The major cryptocurrency Bitcoin has fallen below $75,000. At the time of writing, it is trading at around $74,800, which is the level last seen in November 2024.

The asset has dropped 7% in a day, with trading volume surging over 200%, indicating strong selling pressure. As the downward trend intensifies, major cryptocurrencies may record new short-term lows.

Bitcoin Futures, Traders Exiting…Bull Market Continues

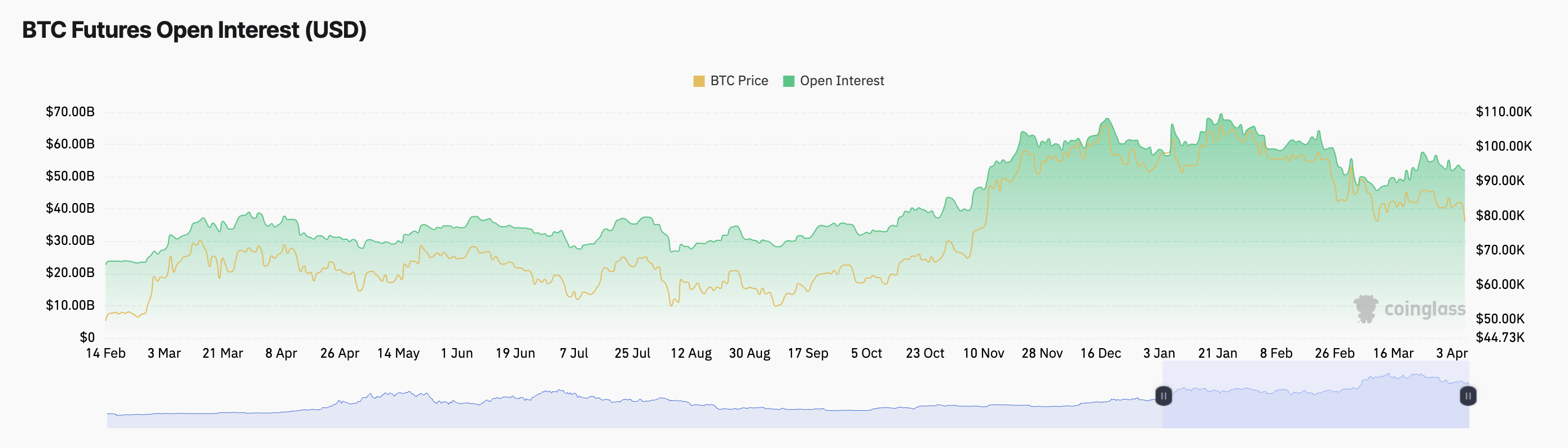

The BTC market's decline is reflected in the decrease of the coin's futures open interest (OI). This indicates that traders are liquidating positions and exiting the market. Currently at $51.88 billion, it has dropped 1% in the past 24 hours.

BTC's futures open interest measures the total number of active futures contracts that are not settled. When it drops like this, it indicates that traders are liquidating positions, either to realize profits or reduce losses.

This decline suggests reduced market participation and weakening confidence in short-term price rebounds.

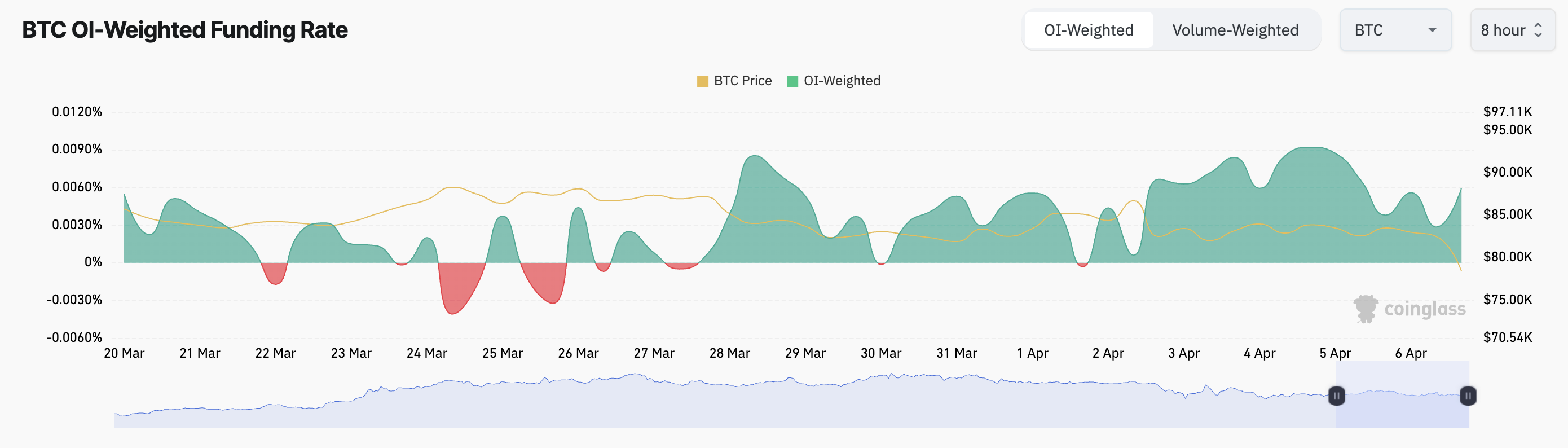

However, despite the sharp decline, market sentiment remains surprisingly robust. BTC's stable positive funding rate is currently 0.0060%, reflecting this.

