Ethereum (ETH) is under pressure again, dropping by about 3% in the past 24 hours to fall below $1,800. This decline is putting several large leverage positions at risk, including two major whale vaults holding over $235 million in ETH.

On-chain indicators are sending warning signals and technical levels are being tested, increasing risks for both bulls and bears. With ETH hovering near a critical support level, the next few days could be decisive for its short-term price trajectory.

Ethereum Whales May Be Liquidated

Ethereum has slipped back below $1,900, dropping approximately 3% in the past 24 hours, putting pressure on large leverage positions in the DeFi ecosystem.

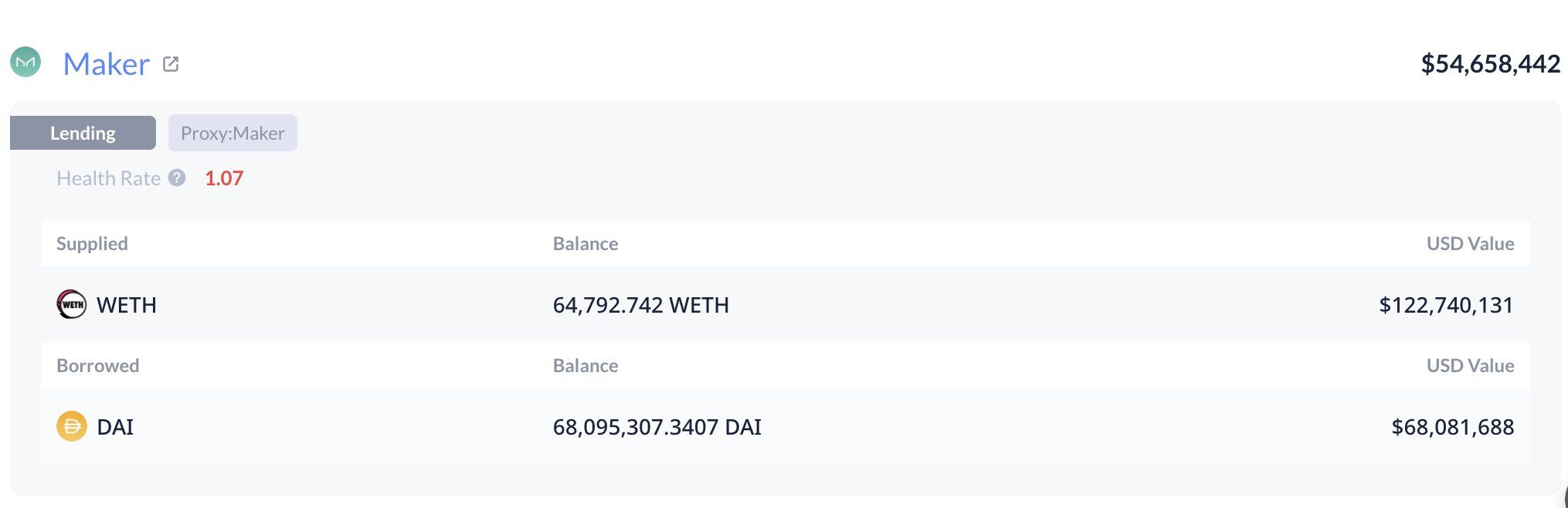

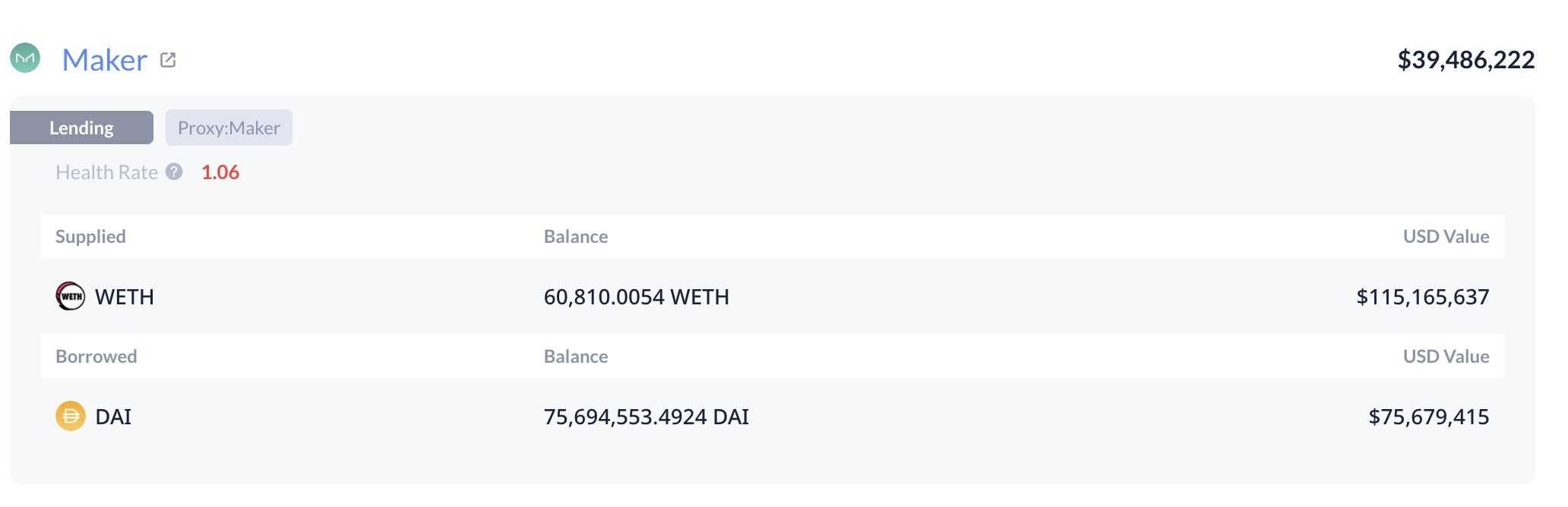

According to on-chain data from Lookonchain, two major whale vaults from Maker, one of the primary decentralized lending protocols, are now approaching critical levels.

These vaults hold a total of 125,603 ETH, which amounts to approximately $235 million. As ETH's price approaches the liquidation threshold, both vaults risk being forcibly liquidated if the downward trend continues.

