As traditional markets show clear signs of economic downturn, the cryptocurrency market cannot escape the impact. The total cryptocurrency market capitalization is reflecting the stock market decline, with liquidations rapidly increasing.

While the cause of this issue is limited to the United States, its impact will be felt globally. Traders must prepare for ongoing challenges.

Recession, What Impact on Cryptocurrencies?

Several economic experts have warned that the US market is preparing for an imminent recession. It may have already begun.

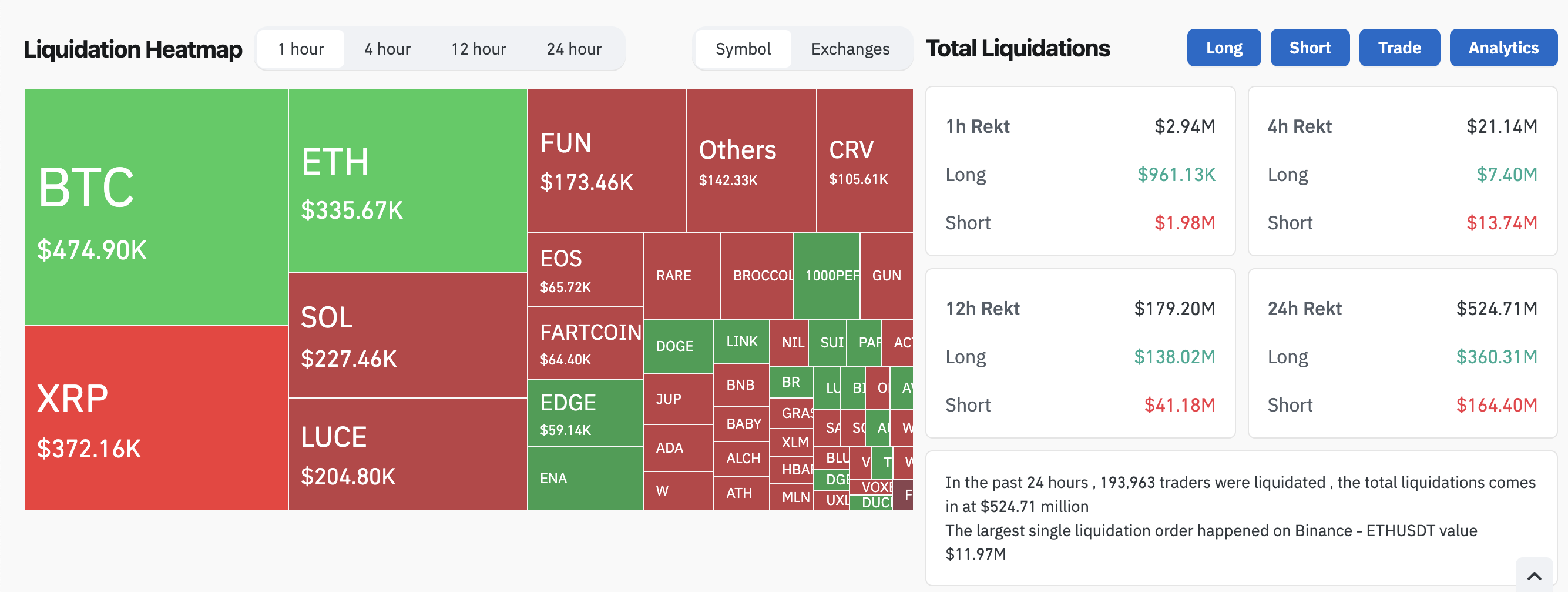

After Donald Trump announced tariffs on Liberation Day, all financial markets were severely hit. The total cryptocurrency market capitalization dropped nearly 8%, and liquidations in the past 24 hours exceeded $500 million.

Several other key indicators show similar trends. At the end of February, the cryptocurrency fear and greed index was in "extreme fear". It recovered in March but fell back into this category today.

Similarly, cryptocurrency-adjacent indicators like Polymarket have begun predicting a higher likelihood of recession.

