"The conditions for an economic recession will act as a catalyst for a surge in BTC"

"BlackRock sees the recent decline as a long-term buying opportunity"

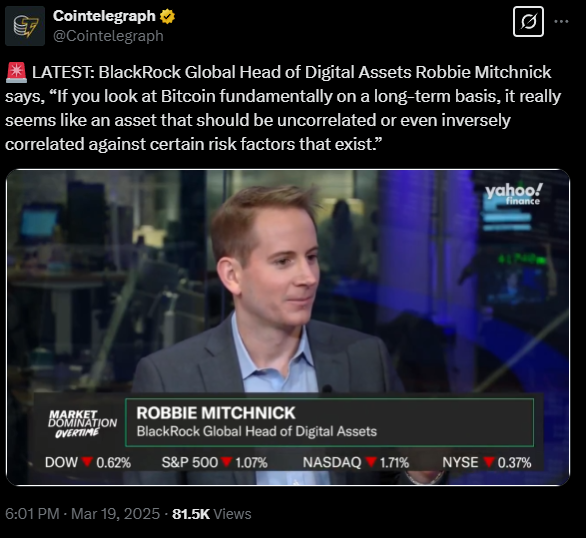

Robby Mitchnick, Head of Digital Assets at BlackRock, predicted in an interview with Yahoo Finance on the 20th that the possibility of an economic recession in the US and the resulting surge in Bit(BTC).

He said, "While I can't be certain about a US economic recession, a recession will be a catalyst for a surge in Bit(BTC)."

Mitchnick cited the following conditions as driving the surge in Bit(BTC): ▲ Increased government fiscal spending ▲ Debt accumulation ▲ Low interest rates ▲ Monetary easing, all of which occur during an economic recession.

He said, "Bit(BTC) can surge due to various conditions arising from social unrest, and these conditions are also the conditions of an economic recession."

Mitchnick explained that while many classify Bit(BTC) as a risky asset, Bit(BTC) behaves completely differently from typical risky assets such as stocks, commodities, and high-yield bonds in economic crisis situations.

Mitchnick revealed that some within BlackRock have started to view the recent decline in Bit(BTC) as a buying opportunity for Bit(BTC) and are unfazed by the economic recession.

Mitchnick said, "BlackRock is not concerned about the net outflows from the Bit(BTC) exchange-traded fund (ETF) 'IBIT'. The net outflows from IBIT are due to hedge funds' arbitrage trading."

Kwon Seung-won Reporter ksw@blockstreet.co.kr