing momentum, opening the possibility of a shift in market direction.

Meanwhile, +DI (Positive Directional Index) has risen from 13.4 to 20.48, and -DI (Negative Directional Index) has declined from 31.3 to 24.4. This change suggests that selling pressure is weakening and buying momentum is increasing.

Bit is still technically in a downtrend, but the narrowing gap between the two directional indices and the rise in +DI indicate a potential trend reversal. If this trend continues and +DI crosses above -DI, it will confirm the shift to an uptrend and signal a change in market sentiment.

However, as ADX is still above 25, sellers still maintain some control, and the next few sessions will be crucial in determining whether Bit can fully reverse the downtrend.

Bit Ichimoku Cloud Displays Mixed Pattern

Bit's Ichimoku Cloud chart presents a mixed outlook, with the price currently attempting to break above a short-term resistance level.

The Conversion Line (blue line) and Base Line (red line) are closely following the price movement, reflecting the battle between buyers and sellers.

Bit has pushed slightly above the Base Line, but the Ichimoku Cloud is still red and currently above the price, indicating that the broader trend remains bearish.

Until Bit decisively breaks above the Cloud, any upward movements will be unstable, and the resistance around $84,000 could be a crucial test for the buyers.

Going forward, Bit needs to maintain a move above the Ichimoku Cloud's lower boundary to establish a potential trend reversal.

However, the thick red Cloud ahead poses a challenge, as sellers still appear to be in control, making further upside movements difficult.

If Bit is rejected by the Cloud, a pullback to the $81,000 support level is possible, while a successful break above $84,000 could shift market sentiment more bullishly, leading to a rally above $86,000.

Is Bit Likely to Drop Below $80,000?

Bit's moving averages are still in a bearish alignment, with the short-term moving average below the long-term moving average, indicating persistent downward pressure.

If the current trend persists, Bit's price could test the key $81,500 support level that has been maintained in recent sessions. A break below this level could trigger additional selling, pushing the price to as low as $76,635, a level not seen in a few weeks.

The moving average structure suggests that sellers are still in control, and without a clear reversal signal, the potential for further downside remains.

However, Bit's DMI chart suggests that a trend reversal is approaching, and bullish momentum could soon gain traction.

If Bit manages to turn around, the first major resistance level is $84,718. This could act as a significant barrier before a sustained upward move.

Successfully breaking above this level could confirm the trend reversal, and if the uptrend strengthens, a path towards $92,910 could open up.