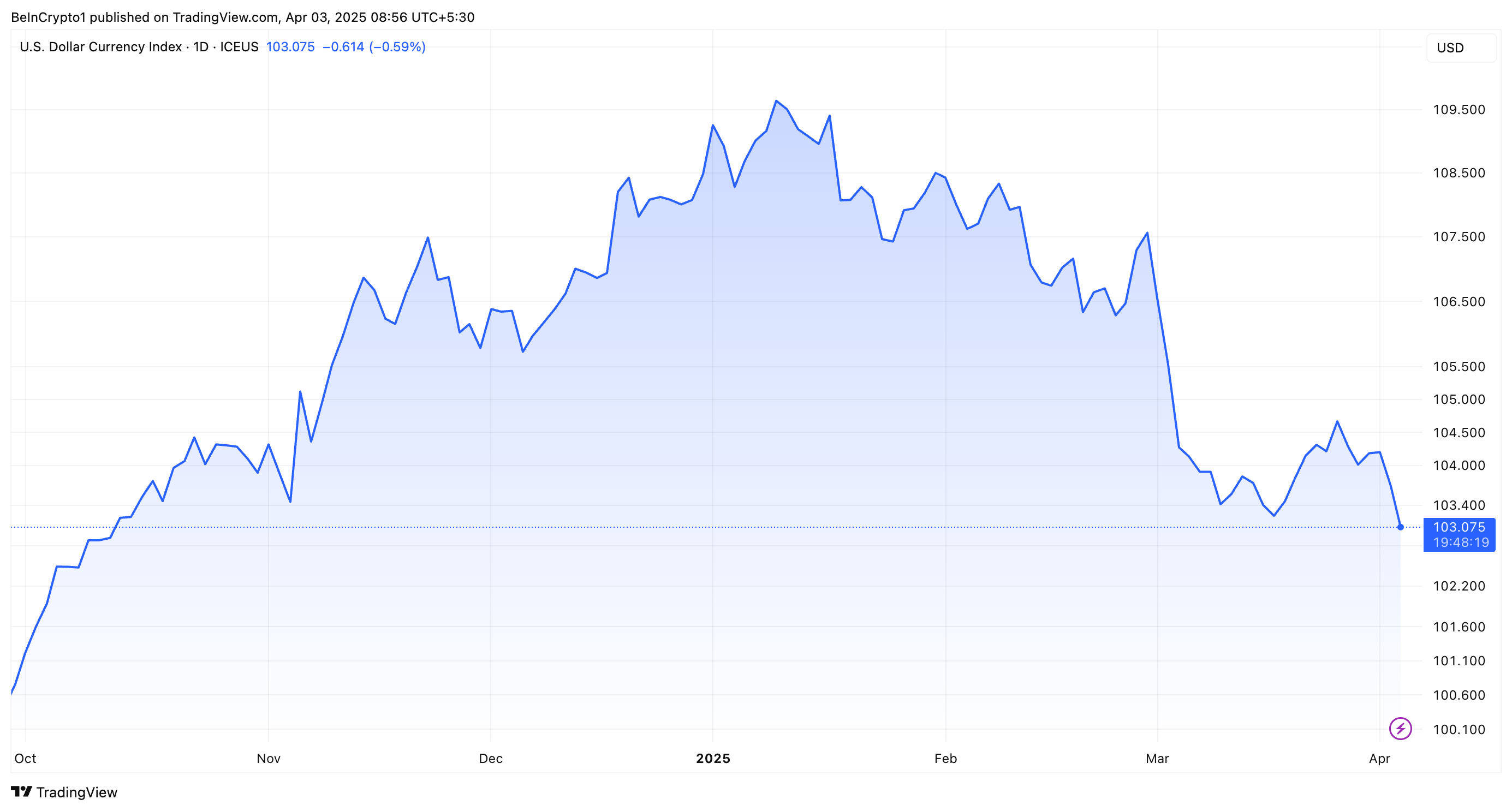

Due to the recent implementation of President Trump's "Liberation Day" policy, the US Dollar Index (DXY) has fallen to its lowest level since mid-October 2024, signaling an uncertain period for the dollar.

Despite the decline, some analysts believe that a weak dollar could promote a short-term rise in Bitcoin (BTC).

Will Bitcoin Benefit from a Weak Dollar?

The DXY, a key indicator measuring the strength of the US dollar against major currencies, is under pressure due to several factors. Concerns about a potential economic recession and escalating global trade tensions have contributed to this decline.

After reaching a two-year high in early January, the DXY has been steadily declining, dropping nearly 4% during the first quarter alone.

Economist Peter Schiff emphasized the severe state of the DXY in a recent X (formerly Twitter) post.

"The US Dollar Index has fallen to its lowest level since October and appears to be heading lower." – Peter Schiff, Economist

Schiff highlighted that contrary to expectations that a strong US dollar would mitigate the impact of tariffs on US consumers, a weak dollar would have the opposite effect, increasing financial burden on consumers.

BeInCrypto reported on April 2, 2025, that President Trump implemented a new "Liberation Day" tariff, imposing a minimum 10% tariff on all imports. This raised concerns about a potential global trade war and further weakened the dollar's value.

A Reuters report emphasized that the dollar fell against the yen, while the euro rose 0.3% to trade at 1.08 dollars, reflecting market unease about the tariff announcement.

However, not all news is bad, especially for cryptocurrencies. Some market observers believe Bitcoin could be a major beneficiary of the dollar's challenges.

Ciara Sun, founder and managing partner of C² Ventures, mentioned on X the increasing likelihood of multiple Federal Reserve rate cuts in 2025, which could further weaken the DXY and enhance Bitcoin's appeal.

"The dollar index shows signs of momentum slowdown, which could be favorable for risk assets." – Ciara Sun, Founder of C² Ventures

Sun's analysis aligns with the inverse correlation between Bitcoin and the US dollar noted in a CoinGecko report from late 2024.

"When the dollar is weak, Bitcoin often shows strength and becomes an attractive alternative." – CoinGecko Report

Adding to the positive outlook for Bitcoin, former BitMEX CEO Arthur Hayes predicted a significant cryptocurrency rise.

"If BTC can maintain $76,500 from now until the US tax day on April 15, we'll be out of danger. Be careful!" – Arthur Hayes, Former BitMEX CEO

This statement follows his prediction that Bitcoin could reach $250,000 by year-end, contingent on the Federal Reserve adopting quantitative easing to support the market.

The path forward remains unclear. Bitcoin may enjoy a short-term rise amid the dollar's decline. However, potential changes in US monetary policy and the ongoing economic impact of global tensions still pose significant risks.

Currently, Bitcoin is experiencing market uncertainty. It dropped 1.5% in the past day, trading at $83,389. Similarly, the overall cryptocurrency market decreased, with market capitalization falling 3.4% during the same period.