As April approaches, traders are carefully watching whether Bitcoin can maintain its current momentum or experience another volatility. The major cryptocurrency is trading at $87,208, having risen 10% over the past two weeks.

As the broader market recovery progresses, Bitcoin demand may strengthen in April, with prices potentially steadily recovering to retest the range between $90,000 and $95,000.

Bitcoin Bottom? Current Level Rebound Signal

Bitcoin (BTC) started March with a strong upward momentum, surging to $96,484 on March 2nd. However, as market sentiment turned bearish, profit-taking intensified, and it recorded a four-month low of $76,642 on March 11th.

Since then, Bitcoin has shown a recovery, supported by broader market rebound and new demand. Currently, Bitcoin is trading within an ascending parallel channel, which indicates that BTC price will gradually rise as buying momentum strengthens.

In an exclusive interview with BeInCrypto, Julio Moreno, Research Head at CryptoQuant, confirmed this upward outlook.

"In April, Bitcoin's price could rebound as selling pressure from traders eases," Moreno said.

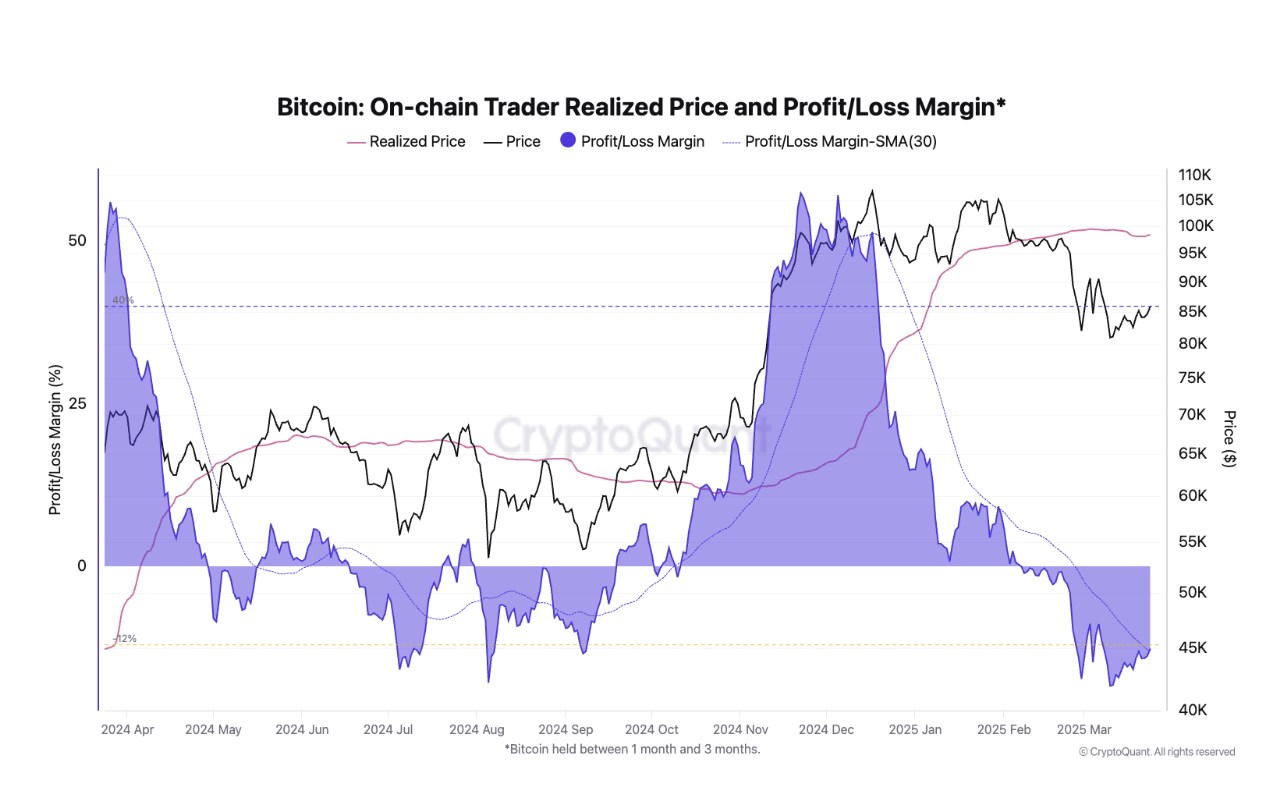

Moreno found that BTC's realized profit/loss margin has been steadily decreasing since the beginning of the year. When this indicator declines, it means the overall profitability of BTC coins used on-chain is decreasing.

