On April 4, 2025, China imposed an additional 34% tariff on all goods imported from the United States in response to the latest tariffs, further escalating the already tense trade war between the world's two largest economies.

Bitcoin dropped 3% within hours of the announcement, briefly falling below $82,000. This latest development raised concerns about potential impacts among cryptocurrency sector investors, analysts, and participants.

Bitcoin Investors Worried About Trade War Escalation

According to Xinhua News Agency, China will impose a 34% tariff on all products imported from the United States starting April 10. Xinhua reported that the US "reciprocal tariffs" violate WTO rules, seriously undermining the legal and legitimate rights of WTO members and hindering the rules-based multilateral trading system and international trade order.

"This is a typical unilateral hegemonic act that undermines the stability of the global economic and trade order. China resolutely opposes this," the spokesperson for the Chinese Ministry of Commerce said in an interview about China's lawsuit against the US "reciprocal tariffs" at the WTO.

Previously, President Trump had already imposed an additional 34% tariff on China on top of the 20% tariffs imposed in two stages. This means a total of 54% tariffs have been applied to China.

The news from China raised concerns among cryptocurrency investors. On April 4, the Bitcoin price dropped 3% from $84,600 to $82,000.

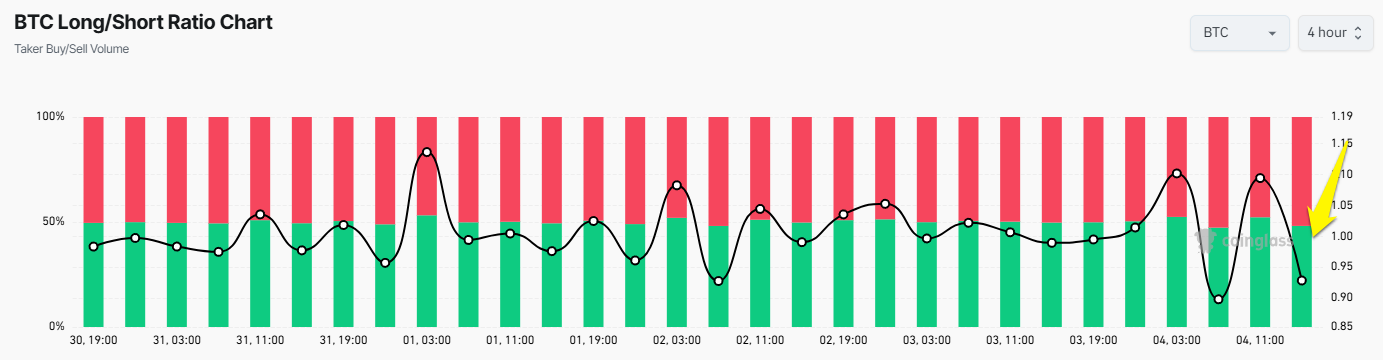

Simultaneously, the Bitcoin Longing/Short ratio fell below 1, indicating a market sentiment favoring Short positions.

Both Bitcoin and other markets were affected. The S&P 500 dropped from 5,260 points to 5,250 points, and the Dow Jones Industrial Average fell from 41,100 points to 40,500 points. China's actions raised concerns about the potential spread of the global trade war.

"The 'Third World War' of trade has begun," commented Kobeissi Letter.

What Will Happen to Bitcoin if US-China Trade War Escalates?

Often praised as a hedge against economic instability, this cryptocurrency tends to behave like a risky asset during sudden uncertain times. Historical patterns support this reaction. During the 2018-2019 US-China trade war, Bitcoin experienced significant sell-offs as tariffs increased, only recovering when the narrative of value preservation took priority.

A substantial part of the global cryptocurrency hardware supply chain comes from China, with companies like Bitmain dominating the production of ASIC mining machines crucial to Bitcoin mining.

Now that the US is imposing a 34% tariff on technology imports from China, the import costs of these mining machines are expected to increase significantly. US Bitcoin miners, already facing high energy costs and competitive pressure on hash rate, may see their profits further reduced.

However, Bitcoin's long-term outlook may not be as bleak as the initial market reaction. Some analysts suggest that long-term trade wars and economic friction could enhance Bitcoin's appeal as a decentralized asset unaffected by government intervention. If tariffs cause inflation or weaken fiat currencies like the dollar, investors might turn to cryptocurrencies as a safe haven.

"Not gold, not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset that doesn't collapse like high-growth stocks but also doesn't attract capital inflows as a traditional safe haven," Stella Zlatareva, editor of Nexo Dispatch, told BeInCrypto.

This sentiment aligns with research suggesting that volatility may cause initial price drops but can pave the way for growth as adoption increases.