Binance Research has published a report analyzing the impact of Trump's tariffs on the cryptocurrency market. The most risky investments were hit the hardest, while real-world assets (RWA) and exchanges were the least affected.

Additionally, the perceived risk of Bitcoin has increased due to its new correlation with the stock market. Only 3% of surveyed investors chose Bitcoin as their preferred asset during a trade war.

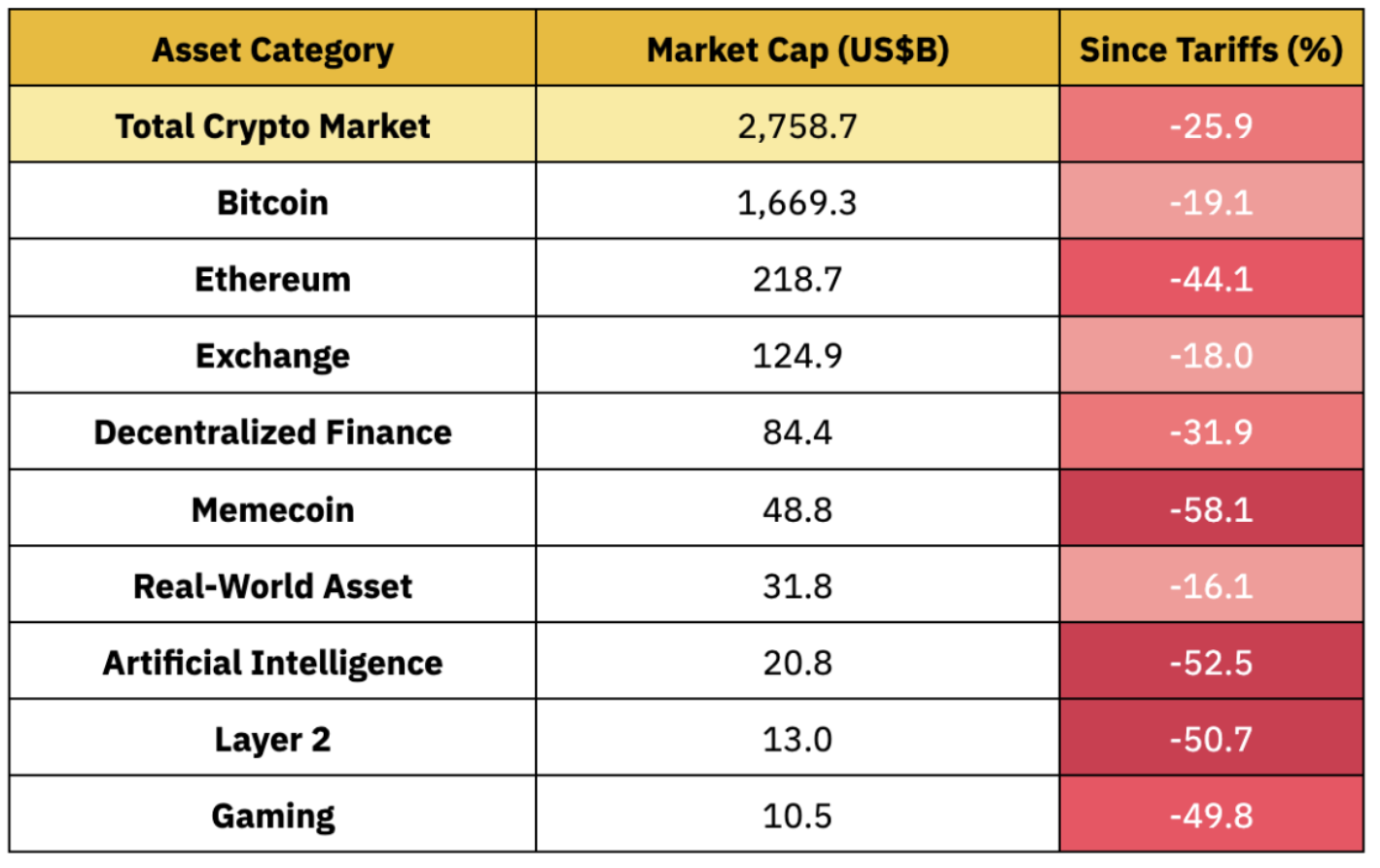

Binance Research, Tariff Analysis

The subsidiary of the world's largest cryptocurrency exchange, Binance Research, is intensively exploring industry trends for 2025. Recently, they reported a significant gap in the latest cryptocurrency airdrop and distribution model.

Today, Binance Research released its latest report on U.S. tariffs.

President Trump's proposed tariffs are particularly important to Binance. They significantly impacted the cryptocurrency market. The report points out that these will be the strictest U.S. tariffs since the 1930s, raising fears of stagflation and a global trade war.

Binance Research analyzed the risks of cryptocurrency-related assets:

Today's market movements support this. For example, Ethereum has fallen to March 2023 levels, and MANTRA's OM token rose after announcing a major RWA fund.

Real-world assets (RWA) are the cryptocurrency market sector facing the lowest risk from tariffs. The report points out that meme coins and AI, perceived as the most risky, are the most vulnerable.

AI tokens and meme coin sectors have fallen by over 50% since the tariff announcement, while RWA tokens dropped only 16%. Exchange-based tokens fell by just 18%.

Binance Research claims that only 3% of FMS investors see Bitcoin as their preferred asset during a trade war. While Bitcoin is one of the most popular narratives for hedging inflation, this new correlation could affect its characteristics.

"Macroeconomic factors, especially trade policies and interest rate expectations, are increasingly driving cryptocurrency market behavior, temporarily obscuring fundamental demand dynamics. Whether this correlation structure persists will be crucial to understanding Bitcoin's long-term position and diversification value." – Binance Research

Ultimately, the report identified many factors that could significantly impact the cryptocurrency market. Other factors include trade war escalation, rising inflation, Federal Reserve policies, and cryptocurrency-related developments.

"As a risk-averse reaction to mutual tariff announcements, the S&P 500 lost over $5 trillion in two days. The U.S. stock market has lost over $11 trillion in the past 44 trading days, approximately 38% of the national GDP. Trump's tariff policy has deepened recession concerns, with JP Morgan raising the probability to 60%." – Pakhul Mia, Executive Director of Gomining Institutional

Overall, while many variables are at play, the possibility of choosing safe options amid this chaos remains high. Blockchain projects driven by utility and long-term development appear to be the safest option in the current highly volatile ecosystem.