This means investors are realizing fewer profits or experiencing losses, reducing selling motivation. Over time, this trend will gradually alleviate selling pressure in the BTC market and drive prices up in the coming weeks.

"After Bitcoin's price dropped 23% from its previous high, traders will now only experience losses if they sell. This situation generally indicates less selling pressure on Bitcoin. In fact, traders' on-chain unrealized profit margin is currently -13%, which is typically associated with local price bottoms. This can easily pull prices back to the $90,000 area," Moreno added.

Sentiment Deterioration... Potential Surge in Selling Pressure

Particularly, as the market attempts recovery, bearish sentiment remains strong among traders.

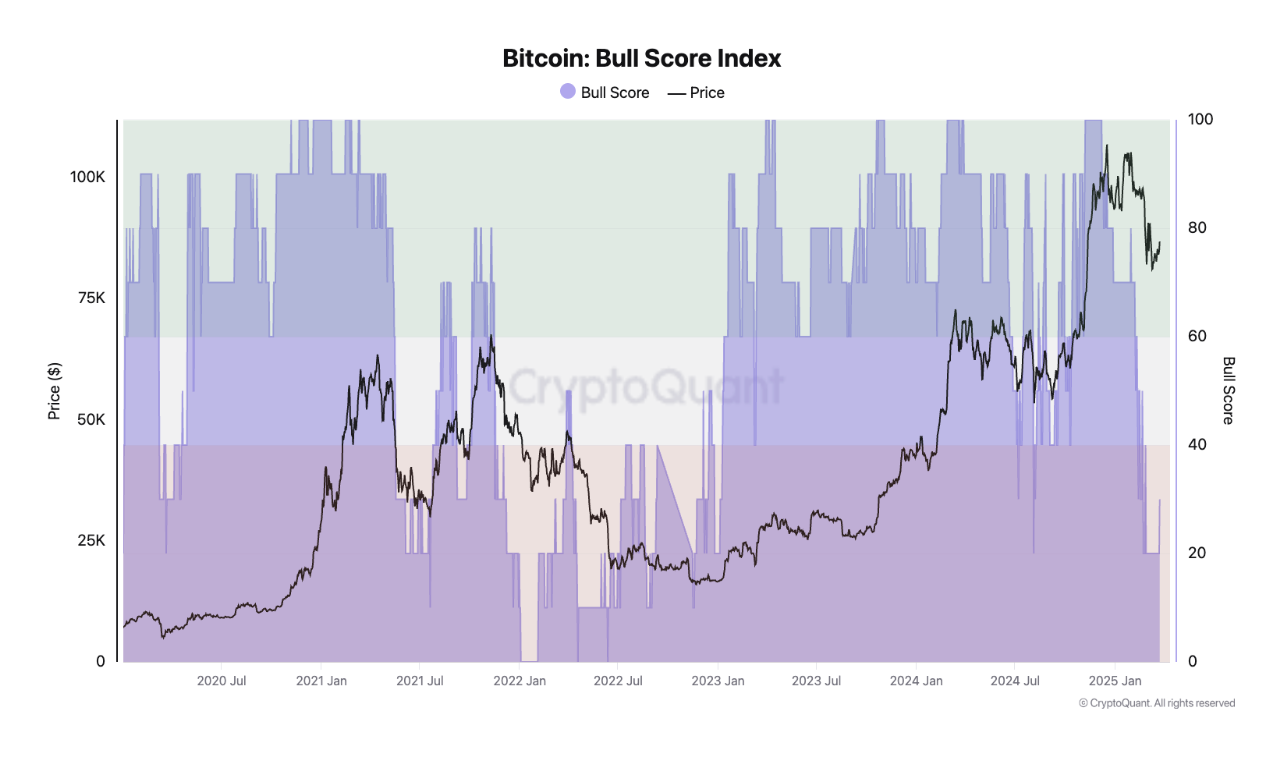

"Overall market sentiment remains bearish, which can be seen in CryptoQuant's Bull Score index. This index reached 20 a few days ago, the lowest since January 2023, indicating a weak market situation. This raises concerns that the recent price decline might be part of a broader downward trend rather than a short-term correction," Moreno explained.

He also noted that historically, Bitcoin has only experienced sustained price increases when the Bull Score is above 60, with scores below 40 being associated with bear markets.

The Crypto Fear and Greed Index reflects this outlook. At the time of reporting, this index is at 40, suggesting the market is currently in a state of fear.

When traders are this fearful, it increases selling pressure, reduces BTC trading volume, and causes price declines.

Bitcoin to Maintain $87,000? Or Drop to $77,000?

