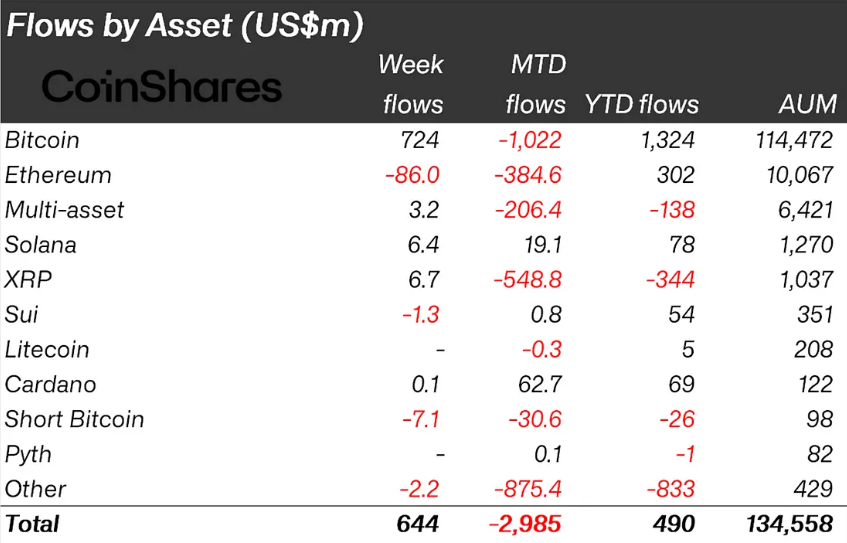

Cryptocurrency inflows reached $644 million last week, creating new market optimism.

This is a significant reversal after 5 consecutive weeks of outflows, suggesting a major shift in investor sentiment.

Cryptocurrency Inflows of $644 Million... Market Sentiment Recovery

This rebound followed a period when substantial funds were withdrawn from the market during a time when investor sentiment was cautiously maintained. With total AUM increasing by 6.3% since March 10th, the latest data indicates a critical change in market confidence.

According to the latest CoinShares report, Bitcoin emerged as the primary driver of market recovery. This pioneering cryptocurrency attracted $724 million in inflows, effectively ending 5 consecutive weeks of total $5.4 billion outflows.

The surge in inflows reflects increased investor confidence in Bitcoin. Previously, it showed continuous outflows amid widespread market uncertainty. While Bitcoin demonstrated a strong recovery, the altcoin market showed mixed performance.

Ethereum experienced the largest outflow of $86 million, while Solana recorded an inflow of $6.4 million.

The difference in altcoin sentiment highlights that investors are selectively approaching where to allocate capital, particularly focusing on projects with strong foundations. The data continues to show investor caution towards Ethereum (ETH) while indicating strong potential for Solana (SOL).

Meanwhile, most inflows last week occurred in the United States, with $632 million entering digital asset investment products.

March Reverses Negative Trend from February

The return of inflows follows the challenging February and early March when cryptocurrency outflows surged. A week ago, cryptocurrency outflows reached $1.7 billion, with Bitcoin experiencing the most severe outflows.

Previously, outflows had reached $876 million, with US investors selling digital assets during a weak trend. Therefore, the latest capital inflows suggest a changing sentiment, potentially triggered by renewed institutional interest and a more stable macroeconomic outlook.

Further strengthening the market's rebound, Bitcoin ETFs also showed strong capital inflows. After 5 consecutive weeks of outflows, Bitcoin ETFs recorded $744 million in inflows last week, indicating increased institutional participation.

The recovery aligns with Bitcoin's broader market revival, suggesting investors are regaining confidence in cryptocurrency-based financial products.

"I bet Bitcoin will retest $76,500 before reaching $110,000 because the Fed is transitioning from quantitative tightening to quantitative easing on government bonds. And tariffs are not important due to temporary inflation." – BitMEX Founder Arthur Hayes

Meanwhile, according to BeInCrypto data, BTC is currently trading at $87,720, representing nearly a 4% increase in the past 24 hours, steadily approaching the psychological level of $90,000.

"Bitcoin surpassed $87,000 on Monday, reaching its highest level since March 7th, after dropping to $76,000 earlier this month. This rally occurred as reports suggested the April 2nd Trump tariffs would be more specific and less destructive than expected." – Financial Expert Walter Bloomberg

The upcoming Trump tariffs, scheduled for April 2nd and dubbed "Liberation Day", are expected to be less destructive than anticipated. This could boost investor confidence in risk assets like Bitcoin. The White House's mutual tariff plan aims to equalize trade barriers, with Trump emphasizing "flexibility" for certain countries without exceptions.