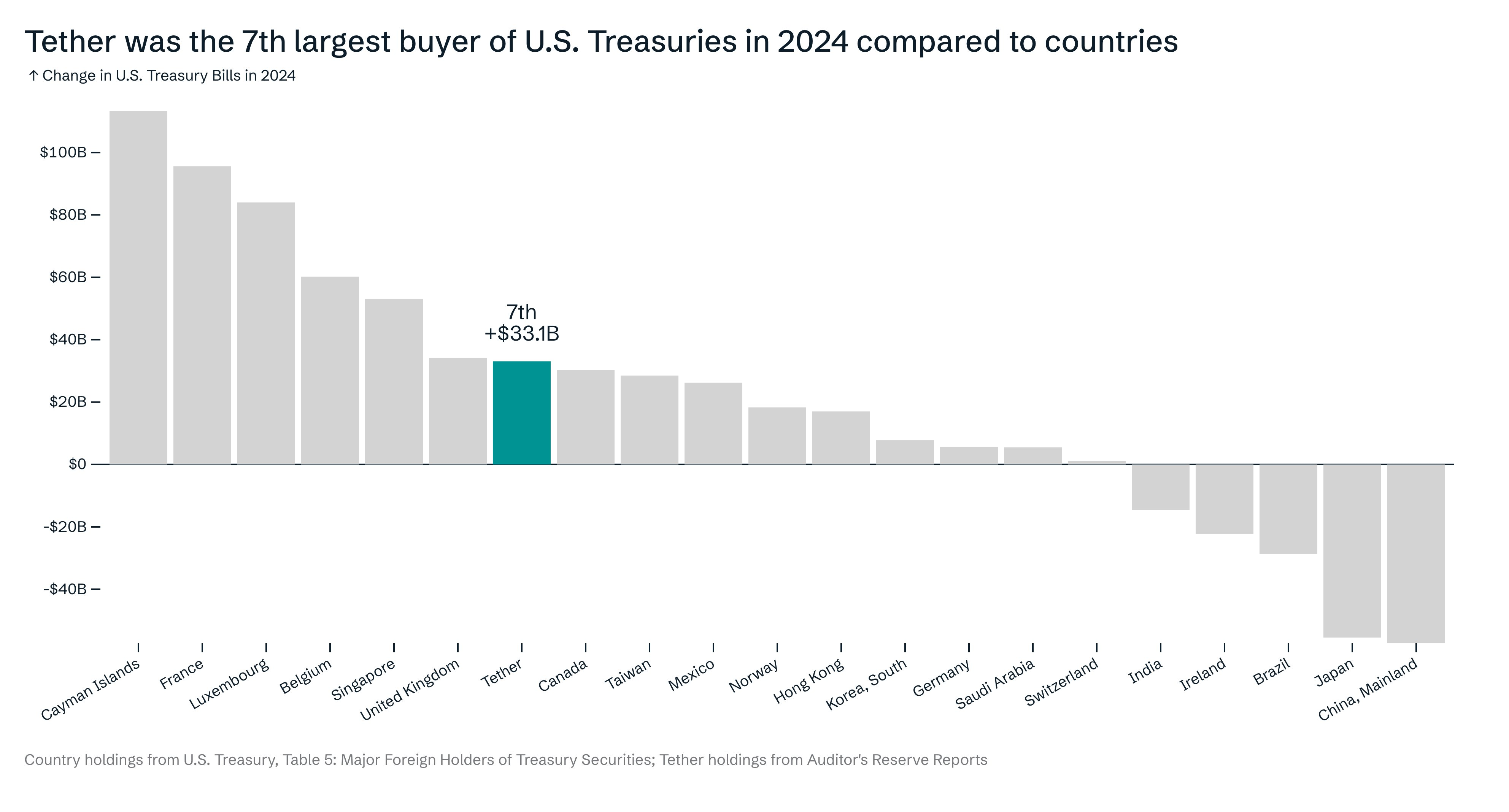

Tether surprised the market by announcing that it purchased over $33 billion in Treasury bonds last year. This makes Tether the 7th largest purchaser of US Treasury bonds, surpassing countries like Canada, Mexico, and Germany.

In today's speech, Trump claimed that stablecoins will promote dollar dominance globally. Through these Treasury bond purchases, Tether can secure a very valuable partnership.

Why is Tether Buying US Treasury Bonds?

The world's largest stablecoin issuer, Tether, may soon have an important opportunity. Today at the Digital Assets Summit, Trump hinted at major plans for the future US stablecoin policy.

A key element of this plan could be that Tether is now one of the largest US Treasury purchasers in the world:

"Tether was the 7th largest purchaser of US Treasuries in 2024 compared to countries. Tether provides US dollars to over 400 million people in emerging markets and developing countries. Undoubtedly, Tether has built the largest distribution network for the US dollar." – Tether CEO Paolo Ardoino said in an SNS post.

This could strengthen USDT's compliance efforts for upcoming stablecoin regulations. The proposed GENIUS bill, awaiting congressional approval, requires stablecoin issuers to hold reserve assets denominated in US Treasuries in the US.

Therefore, these purchases can help comply with upcoming US regulations, which differ from the EU's MiCA.

"Surprising. Tether has become an essential partner of the US in less than 10 years." – Anthony Pompliano wrote.

In today's speech, Trump did not make many firm commitments about future stablecoin policy. However, he claimed that dollar-based stablecoins will "expand the dominance of the US dollar".

If the US government significantly influences the stablecoin market, Tether could be a good medium for Trump's partnership.

Tether and Trump, Strengthening Dollar Dominance?

All proposed US stablecoin regulations include clear requirements: issuers must be subject to third-party audits. Tether has never allowed this, but the new CFO supports audits.

Due to this obstacle, Coinbase has already stated that it would remove Tether products upon request, similar to its delisting in the EU last December.

However, Tether can address these issues by purchasing Treasury bonds. The GENIUS bill requires stablecoin issuers to hold many reserves in US Treasuries.

There were speculations that this regulation might force Tether to sell Bitcoin, but the fact that the company is purchasing Treasury bonds changes these speculations.

"If Congress passes the GENIUS bill, regulatory clarity could attract traditional banking companies to the stablecoin ecosystem, promoting healthy competition. The stablecoin market could reach $3 trillion within the next 5 years, indicating that this asset class could dominate the future global payment ecosystem. The essence of such regulation is to maintain US dollar hegemony in tokenized forms like stablecoins. In the long term, regulatory clarity will be mutually beneficial for the cryptocurrency industry and the US economy." – Agne Ringga, Growth Lead at WeFi, told BeInCrypto.

While Tether purchased a massive amount of Treasury bonds last year, this does not guarantee a partnership with Trump and the US government.

Several major banks are eyeing stablecoin launches, and some individuals around Trump are reportedly discussing partnerships with Binance. So far, there is no evidence that Tether has made similar deals.

Nevertheless, Tether has purchased over $33 billion in US Treasuries in a year, which will have a significant impact. If the Trump administration decides to use Tether to promote dollar dominance, everything could change.

It is still too early to be certain these predictions will materialize. Tether may still require third-party audits despite purchasing Treasury bonds. However, if all conditions align, its dominant position in the stablecoin market could be strengthened.