The value of Ethereum, a major altcoin, has fallen to its lowest point since March 2023, indicating a sharp decline in market confidence. The market downturn was intensified by Donald Trump's liberation day.

Exacerbating the downward trend, the ETH/BTC ratio has dropped to its lowest level in 5 years, suggesting Bitcoin's relative strength compared to Ethereum.

ETH/BTC Ratio at 5-Year Low... Traders Leaving

ETH's price drop has pushed the ETH/BTC ratio to a 5-year low of 0.019. This ratio measures ETH's relative value compared to BTC. If the ratio rises, it indicates that altcoin prices are rising faster or Bitcoin's price is falling.

Conversely, this decline suggests Bitcoin's relative strength compared to Ethereum. It indicates that traders are moving capital to BTC, seeing it as a safer or more profitable investment despite current price issues.

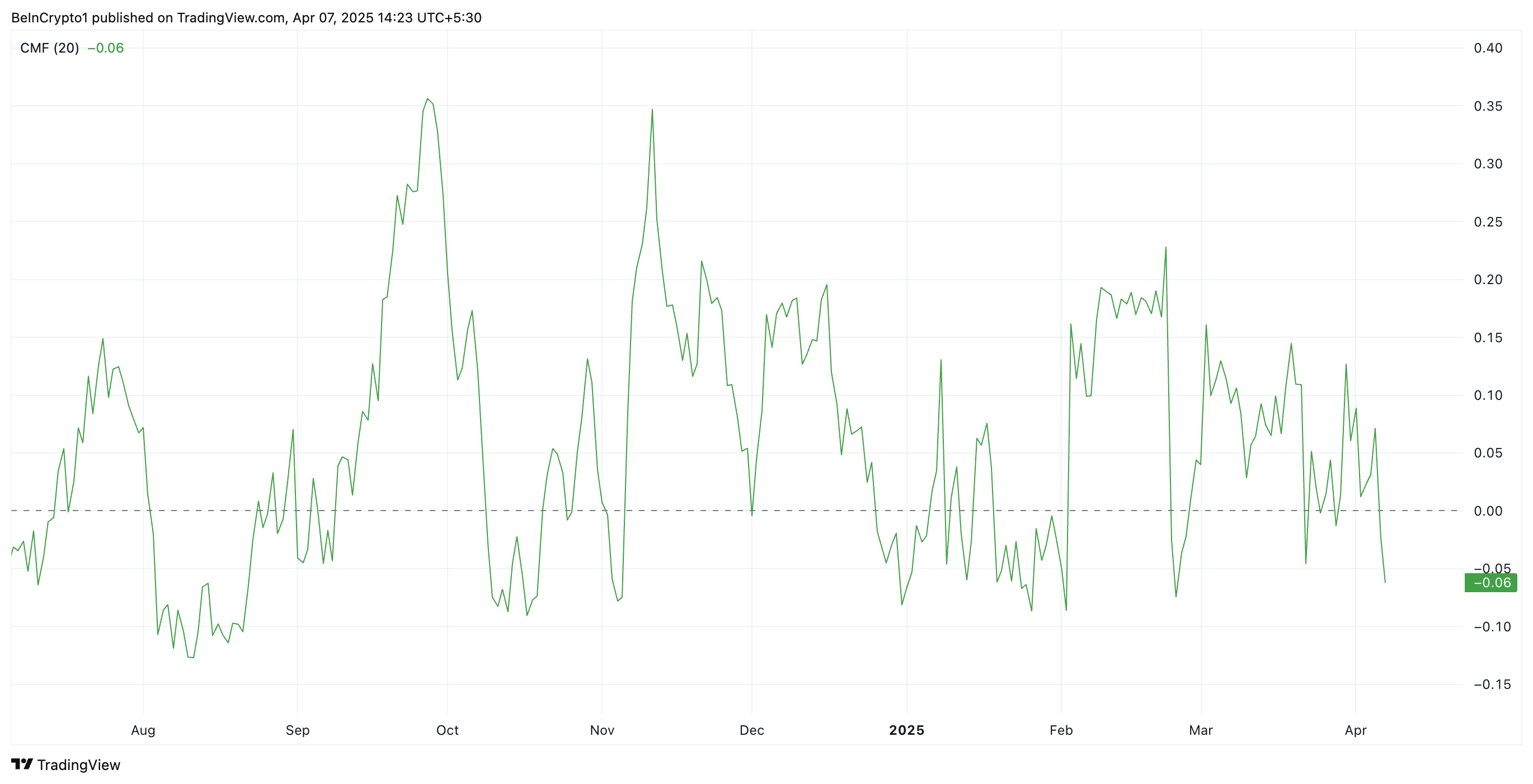

Additionally, ETH's negative Chaikin Money Flow (CMF) on the daily chart confirms the coin's decreased demand. At the time of reporting, it is -0.07.

The CMF indicator measures the period-weighted cumulative accumulation and distribution of an asset. It helps assess buying and selling pressure. A value falling below 0 indicates that selling pressure is dominant.

ETH's CMF value suggests that more traders are distributing (selling) rather than accumulating the coin. This reflects weakening demand and is a bearish signal for the asset's price momentum.

ETH, Oversold Signal... Will It Rebound?

ETH's Relative Strength Index (RSI) on the daily chart shows that the altcoin is currently oversold. At the time of reporting, the momentum indicator is at 25.62 and declining.

The RSI indicator measures an asset's overbought and oversold market conditions. It has values between 0 and 100. Values above 70 indicate an asset is overbought and a price drop is expected. Values below 30 suggest the asset is oversold and may rebound.

At 25.62, ETH's RSI indicates the coin is deeply oversold, providing a buying opportunity. Such lows typically lead to price rebounds.

In this case, ETH's price could recover above $1,589. If this support level is strengthened, it could drive ETH's value to $1,904.

However, this rebound is not guaranteed. If ETH's downward trend continues and selling pressure persists, the coin could fall to $1,197.