In the past 24 hours, approximately $252 million (about 367.9 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, long positions dominated the liquidated positions, highlighting the market's downward pressure.

Bybit had the most position liquidations in the past 4 hours, with a total of $29.69 million (36.02%) liquidated. Among these, long positions accounted for $19.16 million, or 64.55%.

Binance was the second-highest exchange with liquidations, with $23.52 million (28.54%) of positions liquidated, of which long positions were $16.12 million (68.56%).

OKX saw approximately $14.02 million (17.01%) in liquidations, with a long position ratio of 64.38%.

Notably, CoinEx had a higher short position liquidation rate of 60.44% compared to long positions, while on BitMEX, 99.95% of liquidations occurred in long positions.

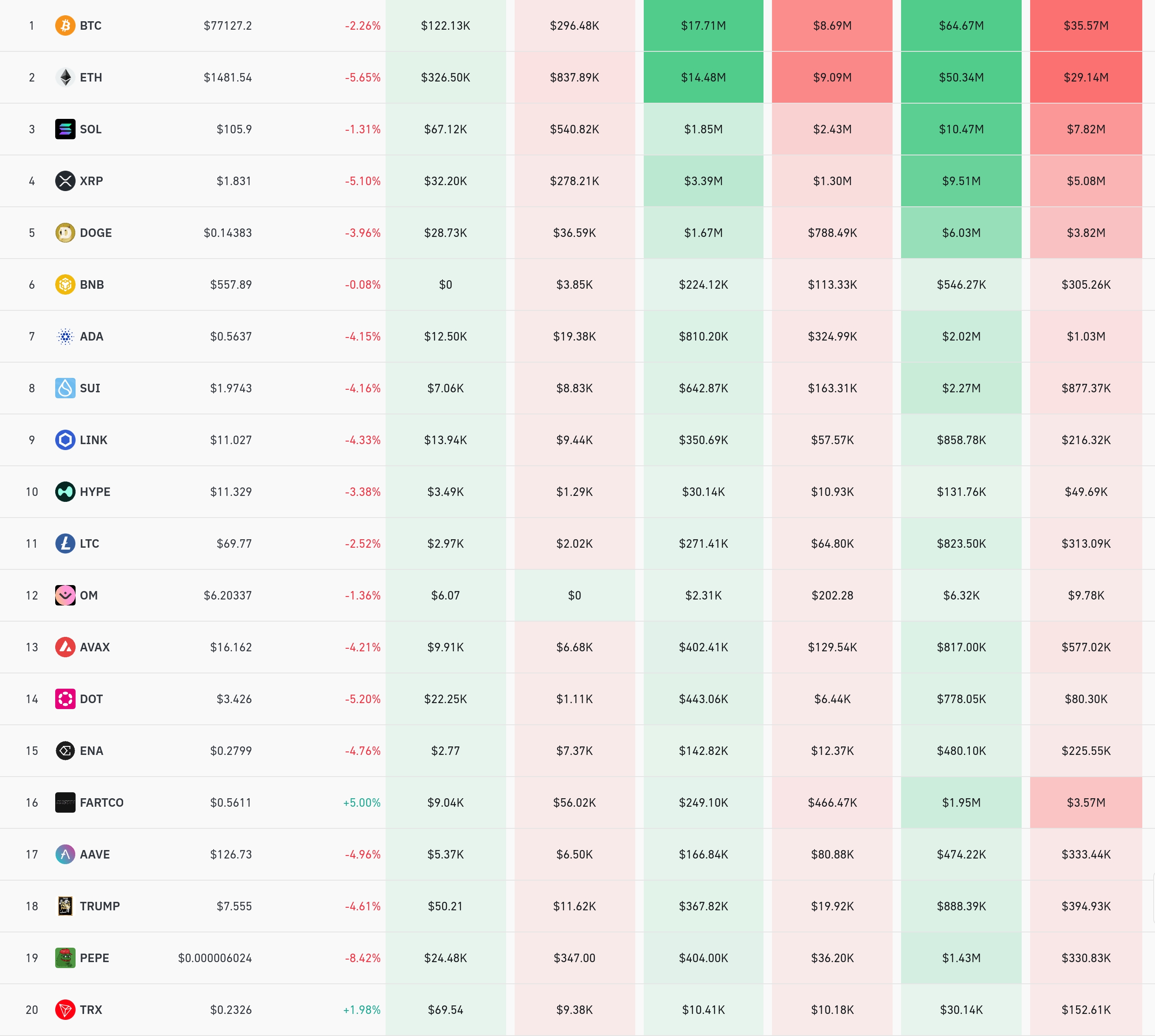

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $100.24 million in Bitcoin positions were liquidated in 24 hours, with $64.67 million in long positions and $35.57 million in short positions liquidated in 4 hours. The current Bitcoin price is $71,727, down 2.26% in 24 hours.

Ethereum (ETH) saw about $79.49 million in positions liquidated in 24 hours, with $50.34 million in long positions and $29.14 million in short positions liquidated in 4 hours. Ethereum is currently trading at $1,481, down significantly by 5.65% in 24 hours.

Solana (SOL) had approximately $18.29 million liquidated in 24 hours, followed by XRP ($14.59 million) and Doge ($9.85 million) among other major altcoins.

Notably, the FARTCO Token saw short position liquidations ($3.57 million) higher than long position liquidations ($1.95 million) during 4 hours, alongside a 5% price increase. This was contrary to the trend of most coins, where long position liquidations were prevalent with price declines.

The Trump-related token TRUMP also experienced significant liquidations with a 4.61% price drop, and the meme coin PEPE saw $1.43 million in long position liquidations with a substantial 8.42% price decline.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This large-scale liquidation can be seen as an indicator of increased volatility in the recent cryptocurrency market, particularly with major cryptocurrency price drops leading to massive long position liquidations.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>