Bitcoin (BTC) is showing positive momentum in recent price movements and indicating potential breakthrough signs.

As the broader market situation stabilizes, BTC is maintaining steady performance. Consistent investor behavior is generating hope for further increases. This altcoin continues to attract investor interest while showing growth potential.

Bitcoin, Major Holder Support

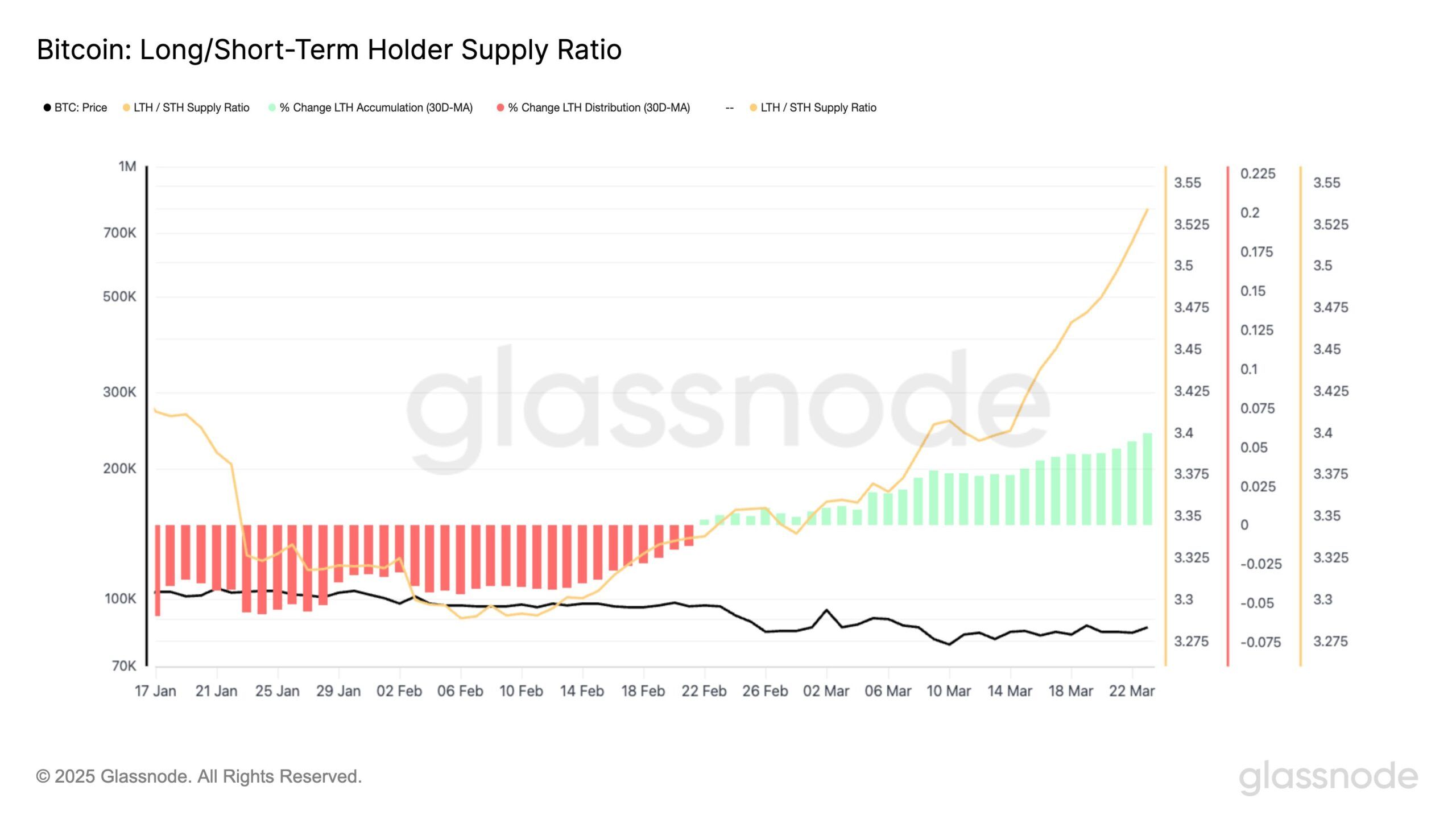

The long-term/short-term holder supply ratio has shown notable growth since late February, indicating a positive change in investor behavior. Long-term holders (LTH) are steadily accumulating, with the 30-day accumulation rate now approaching 6%. The pace of this change is also increasing, recording a daily average of 7% since late February.

This continuous accumulation suggests that LTH strongly believe in the future potential of Bitcoin. This could help BTC maintain its recent growth. LTH are often considered a stabilizing force in the market, and their consistent accumulation could form the basis for Bitcoin's continued price appreciation.