In the Maker system, users can deposit ETH as collateral to borrow Dai stablecoin. To avoid liquidation, the collateral must maintain a certain health ratio. This is essentially a safety buffer.

If that buffer becomes too low, the protocol automatically sells the collateral to repay the debt. In this case, the whale positions' health ratio has dropped to 1.07, dangerously close to the minimum threshold.

One vault faces liquidation when ETH price hits $1,805, while another will be liquidated at $1,787. If ETH continues to decline, these vaults could trigger significant selling pressure, potentially accelerating the downward trend.

Metrics Suggest Potential Continued Decline

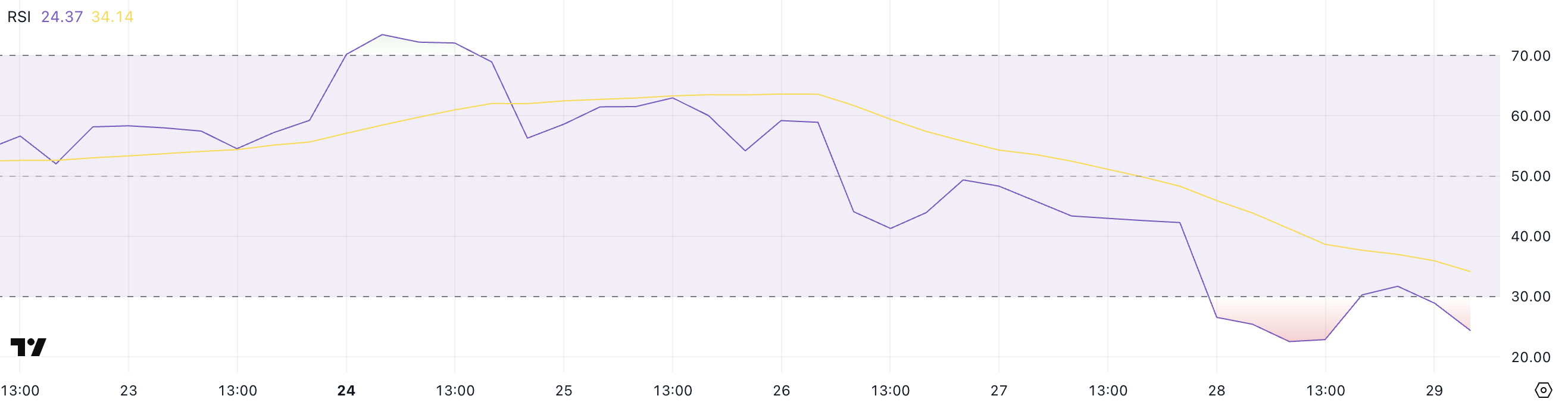

Ethereum's recent price drop has pushed the Relative Strength Index (RSI) back into oversold territory, currently sitting at 24.37. Just three days ago, the RSI was at 58.92, demonstrating how quickly market sentiment has shifted.

