Coinbase, the largest cryptocurrency exchange in the United States, recorded its worst quarter since the dramatic collapse of FTX at the end of 2022.

Coinbase's stock (COIN) plummeted 30% in the first quarter of 2025, reflecting the significant losses across the cryptocurrency market.

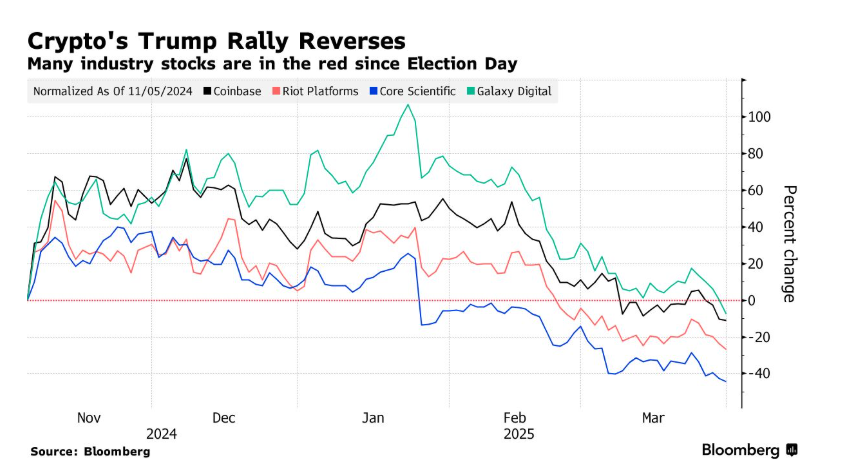

Cryptocurrency Stocks, Assets Post First Quarter Losses

According to Bloomberg, this decline also impacted other major cryptocurrency-related stocks. Galaxy Digital, Riot Blockchain, and Core Scientific also experienced substantial drops.

Moreover, the cryptocurrency market is experiencing challenging times. Bitcoin, long considered an indicator of digital assets, declined 10% this quarter. More dramatically, Ethereum (ETH) showed a massive 45% drop. These losses reflect the overall cryptocurrency market decline triggered by various macroeconomic factors.

Analysts point to global uncertainty surrounding the US economy, concerns about Trump's tariffs, and fears of an economic recession. This has created a general "risk-averse" atmosphere among investors.

"In a risk-averse environment, no asset is safe. Stocks and cryptocurrencies are both impacted. At such moments, emotions matter more than fundamentals," a investor commented on X.

While some highlight these macroeconomic pressures as the primary cause, others argue that market weakness stems from ongoing fears of trade wars and broader geopolitical instability.

"Trump's trade war is driving the market into a panic state. Despite whatever he's doing for cryptocurrency, the macro market conditions are speaking louder. Despite positive news from the White House, his trade war is suppressing price increases," another X user mentioned.

Coinbase was particularly hard hit by this decline. Coinbase's revenue model heavily depends on trading volumes of altcoins and assets beyond Bitcoin. Therefore, the overall market downturn may have impacted the exchange's stock price. Additionally, Coinbase users lost over $46 million to fraud in March.

While cryptocurrencies plummeted, other assets performed much better. Gold, for instance, surged to its best quarter since 1986, as investors flocked to safe-haven assets amid market chaos. Post-election high interest in cryptocurrency briefly pushed Bitcoin's value to $109,000, but that excitement is now cooling down.

Despite overall market challenges, some cryptocurrency-related companies showed resilience. MicroStrategy, led by CEO Michael Saylor, continues to maintain an upward trajectory thanks to substantial Bitcoin holdings.

Currently, the cryptocurrency market must weather the storm, with analysts continuing to monitor macroeconomic factors and their impact on digital assets.