The funding rate is a periodic payment between long and short traders in perpetual futures contracts. It is designed to align with the spot market price. A positive funding rate means long-position traders are paying short-position traders, indicating more traders are betting on price increases.

This trend reflects a prevailing bullish sentiment among many BTC holders, even as the coin's price is temporarily declining.

Options Traders Prepare for Further Decline

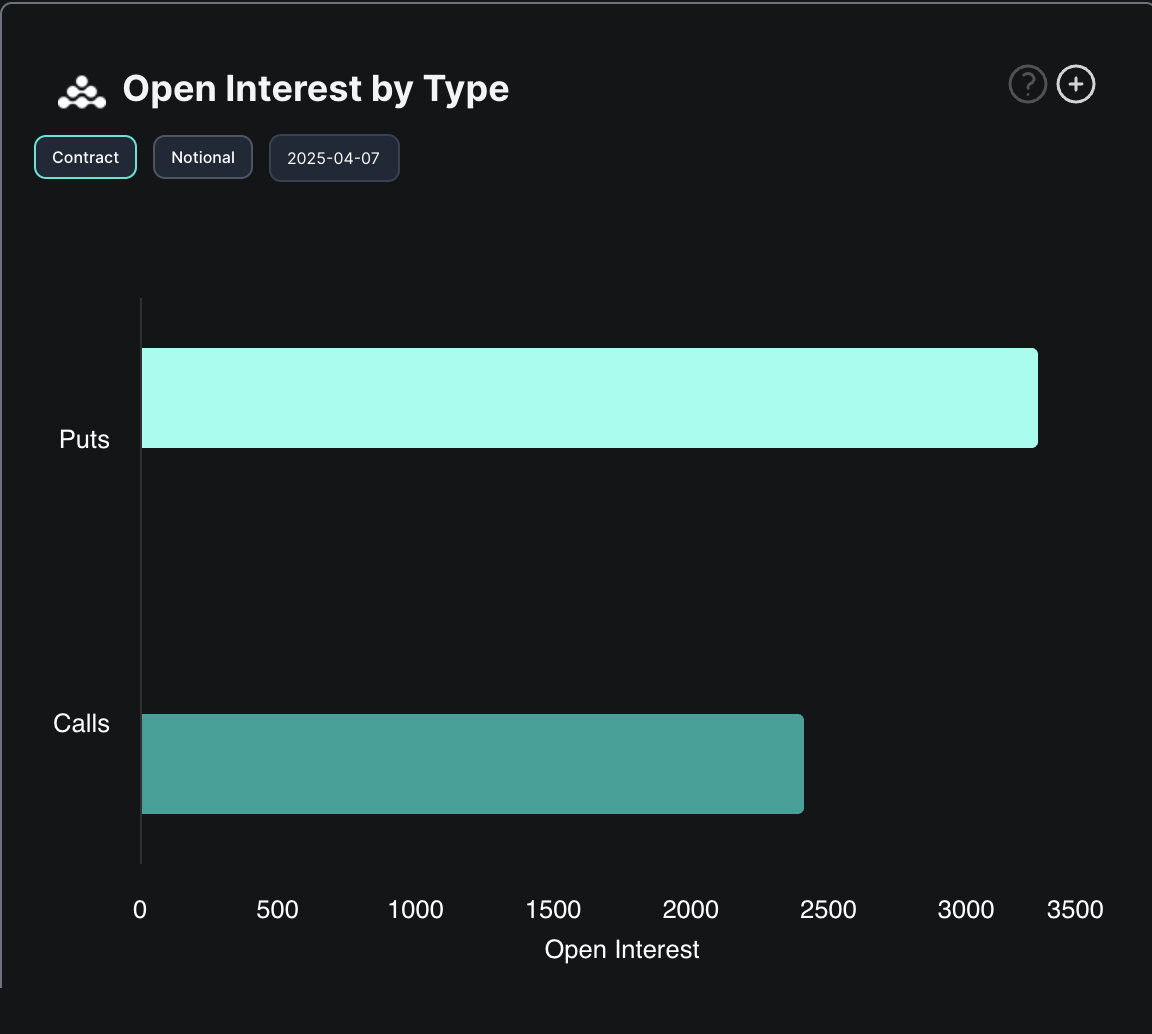

Options market data confirms increasing selling pressure among traders. According to cryptocurrency derivatives exchange Deribit, there are currently more put contracts open than call contracts. This clearly shows that investor confidence in a short-term Bitcoin rebound continues to weaken.

This mixed signal indicates one thing: the market is in a state of conflict, emphasizing that uncertainty prevails. Therefore, caution is advised.