The RSI is a momentum indicator measuring the speed and change of price movements, with values below 30 indicating an oversold asset.

This suggests Ethereum could see a short-term rebound or relief rally, but historical data shows RSI can remain oversold for extended periods or further decline if bearish momentum is strong.

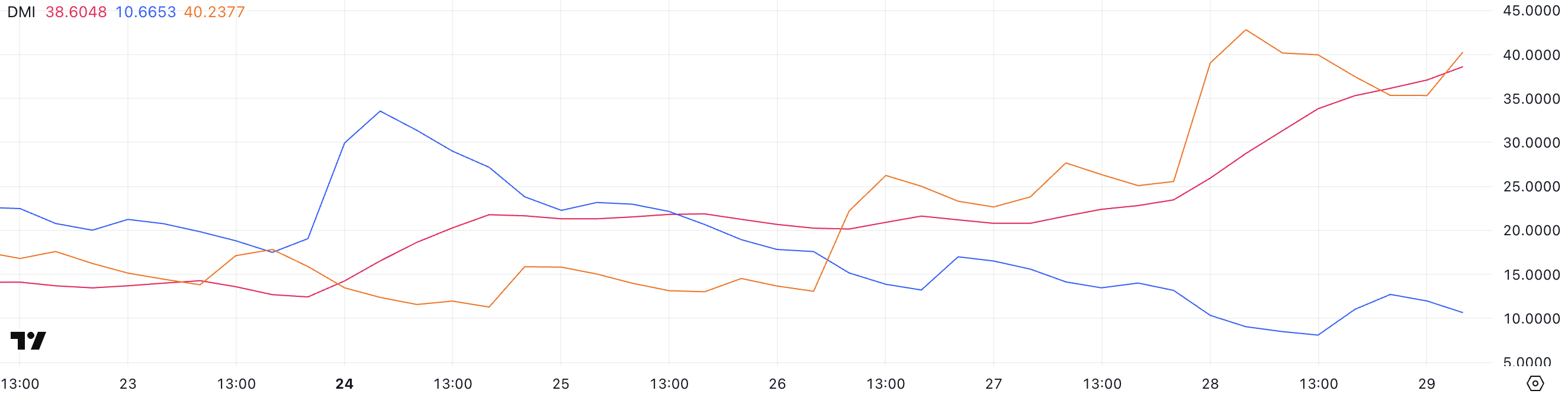

Ethereum's Directional Movement Index (DMI) indicates a strong downward trend, adding to the bearish outlook. The Average Directional Index (ADX), which measures trend strength, has sharply increased from 23.47 to 38.6, indicating growing momentum behind the current movement.

Meanwhile, the +DI (positive directional indicator) has dropped to 10.6, and the -DI (negative directional indicator) has surged to 40.23, showing sellers are firmly in control.

This combination—rising ADX, high -DI, falling +DI—typically suggests an intensifying bearish trend, implying Ethereum's price could face further short-term pressure despite already being technically oversold.

Ethereum to Drop Below $1,800 Soon?

If Ethereum's decline continues, the next key level to watch is the $1,823 support. Falling below this could quickly push the price to $1,759, which would trigger liquidation of Maker's two major whale vaults already near their threshold.

These potential liquidations could amplify selling pressure, making it even more difficult for Ethereum's price to stabilize in the short term. Given the current bearish momentum and weak technical indicators, this scenario remains a realistic risk unless bulls intervene.

However, if market sentiment shifts and the trend reverses, Ethereum could rise again to test the $1,938 resistance level.

Breaking through this could open the path to $2,104, a level that has previously acted as resistance and support. If buying momentum strengthens further, ETH could continue rising towards $2,320 and potentially reach $2,546.