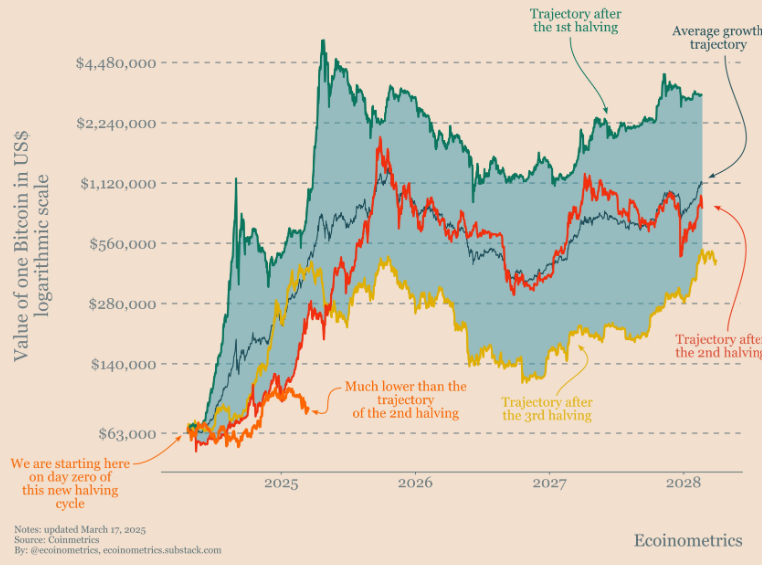

Bit (BTC) has shown a relatively clear price pattern through the previous three halving cycles. As supply decreased and demand surged, the price of Bit (BTC) skyrocketed. However, the fourth halving cycle is different.

According to the data, Bit (BTC)'s growth trajectory no longer follows the historical range set by the previous cycles. Many industry experts believe that Bit (BTC) has entered a completely different stage.

What's different in Bit (BTC)'s fourth halving?

According to the observation of Ecoinometrics, the growth rate of Bit (BTC) in this cycle is significantly lower than the previous cycles. This indicates that the halving event no longer plays a central role in driving the price of Bit (BTC).

If Bit (BTC) grows similarly to the previous cycles, the price could range from $63,000 to $450,000. However, Bit (BTC) is currently trading at around $80,000.

"At this stage of this cycle, the lower bound of the historical range should be around $250,000." – Ecoinometrics comment.

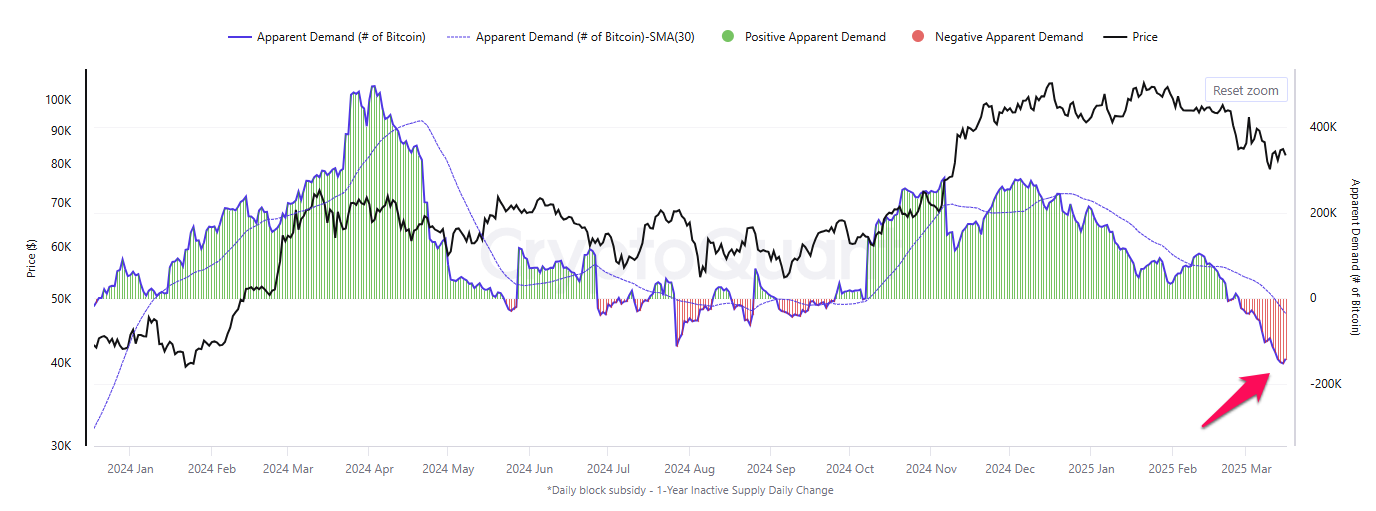

Another important factor is that Bit (BTC) demand has fallen to its lowest level in over a year, according to CryptoQuant data. The Bit (BTC) net demand metric emphasizes the actual demand by comparing inactive supply and new supply.

This suggests that while the halving event reduces supply, Bit (BTC) prices may struggle to rise without new capital inflows or strong investor interest.

