"Majority of 'long-term holders' holding BTC for over 155 days, still in profit"

"Long-term holders, waiting for year-end bull market, BTC selling pressure decreases"

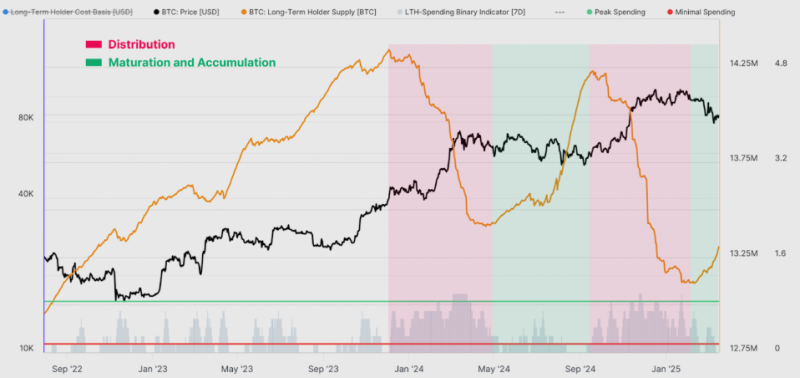

Glassnode, in a report released on the 19th, classified wallets holding BTC for more than 155 days as 'Bitcoin long-term holders', and pointed out that the situation where long-term BTC holders show no movement is becoming entrenched.

The selling and buying pressure of long-term holders is generally cited as a key on-chain indicator that predicts a bull or bear market.

Recently, Bitcoin recorded a 4-month low of $76,000 due to the expansion of the trade war by former U.S. President Trump. Glassnode pointed out that despite the decline in Bitcoin, long-term holders are still holding Bitcoin.

Glassnode identified that Bitcoin long-term holders are showing a unique pattern of neither buying nor selling Bitcoin. Glassnode suggested that "the behavioral indicators of Bitcoin long-term holders are showing a slowdown, indicating the willingness of Bitcoin long-term holders to simply hold Bitcoin."

The report stated that "the activity of long-term holders is showing a slowdown, and the selling pressure has also decreased noticeably."

Glassnode explained that Bitcoin long-term holders still hold a large amount of profits, which is slowing down the selling pressure. Glassnode wrote that "Bitcoin long-term holders seem to be expecting a rise in Bitcoin prices by the end of this year" and "the unique market dynamics are likely to persist for longer."

Reporter Kwon Seung-won ksw@blockstreet.co.kr