According to local media reports, the four worst-performing ETFs in the UK in the first quarter of 2025 were all related to cryptocurrency and blockchain. These products track vague market indicators rather than specific tokens.

However, concerns about global economic recession are also driving the decline of ETFs linked to specific assets. This data is only from the UK, but it does not suggest optimistic results in the near future.

UK, Cryptocurrency ETF Decline

More than a year has passed since the SEC first approved Bitcoin ETFs, and this asset category has completely transformed the cryptocurrency space. These products have recently seen large inflows, and more and more traditional financial ETF investors want exposure.

However, according to local media reports, some cryptocurrency products have emerged as the worst-performing ETFs in the UK in the first quarter of 2025.

The UK financial publication Morningstar claimed that the four worst-performing ETFs in the UK in the first quarter of 2025 were related to cryptocurrency and blockchain.

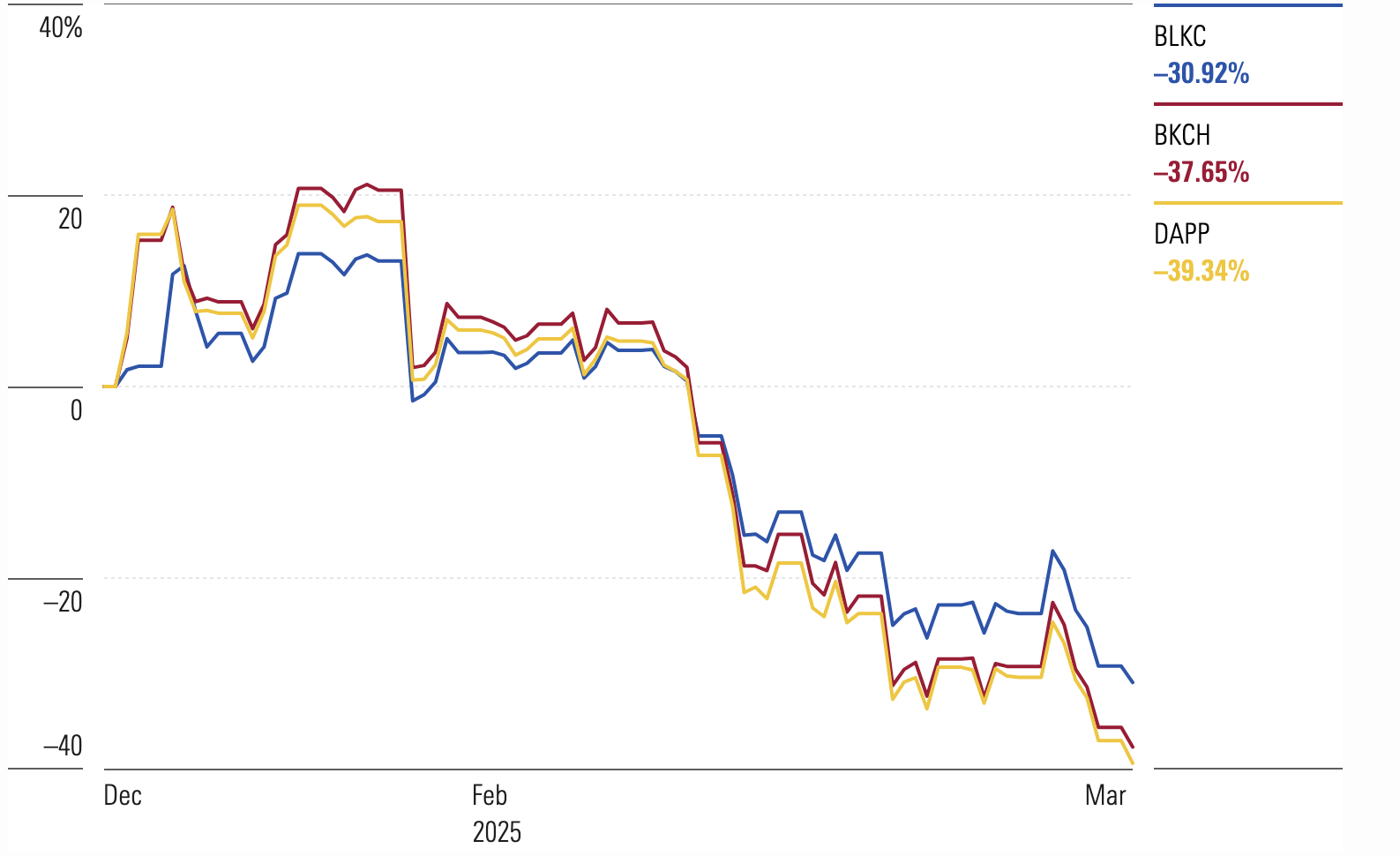

The worst performers were VanEck Crypto & Blockchain Innovators UCITS ETF (DAPP), Global X Blockchain UCITS ETF (BKCH), and iShares Blockchain Technology UCITS ETF (BLKC).

It should be noted that all these ETFs are linked to the cryptocurrency market as a whole, not to specific tokens. As US-friendly regulatory authorities send new approval signals, issuers are launching more of these indirect products.

Three of the four worst-performing ETFs in the UK are traded by major cryptocurrency-related issuers.

Concerns about global economic recession are still causing losses in standard cryptocurrency ETFs. Investors have withdrawn hundreds of millions of dollars from Bitcoin and Ethereum ETFs due to Trump's tariff threats, and these inflows have not yet returned.

Issuers are still signaling long-term confidence in the underlying assets, but positive growth has not been realized.

All of this means that recent UK data can provide valuable insights into the global cryptocurrency ETF market. These results do not paint an optimistic picture, and news of the decline of token-specific ETFs makes the market look even more gloomy.

It may be too early, but institutional cryptocurrency funds may face contraction.