Bit (BTC) is showing signs of a potential reversal despite recent volatility. Key on-chain indicators and institutional flows are indicating an improved sentiment. The Mayer Multiple has been consistently recording below 1, suggesting that the Bit price is undervalued.

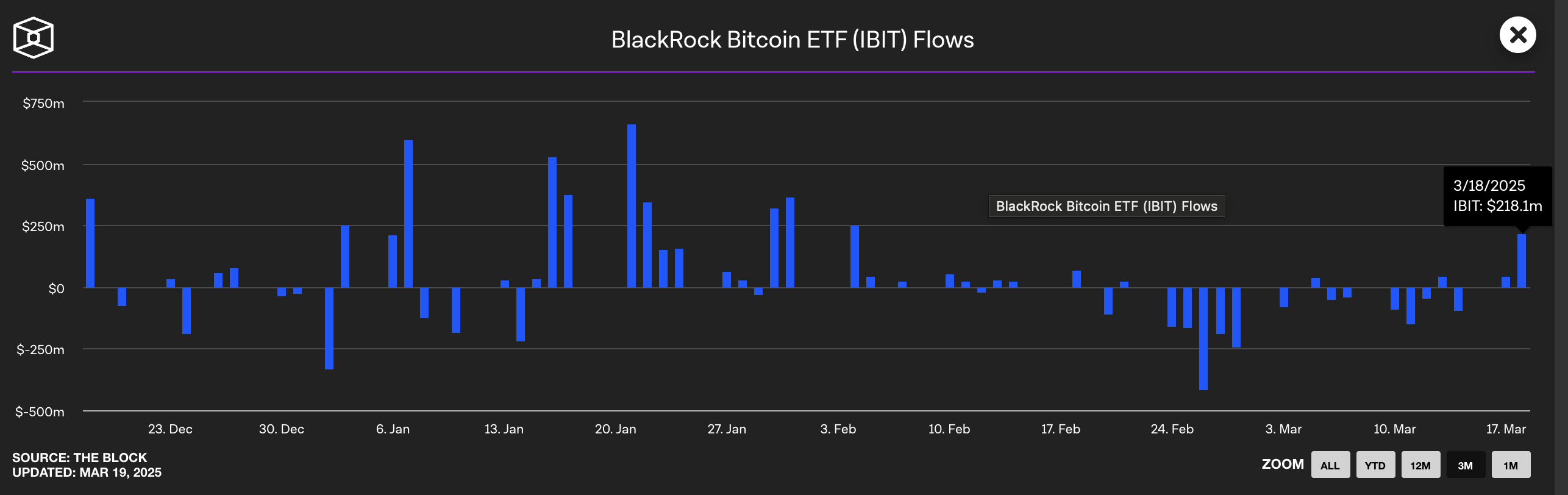

Meanwhile, institutional trust appears to be returning. BlackRock's recent purchase of 2,660 BTC recorded the largest inflow into a Bit ETF in 6 weeks. As the market stabilizes and adapts to macroeconomic pressures, a path is forming for Bit to reach new highs.

Bit Mayer Multiple Still Below 1

The Bit Mayer Multiple is an indicator that sends buy and sell signals by comparing the current price to the 200-day moving average. It is currently at 0.98, slightly higher than the recent low of 0.94 recorded on March 10.

This figure suggests that Bit is still undervalued compared to historical standards. It continues to trade below the 200-day moving average.

This indicator has remained below 1.0 during the recent correction period. It raises questions about when BTC can regain sufficient momentum to reach new highs.

The Mayer Multiple measures the ratio of Bit's current price to its 200-day moving average, indicating whether the asset is overextended or undervalued.

Historically, values below 0.8 suggest that Bit is significantly discounted and may be in a long-term accumulation zone. Levels above 2.4 indicate an overheated state.

The current reading of 0.98 places Bit on the border between neutral and bullish territory.

When the Mayer Multiple dropped to 0.84, Bit surged from $54,000 to $65,000 in just 2 weeks. It then stabilized between 1.2 and 1.4 before breaking above $100,000 for the first time.

While history does not always repeat, the current situation may be an early signal that Bit is laying the groundwork for its next major upswing.

