Cryptocurrencies and financial markets are being shaken by recent volatility and geopolitical pressures. Consequently, speculations are intensifying about whether the Federal Reserve (Fed) will switch back to quantitative easing (QE).

The potential QE reminds of aggressive monetary interventions in 2008 and 2020. The impact on cryptocurrencies could be massive, with many traders expecting a V-shaped recovery and a historic rally if QE is revived.

Analysts Share Signals of Fed Potential Action

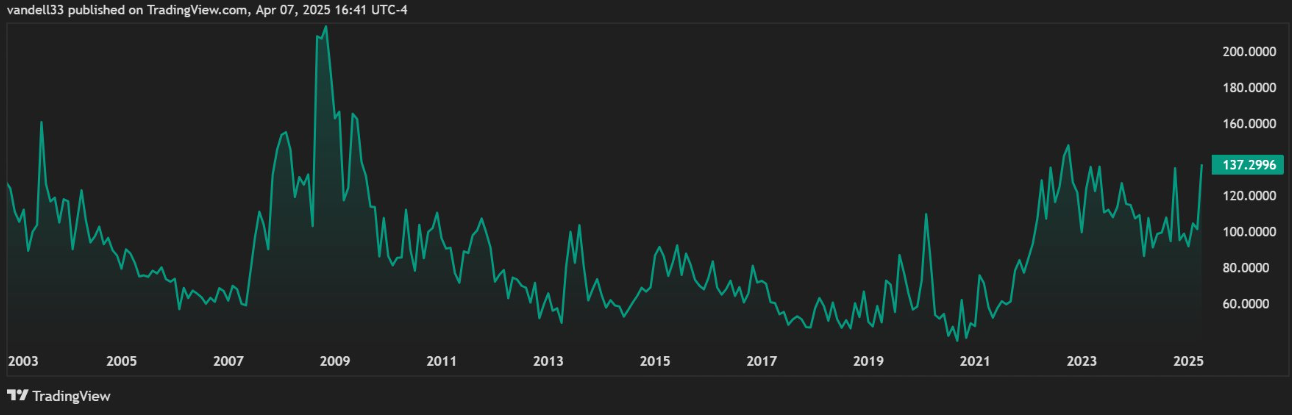

Analysts shared reasons why the Fed might intervene, with one mentioning the MOVE index. This is the "fear index" of the bond market, currently at 137.30 within the 130-160 range. This range is historically when the Fed has acted during crises.

"Currently at 137.30, within the 130-160 range where the Fed can intervene depending on the economy. Even if they don't intervene, they will soon lower rates to refinance debt," – wrote the co-founder of Black Swan Capitalists Vandell.

This signal aligns with other warnings of financial instability, coinciding with global market sell-offs that set the stage for the cryptocurrency Black Monday. This led the Fed to schedule a closed-door meeting on April 3rd.

According to analysts, this timing is no coincidence, and as pressure increases, it's likely that the Fed will capitulate and do as former President Trump desires.

"Everything changes when the Fed hints at QE. Risk: Reward now favors a bull market. Be cautious of volatile price movements but don't miss the recovery rally. And remember... trading this market is easier than holding," – said cryptocurrency trader and analyst Aaron Dishner.

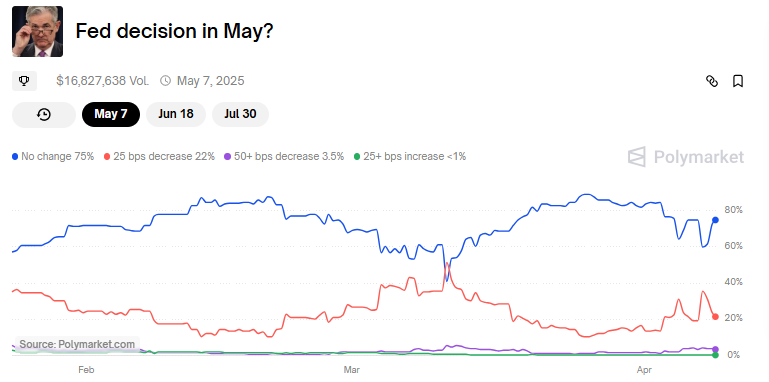

This suggests investors are reading signals between now and the Fed's next policy decision scheduled for May 6-7. JPMorgan became the first Wall Street bank to predict a US recession, adding urgency to the conversation with Trump's proposed tariffs.

