As the cryptocurrency market plummets under the pressure of new global tariff policies, fear is spreading throughout the investment community.

Amid the chaos, cryptocurrency whales are showing two contrasting tendencies: aggressive selling to minimize losses and strategic accumulation in anticipation of a rebound.

Cryptocurrency Market Crash...Increasing Tariff Pressure

The cryptocurrency market is in free fall, with both Bitcoin and Ethereum experiencing sharp declines. Bitcoin has dropped below $75,000, falling 5.75% in the past 24 hours. Ethereum has suffered even greater losses, falling below $1,400 with a 9.36% decline during the same period.

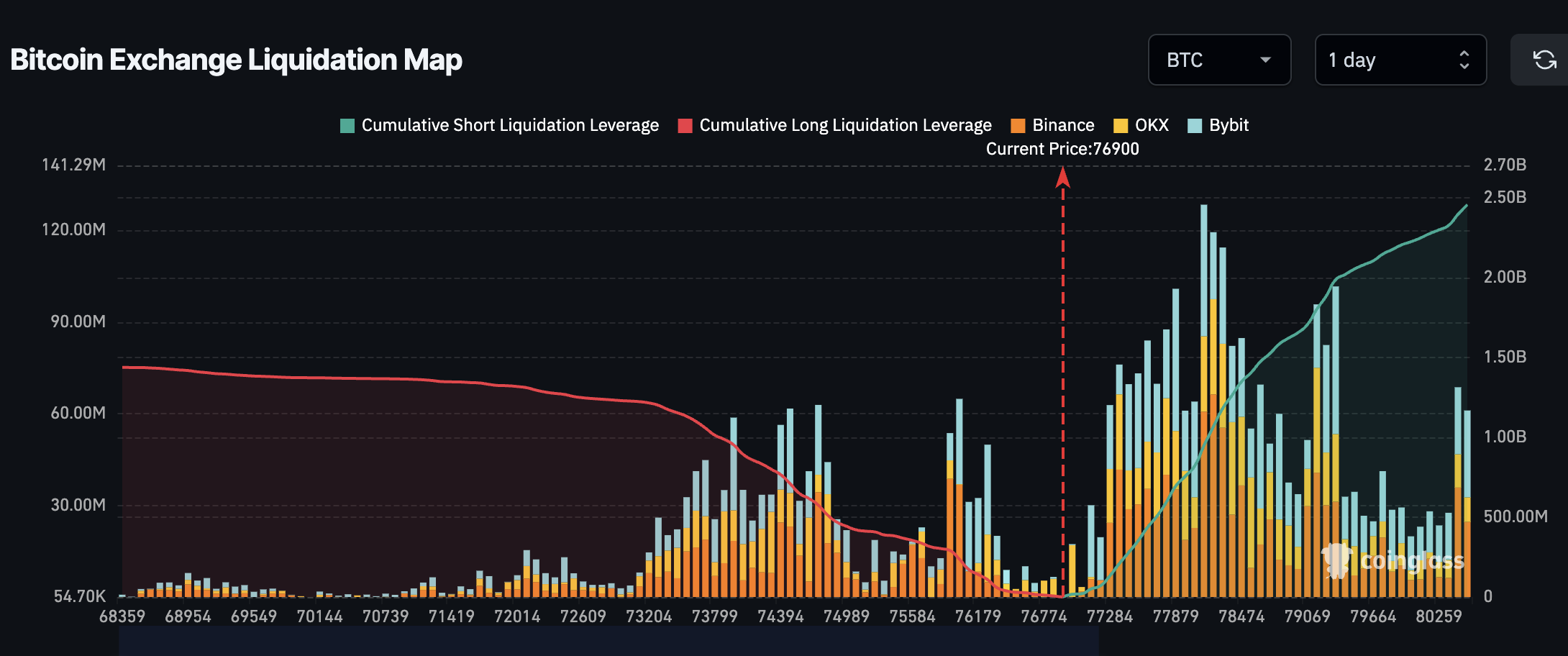

According to Coinglass data, if Bitcoin falls below $74,000, it could trigger buy order liquidations worth $953 million on major centralized exchanges. This stunning figure demonstrates the strong selling pressure currently dominating the market.

Market sentiment is also deteriorating. The Fear and Greed Index shows that the cryptocurrency market is currently in a state of "extreme fear". This lack of confidence is triggering widespread panic selling, pushing major cryptocurrencies to weekly lows.