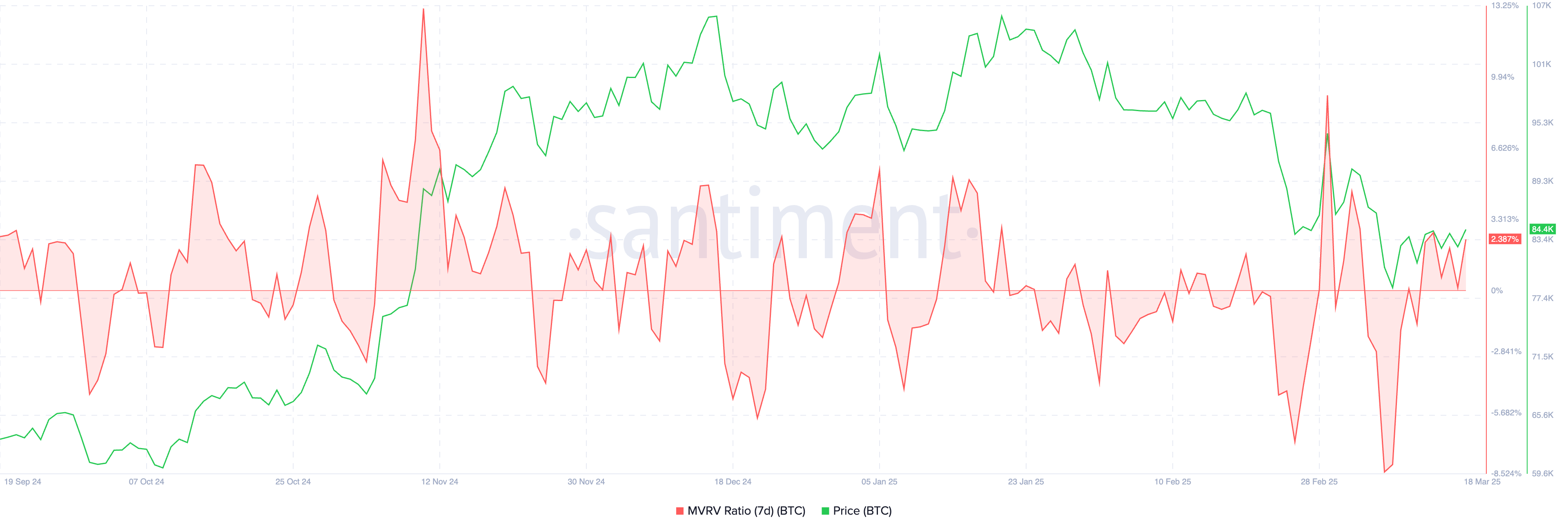

Bit MVRV Reaches a Critical Threshold

Bit's 7-day MVRV (Market Value to Realized Value) ratio has risen to 2.38%, recovering from the recent low of -8.44% on March 8.

This rebound indicates that short-term holders are starting to see some profits. However, historical patterns suggest that stronger price momentum tends to follow when the 7D MVRV exceeds 5%.

At the current level, BTC appears to still be in a transitional phase. Sentiment is shifting, but it has not yet fully transitioned to a bullish breakout scenario.

The 7D MVRV measures the ratio between Bit's market value and the average price paid by short-term holders (typically those who have acquired BTC within the last 7 days). A negative ratio indicates they are in a loss, while a positive ratio means they are in profit.

Historically, BTC tends to gain upward momentum when the 7D MVRV exceeds +5%. This suggests that trust is being restored among short-term participants. As BTC is still below this critical threshold, additional accumulation or correction may be needed before it can confidently push towards new highs.

If the ratio continues to rise and exceeds 5%, it could trigger a new bullish wave and potentially lead to a breakout towards new all-time highs.

Bit (BTC), Ready to Reach New Highs Soon?

Despite Bit declining 11.4% over the past 30 days, institutional bullish sentiment appears to be returning. BlackRock is demonstrating renewed confidence in BTC.

The world's largest asset manager, BlackRock, recently added 2,660 Bit to its iShares Bit Trust (IBIT), recording the largest inflow into the fund over the past 6 weeks.

This significant purchase came after a period of uncertain flows into IBIT since early February. It suggests that institutions are repositioning themselves to potentially capitalize on an upswing as market conditions evolve.

BlackRock's latest purchase may indicate that major players are disregarding short-term volatility and refocusing on Bit's long-term value.

Institutional interest is increasing, and the market is slowly adapting to macroeconomic pressures, such as the proposed tariffs by Trump.

Despite the remaining uncertainties, the groundwork for a Bit price rally towards new highs is being strengthened. Once macroeconomic conditions stabilize, Bit may be poised for another upswing.