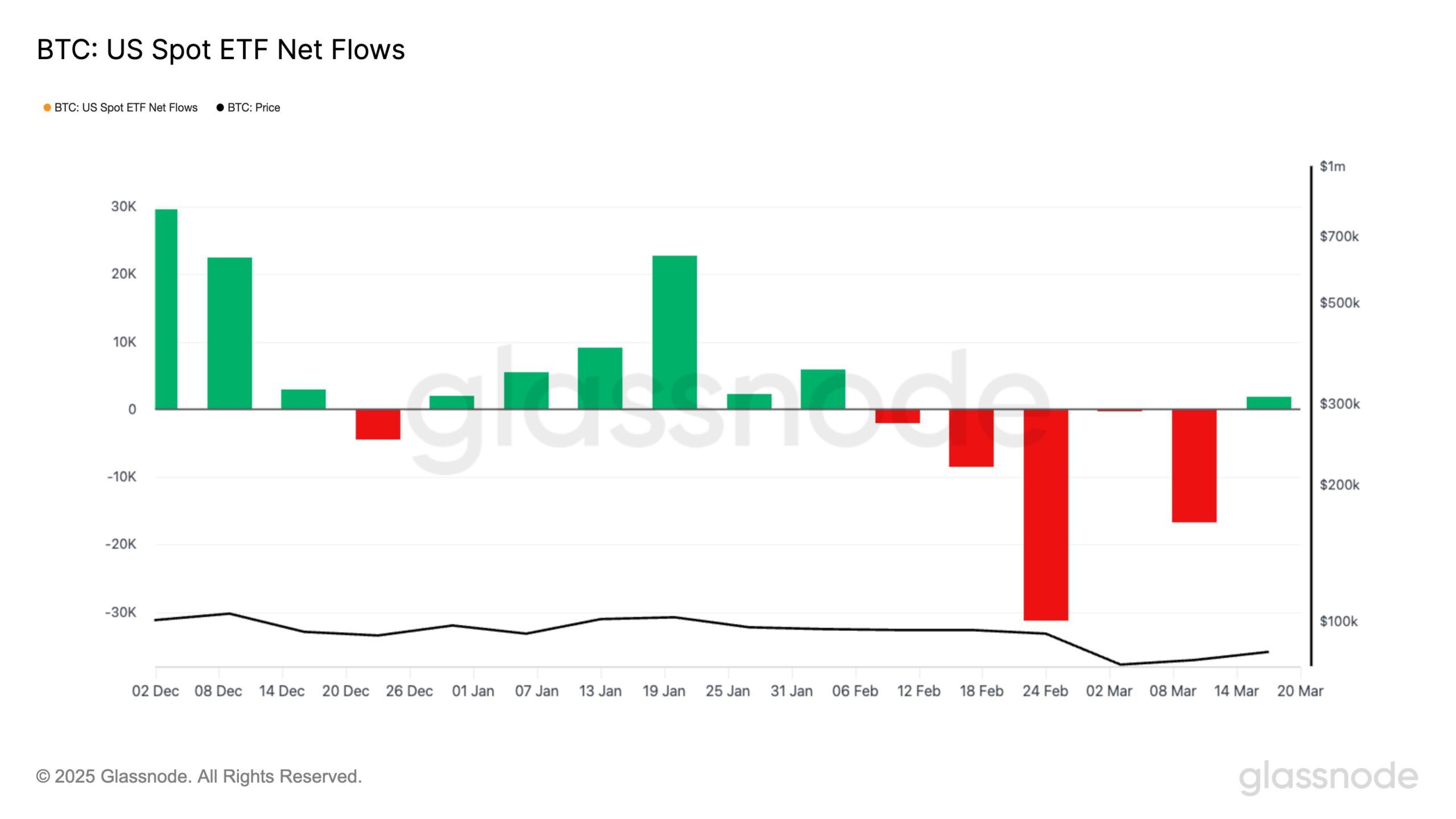

Bitcoin also showed positive macroeconomic momentum with recent inflows into Bitcoin spot ETFs. Last week marked the first ETF inflows in a month, breaking a four-week outflow streak. This change particularly indicates investor confidence is recovering among macro financial investors. The new interest in BTC ETFs reflects increasing demand for Bitcoin exposure in institutional portfolios.

The inflows suggest that large investors are again viewing Bitcoin as a valuable asset. This could strongly imply that demand for Bitcoin is recovering, which could further drive up prices. Institutional investor participation could lead to significant price increases in the coming weeks.

BTC Price Increase Continues

Bitcoin is currently trading at $86,630, breaking through a descending wedge pattern. The price is attempting to secure $86,822 as a support level, which is crucial for BTC's next movement. If the support level is maintained, Bitcoin could continue its upward trend towards the $89,800 resistance level.

Confirmation of the breakthrough will occur when Bitcoin transforms the $89,800 resistance into support. Consistently surpassing this level could push the price to $93,625, and potentially up to $95,000.

However, if Bitcoin fails to break through $89,800, it may struggle to maintain its current momentum. A correction below this level or a drop to $85,000 would delay recovery and cautiously shift market sentiment. This could halt progress and potentially lead to a longer consolidation phase.