Ethereum (ETH) price rose by 9% last week. This is a rebound as the cryptocurrency market attempts to recover from recent lows.

Considering the previous poor performance of Ethereum's price, this price recovery appears to be due to the overall market's positive buying sentiment rather than Ethereum's own capabilities. However, two key on-chain indicators recently observed suggest that ETH's momentum could be further strengthened.

ETH Supply at Annual Low... Traders Making Large Bets

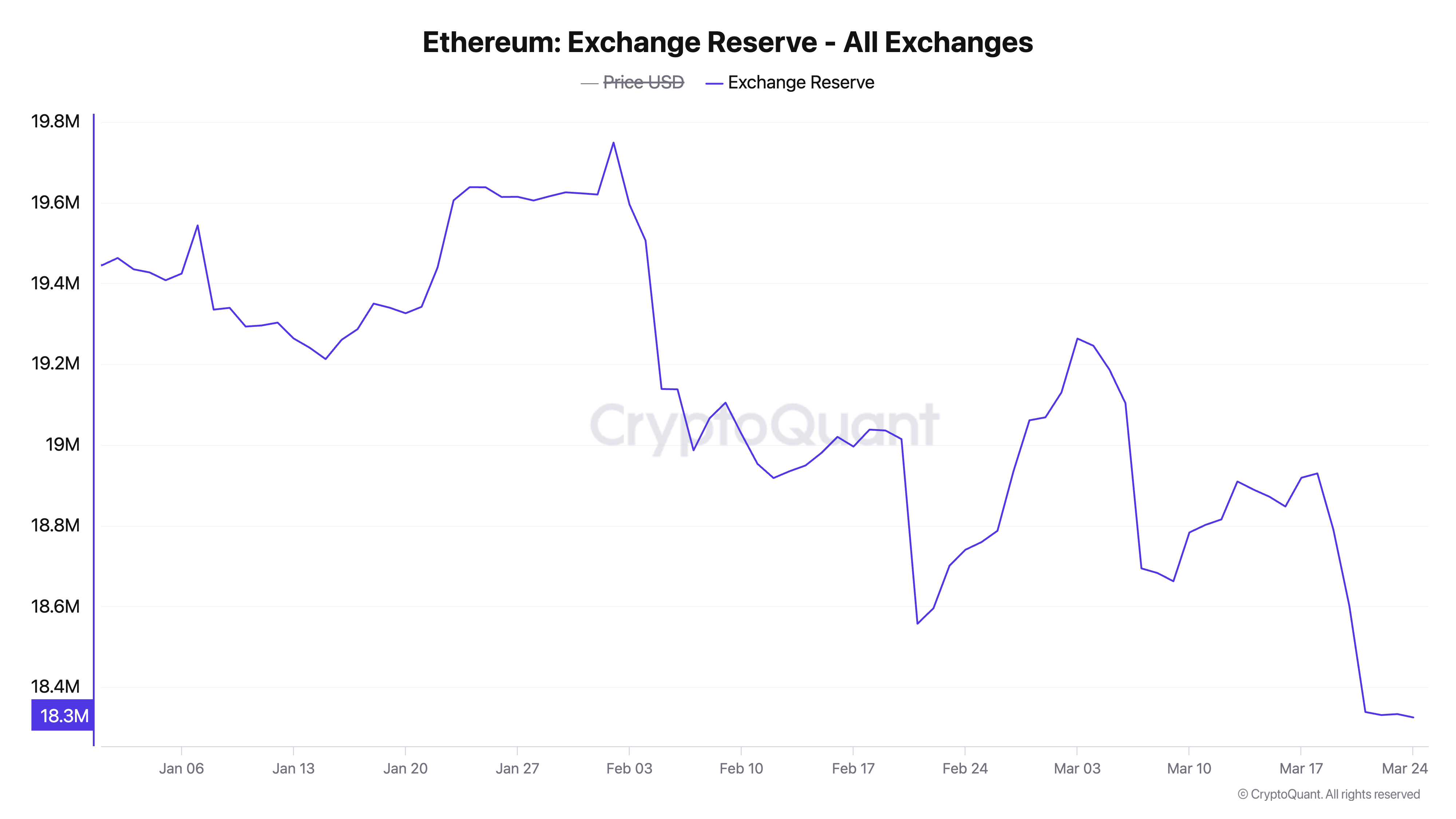

On-chain data shows that ETH's exchange reserves have dropped to the lowest level this year. Currently, this indicator is 18.32 million ETH, a 7% decrease from 19.74 million coins recorded on February 2nd.(Reference)

Exchange cryptocurrency reserves represent the total amount of coins or tokens stored in exchange wallets. As these are immediately tradable, they can create selling pressure in the market. Reserves decrease when market participants store assets in personal wallets or move them to exchanges for staking purposes. When exchange reserves decrease, selling pressure naturally reduces.

This means that the decrease in ETH supply could create upward price pressure. Cryptocurrencies tend to rise in price when sales liquidity is low and demand remains steady.