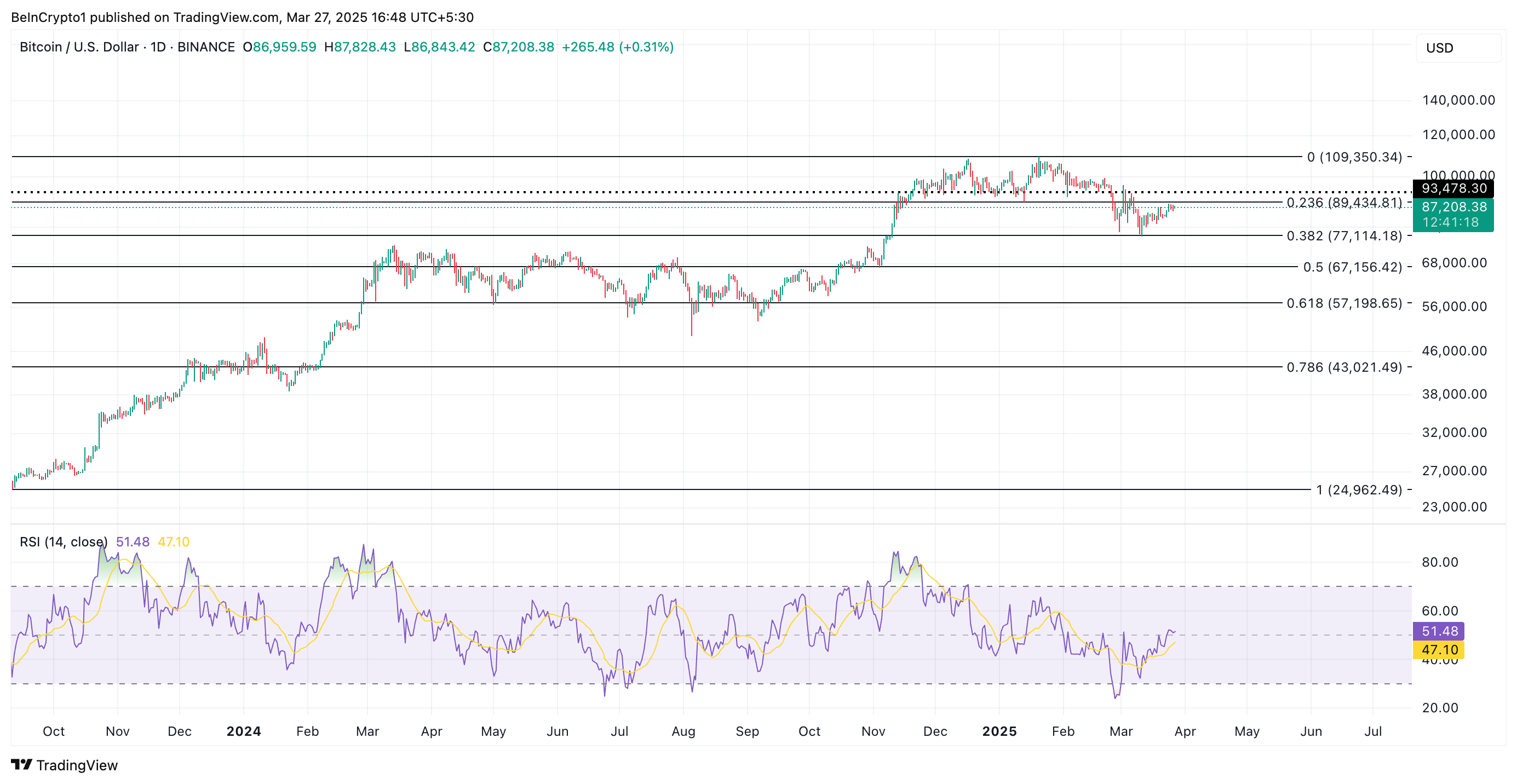

At the time of reporting, BTC is trading at $87,208, rising 2% last week. On the BTC/USD daily chart, the coin's Relative Strength Index (RSI) is slightly above the neutral line at 51.48, indicating a gradual revival of new demand.

The RSI indicator measures an asset's overbought and oversold market conditions. It ranges from 0 to 100. Values above 70 indicate an asset is overbought and a price decline is expected, while values below 30 suggest the asset is oversold and may rebound.

BTC's RSI showing a slight upward trend at 51.48 suggests strong upward momentum in the market. Strengthening demand could push the coin's price to $89,434. Successfully breaking this resistance could trigger a rally to $93,478.

However, if selling resumes, BTC's price could drop to $77,114.