The US Dollar Index (DXY) has recently declined following the Federal Open Market Committee (FOMC) meeting. This outcome has sparked discussions on Bitcoin (BTC) and overall liquidity conditions.

Meanwhile, the Bitcoin price has recovered to the $85,000 range. However, as the leading cryptocurrency remains range-bound, the potential for further upside is still debated.

Fed Revises Economic Outlook Amid Growth Concerns

Market analysts and cryptocurrency experts suggest that the decline in the dollar could create a more favorable environment for a Bitcoin price recovery. This optimism persists despite the lingering macroeconomic concerns.

Meanwhile, President Donald Trump is exerting political pressure by urging the Federal Reserve (Fed) to cut interest rates.

"The Federal Reserve should cut the Rate bigger and faster, and the Fed is making a big mistake in what it is doing," Trump wrote on Truth Social.

These remarks indicate potential political conflicts over monetary policy, which could have additional impacts on the performance of risk assets.

However, the FOMC has rejected further rate cuts, and the Fed has significantly downgraded its 2025 economic outlook, indicating weak growth and persistent inflation.

The Fed lowered its GDP growth forecast from 2.1% to 1.7% and raised its unemployment rate projection to 4.4%. Inflation expectations also increased, with PCE inflation forecast at 2.7% and core PCE inflation at 2.8%, both higher than previous estimates.

These revisions suggest a more challenging economic environment, resulting in the decline of the DXY.

Jamie Coutts, the lead cryptocurrency analyst at Real Vision, commented on this outcome. In an X (Twitter) post, he argued that Quantitative Tightening (QT) has effectively ended in the near future.

Coutts points to the correlation between Treasury yield volatility and the decline in the DXY, stating that these are key indicators of increased liquidity, which is generally positive for BTC.

"QT has effectively ended (for a period of time) as of last night. Treasury volatility has collapsed, and the DXY drop earlier this month reflects this. All very positive for liquidity," Coutts mentioned.

However, not everyone agrees on the extent of the slowdown in QT. Analyst Benjamin Cowen warns that QT is still ongoing, but the pace has slowed.

"QT did not 'effectively end' on April 1st. They are still reducing mortgage-backed securities by around $35 billion per month. They just reduced QT from $60 billion to $40 billion per month," Cowen wrote.

Bitcoin and the Dollar, a Delayed Reaction?

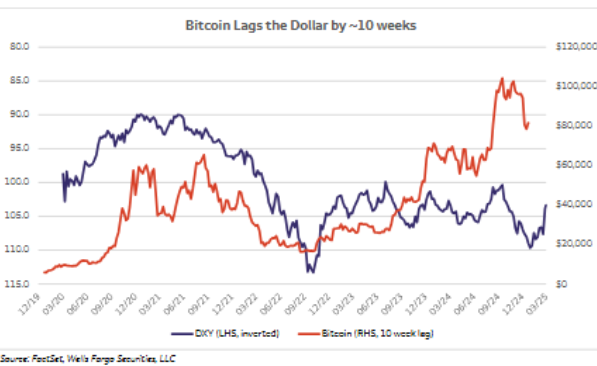

The most compelling argument for Bitcoin's potential recovery comes from Mathew Sigel, the head of digital asset research at VanEck. He points out that BTC has historically tracked the inverse DXY with a 10-week lag, suggesting that the current BTC price decline could be a delayed reaction to the strong dollar seen in late 2024.

If the pattern holds, the recent weakness in the DXY could set the stage for a bullish phase in BTC in the coming months.

Meanwhile, BitMEX co-founder Arthur Hayes takes a more cautious stance on Bitcoin's path. While acknowledging the slowdown in QT, he questions whether the liquidity injection from the European Union's military spending could have a greater impact than the changes in US finance.

"Will the EU's rearmament paid for with printed euros overwhelm the short-term negative fiscal shock in the US? That is the big macro question. If so, the correction is over. If not, don't let your guard down," Hayes wrote.

Hayes speculates that Bitcoin's recent decline may have bottomed at $77,000. However, he warned that traditional markets could experience further downside, which could temporarily impact cryptocurrencies.

Based on these factors, the post-FOMC environment presents a mixed outlook for Bitcoin. On one hand, the decline in the DXY, reduced Treasury yield volatility, and the slowdown in QT point to increased liquidity, which has historically been positive for BTC.

On the other hand, macroeconomic risks, including rising corporate bond spreads and potential instability in traditional markets, could still create headwinds.

Considering Bitcoin's historical tendency to lag behind DXY movements, the coming weeks will reveal whether a delayed rally emerges. Meanwhile, global liquidity conditions and political developments remain key factors that could influence Bitcoin's next major move.

According to BeInCrypto data, BTC was trading at $85,832 at the time of reporting. This represents a slight increase of almost 4% over the past 24 hours.