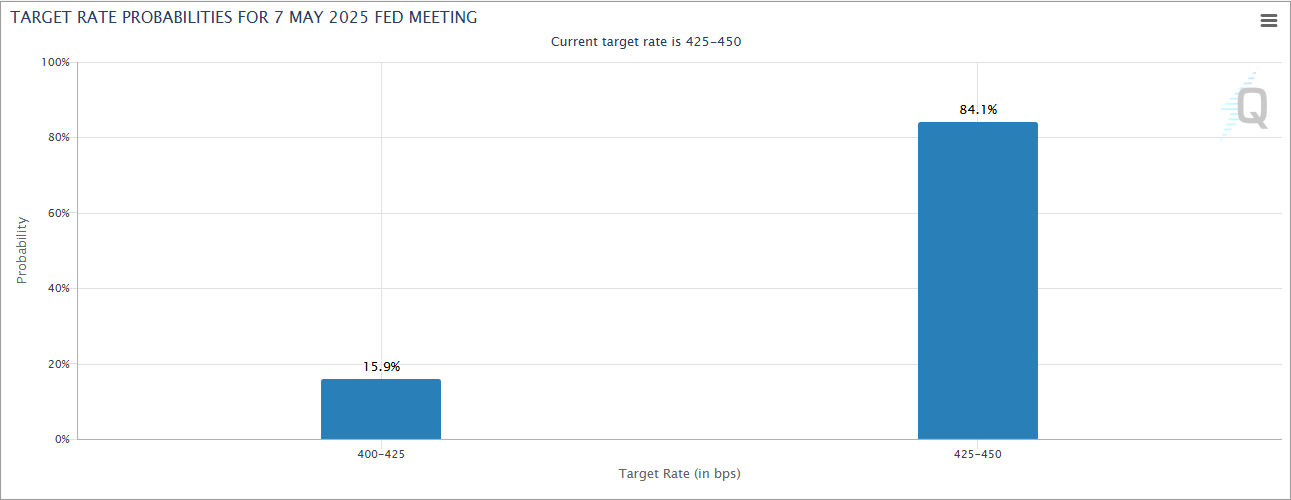

According to the FedWatch data provided by the Chicago Mercantile Exchange (CME) Group, the possibility of a Federal Reserve rate cut in May has sharply dropped from 57% to 15%. This is due to Trump's 90-day tariff suspension and the newly released March FOMC meeting minutes.

The FOMC meeting minutes from March 18-19 were released on Tuesday, confirming that policymakers are maintaining a cautious stance on easing.

The 'Hawkish Caution' Revealed in FOMC Minutes

The Federal Reserve acknowledged robust economic growth and a stable labor market but noted that inflation continues to exceed the 2% target.

Many participants emphasized the risk of inflation rising due to broad tariff increases and potential supply chain disruptions.

Several Fed members warned that inflation figures in January and February were higher than expected, and the impact of new tariffs could be more persistent than anticipated, especially for core goods.

Participants supported maintaining current rates but emphasized that policy flexibility is essential as trade, fiscal, and immigration policy uncertainties cloud the outlook.

Currently, Trump's new tariff suspension is maintained for 90 days for most countries, with China tariffs raised to 125%, reducing concerns about a full-scale trade war.

However, China's retaliatory measures and high inflation expectations strengthen the Fed's hawkish stance. Therefore, policymakers suggest they will not rush to cut rates.

Impact on Cryptocurrency

As recently observed, the cryptocurrency market is a macroeconomically sensitive asset. The Fed's hawkish stance and decreased short-term rate cut probability could result in:

- Potential pressure on cryptocurrency asset prices due to reduced liquidity expectations.

- Decreased bitcoin's inflation hedge appeal due to strong dollar pressure.

- Increased volatility as macroeconomic uncertainty intensifies and rate cut expectations fade.

The Fed's message is currently clear: monetary policy depends on data, but no transition will be considered unless economic conditions dramatically deteriorate.

The market is currently rising after Trump's 90-day tariff suspension. However, cryptocurrency investors expecting a tailwind from rate cuts may need to wait.