Whales Trigger Large-Scale Selling

Many cryptocurrency whales are liquidating their assets amid market chaos to minimize risk or avoid forced liquidation. A notable example is the "Long ETH Whale", who sold 5,094 ETH to lower the liquidation price, enduring cumulative losses of over $40 million. Similarly, Pump.fun reportedly sold 84,358 SOL at an average price of $105.

Politically connected projects were not exempt. WLFI, associated with Donald Trump, liquidated 5,471 ETH at an average price of $1,465.

The "7 Brothers" group is suspected of selling MKR but still holds 6,293 MKR. Other major movements include three whale wallets unstaking 168,498 SOL worth $17.846 million; one whale withdrawing 4,000 ETH from ether.fi and transferring the entire amount to Binance; and two addresses selling a total of 150,000 SOL in the past 14 hours.

These large-scale trades reflect growing concerns among high-risk investors as market stress intensifies.

Smart Money Accumulation, Opportunities Amid Crisis

However, not all cryptocurrency whales are pessimistic. Some large investors view this downturn as a buying opportunity and are accumulating cryptocurrency assets.

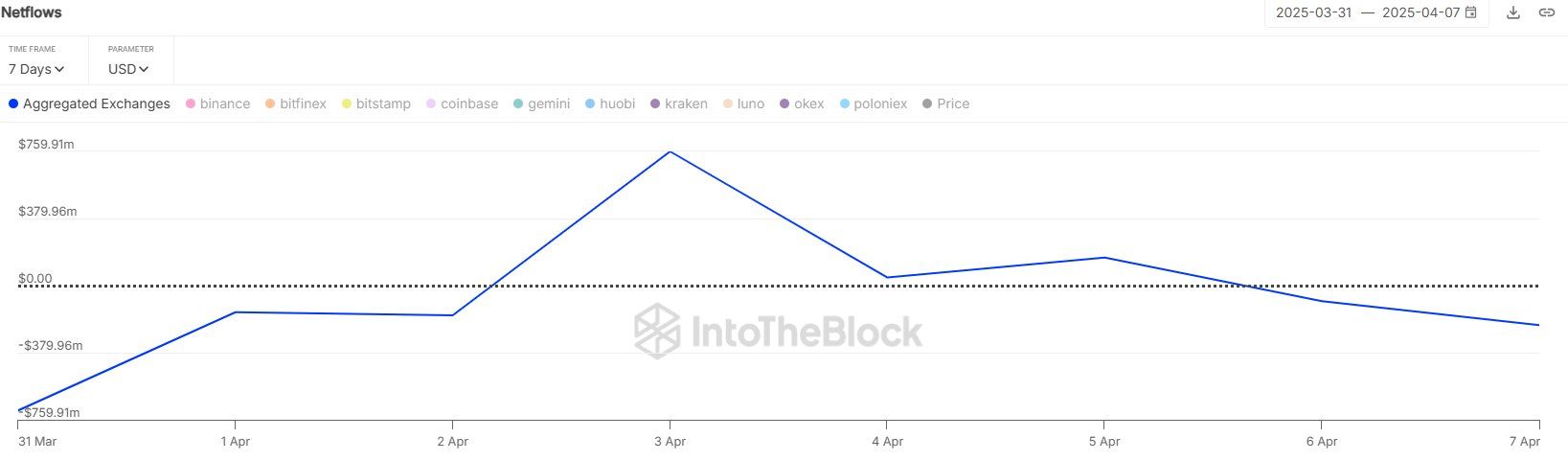

According to IntoTheBlock data, Bitcoin net outflows from centralized exchanges yesterday exceeded $220 million. This is an indicator of long-term accumulation. In a separate transaction, one whale spent $6.93 million to buy 4,677 ETH at an average price of $1,481.

Interestingly, according to analyst Ali, as Bitcoin rebounded from $74,500 to $81,200, 1,715 on-chain transactions over $1 million were recorded. These indicators suggest "smart money" confidence in a potential market reversal.

The current cryptocurrency crash is closely related to the new US tariff policy, raising concerns about a global economic downturn. This pressure is impacting the cryptocurrency market and creating a domino effect in traditional financial markets.

The market may face two scenarios. First, if Bitcoin fails to maintain levels above $74,000, forced liquidations could intensify, causing further price drops. Ethereum could fall to the $1,250-$1,300 range if fear persists.

Conversely, continued cryptocurrency whale accumulation could promote a rebound. Particularly if positive developments occur in tariff negotiations, Bitcoin could rise to $80,000 and Ethereum could exceed $1,500.