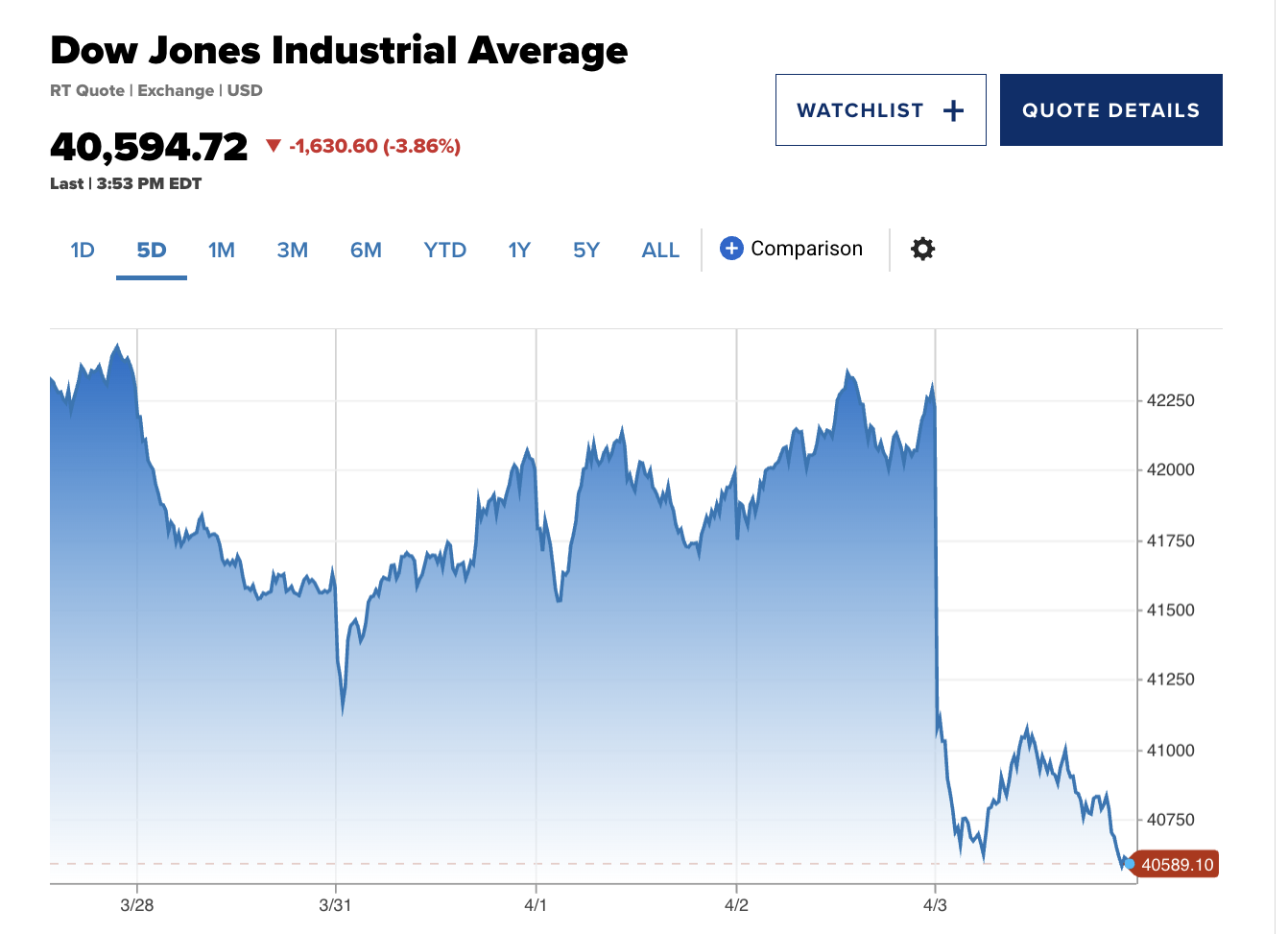

While the cryptocurrency industry is closely linked to Trump's administration, this is not the primary cause of recession concerns. In fact, cryptocurrencies seem to be following traditional financial markets.

The Dow Jones index dropped 1600 points today, and the Nasdaq and S&P 500 recorded their worst daily decline since at least 2020.

Amid these recession concerns, it was difficult to find positive aspects for cryptocurrencies. Bit seemed stable for a moment, but dropped over 5% in the past 24 hours.

This does not necessarily reflect its status as a safe store of value. Gold similarly appeared stable before collapsing. To be fair, gold only dropped 1.2% today.

In this environment, cryptocurrency enthusiasts worldwide should consider preparing for a recession. Trump's proposed tariffs significantly exceeded the worst expectations, and the resulting crisis is centered on the United States.

Overall, current predictions suggest that the cryptocurrency market will somewhat reflect the stock market. If the Nasdaq and S&P 500 continue to decline, the impact on risk assets could worsen.