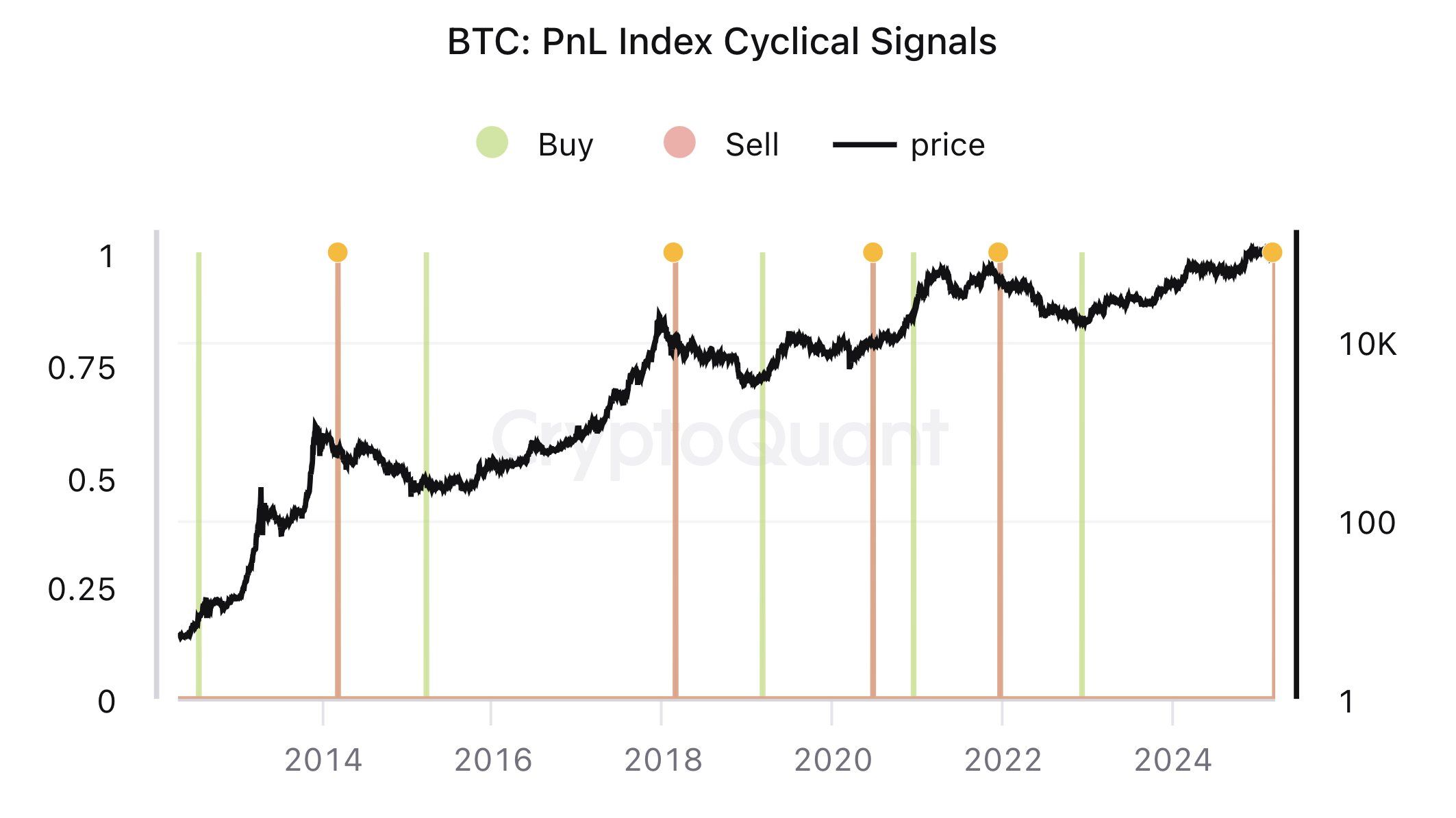

Along with the Bit (BTC) net demand, CryptoQuant founder Ki Young Ju also analyzed the Bit (BTC) PnL Index Cyclical Signals. This metric applies a 365-day moving average to key on-chain data such as MVRV, SOPR, and NUPL. It provides "buy" or "sell" signals at major turning points of large-scale cycles, not short-term fluctuations.

Based on this data, Ki Young Ju predicted that the Bit (BTC) bull cycle has ended.

"The Bit (BTC) bull cycle has ended, and I expect a bearish or sideways price movement for the next 6-12 months." – Ki Young Ju prediction.

Charles Edwards, the founder of Capriole Investments, pointed out another major difference in this Bit (BTC) cycle. While the previous cycles benefited from the expansionary monetary policy of central banks, this time central banks are tightening or maintaining a neutral policy.

During the last cycle, Bit (BTC) thrived as central banks injected liquidity into the economy. This created a favorable environment for risky assets like cryptocurrencies. However, the current monetary policy lacks such supportive power, making it difficult for Bit (BTC) to maintain strong upward momentum.

Nevertheless, Charles Edwards remains somewhat optimistic. He mentioned that US liquidity is showing potential technical signals of a possible recovery.

"In this Bit (BTC) cycle, we are primarily fighting a flat monetary cycle. This is in contrast to the strong uptrend (green) of the previous cycle. This can change soon. Along with the Eve/Adam bottom formed today, I'm seeing the first signs of a potential major multi-year bottom in US liquidity. It's been almost 4 years since tightening began. 2025 could be an appropriate time for a shift in monetary policy trends amidst tariff pressures. Let's see if this new trend can be sustained." – Charles Edwards predicted.

The halving cycle was once the most important factor in Bit (BTC) prices. However, the current data paints a different picture. Weak demand, unfavorable monetary policy, and expert predictions suggest that Bit (BTC) has entered a new phase.

In this environment, macroeconomic factors and institutional capital flows are likely to have a greater influence on Bit (BTC) price trends than the halving event itself.