The bank suggests the Fed might need to act sooner with rate cuts or even QE before the scheduled FOMC meeting. In this context, cryptocurrency investor Eliz shared a provocative perspective.

"Honestly, I think Trump is doing all of this to accelerate the Fed's rate cuts and QE process," – they mentioned.

This isn't entirely far-fetched, given the Fed needs to manage over $34 trillion in federal debt. Notably, servicing this debt is more difficult at high interest rates. According to Polymarket, the probability of the Fed cutting rates in 2025 is now 92%.

QE Expectations Difficult Before Rate Cuts

If QE materializes, historically, cryptocurrencies could be among the biggest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted QE could inject up to $3.24 trillion into the system, nearly 80% of the amount added during the pandemic.

"Bitcoin rose 24x from its COVID-19 bottom thanks to $4 trillion in stimulus. If we see $3.24 trillion now, BTC could reach $1 million," – he said.

This aligns with his recent prediction that Bitcoin could reach $250,000 by year-end if the Fed switches to QE to support the market.

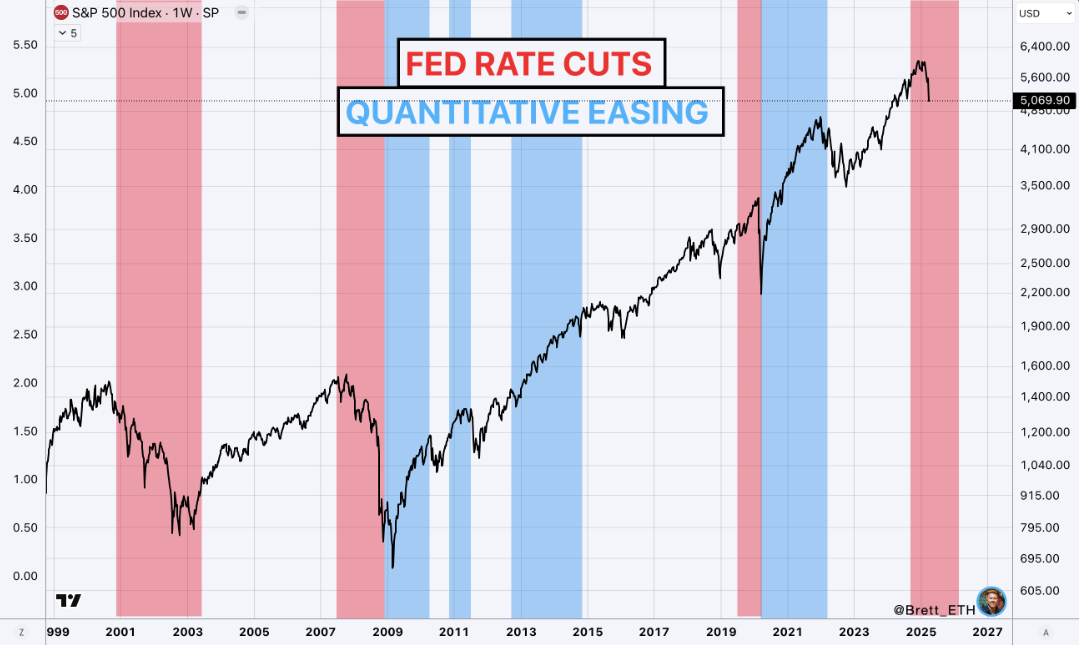

Analyst Brett offered a more cautious view, noting that QE typically follows rate cuts.

"We'll see rate cuts by mid-2026... Like in 2008 and 2020, Powell said QE won't come until rate cuts are complete," – Brett explained.

Based on this, the analyst decided to buy selectively but didn't expect a V-shaped rebound without significant changes.

That "something" could be Trump withdrawing tariffs or the Fed taking emergency easing measures ahead of a recession. If either occurs, the cryptocurrency market could rise quickly.

Is Alt Season Coming?

Meanwhile, Our Crypto Talk says the May quantitative easing could lay the groundwork for a potential altcoin season.

Their prediction reflects how quantitative easing in previous cycles triggered explosive movements in risk assets. When QE started in March 2020, altcoins surged over 100x by the end of 2022.

Traders are now eyeing May as the potential start of the next liquidity wave. Bettors see a 75% chance the Fed will maintain rates. If that probability changes, traders expect the money-printing machine to follow.