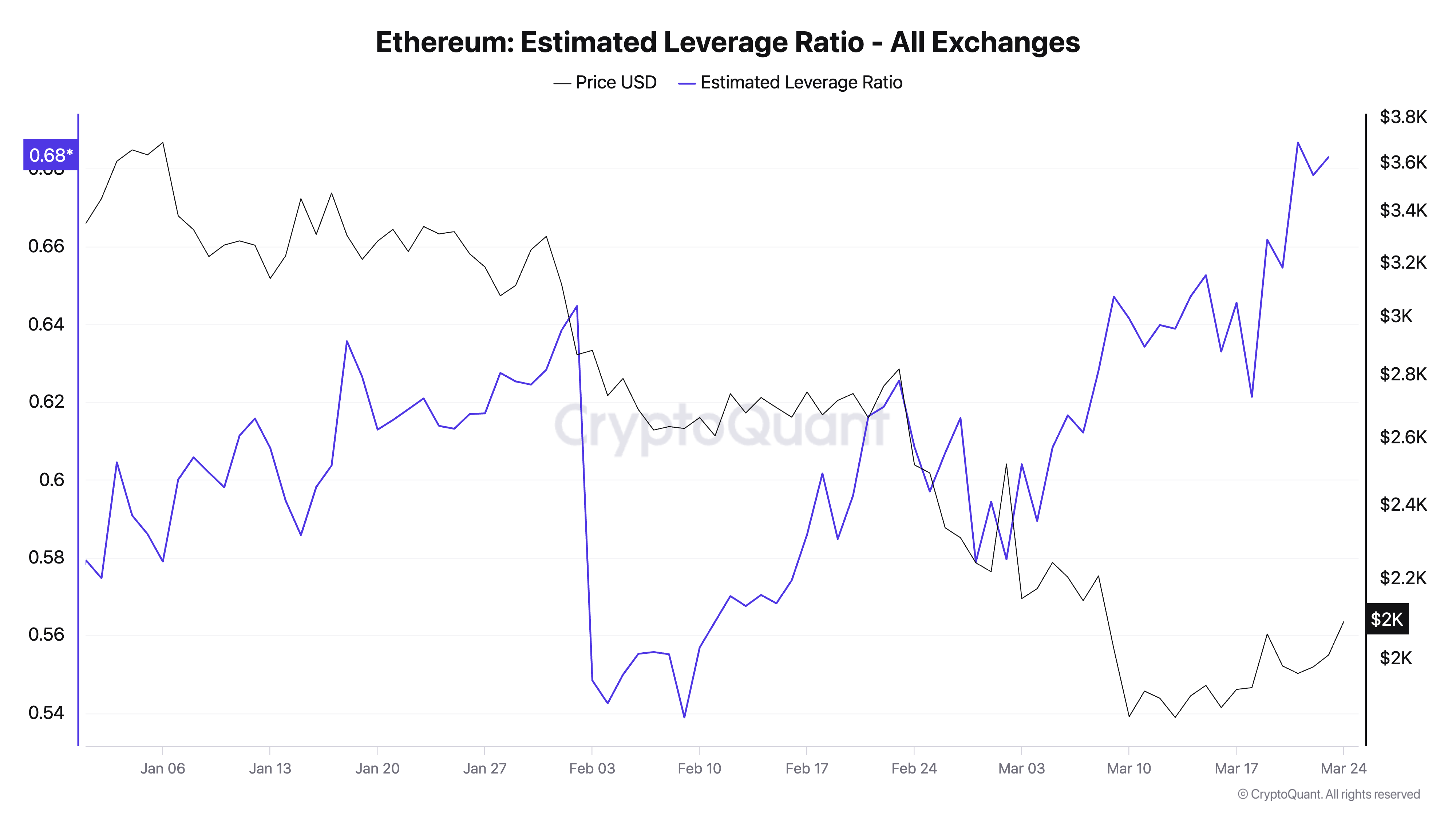

Another on-chain data signal is the rise in ETH's Estimated Leverage Ratio (ELR), suggesting that traders are increasingly using leverage to amplify the coin's future price increase.

Notably, the ELR reached its annual high of 0.686 on March 21st before slightly declining. Currently, ETH's ELR is 0.683.

ELR measures the average leverage traders use to execute trades on cryptocurrency exchanges, calculated by dividing outstanding contracts by the exchange's reserve of that currency.

ETH's surging ELR indicates increased risk appetite among traders despite price challenges since the beginning of the year. This trend shows that many coin holders are optimistic about short-term rallies and willing to leverage positions to potentially increase profits.

ETH Turning Point... Bullish at $2,224, Bearish at $1,924

ETH is currently trading at $2,089, rising 4% in the last 24 hours. The green histogram bar posted by the Elder-Ray indicator reflects a strong upward bias for altcoins, currently at 52.80, its highest in the past 30 days.

This indicator measures buying and selling pressure in the market. A positive value indicates buyer dominance, suggesting strong upward momentum and potential price increase trends.

If ETH's bullish momentum strengthens, it could push the coin's price to $2,148.

However, if bears regain control, the altcoin's value could drop to $1,759.