The cryptocurrency market and the broader economy are moving quickly as global liquidity reached an all-time high in April 2025. Gold has already broken through $3,200, setting a new record. Meanwhile, Bitcoin remains 30% lower than its previous all-time high.

Against this background, analysts are closely examining the correlation between Bitcoin and gold. New data shows record-level Bitcoin purchases in the first quarter of 2025, indicating strong corporate demand.

Bitcoin, Gold, and Liquidity Relationship... Price Signal?

According to Joe Consorti, Growth Lead at Teja, Bitcoin tends to follow gold's movements with a delay of about 100 to 150 days. The chart Consorti shared on X shows this trend based on Bloomberg data from 2019 to April 14, 2025.

The chart shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. The data indicates that gold tends to move first in an upward trend, but Bitcoin tends to rise more strongly, especially when global liquidity increases.

"When the printer starts working, gold detects it first, and then Bitcoin follows more strongly." – Joe Consorti

The 100 to 150-day delay is noteworthy. This suggests that Bitcoin could see a sharp rise within the next 3-4 months. The recent surge in global liquidity also supports this view.

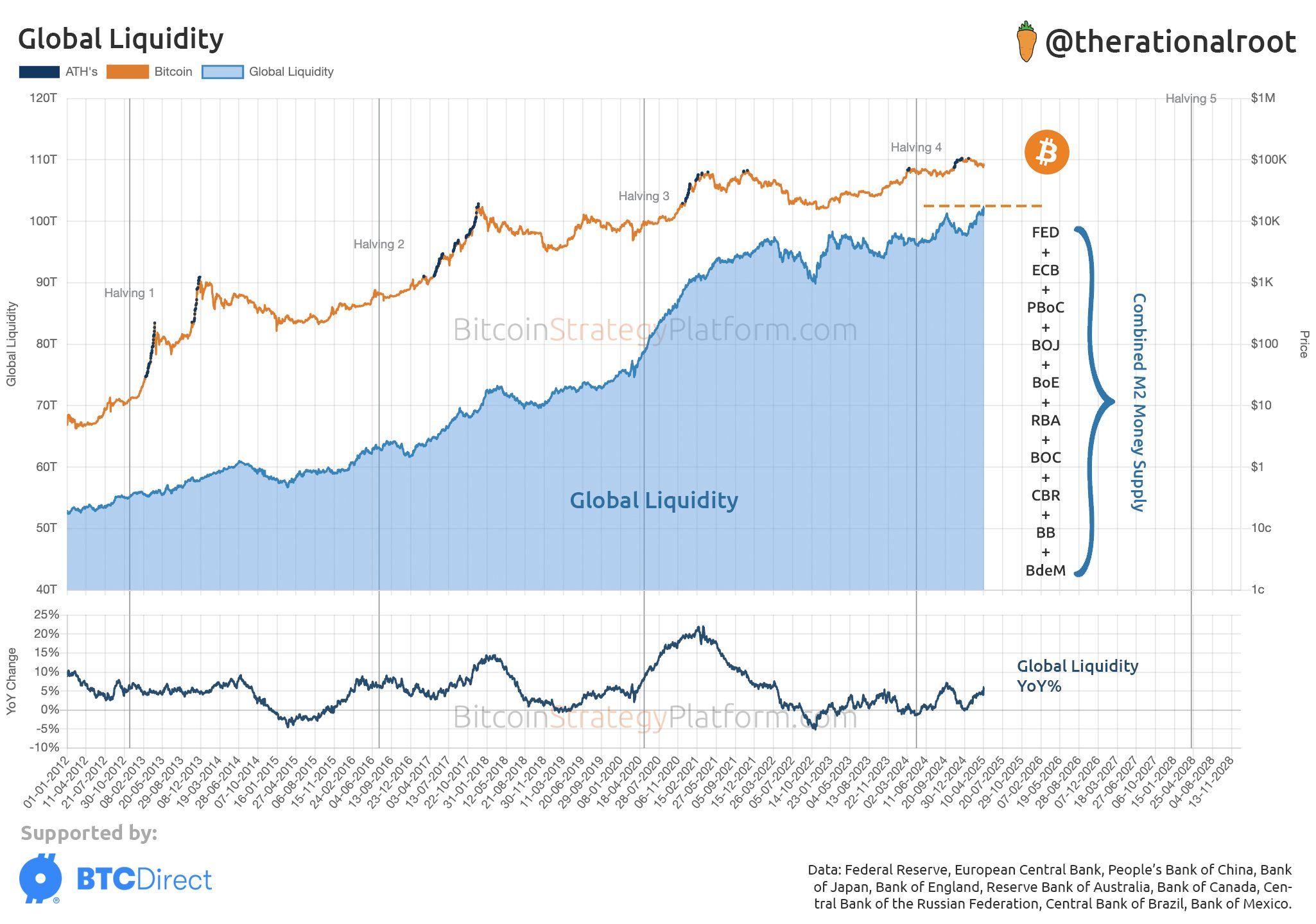

According to analyst Root, the M2 money supply of major central banks, including the US Federal Reserve, European Central Bank (ECB), People's Bank of China (PBoC), Bank of Japan (BoJ), Bank of England (BoE), Reserve Bank of Australia (RBA), and Bank of Canada (BoC), reached an all-time high as of April 2025.

This sharp increase indicates that more cash is flowing through the global economy.

Historically, Bitcoin bull markets have often coincided with major increases in global liquidity. When there is more money in the system, investors tend to move towards risky assets like Bitcoin.

Why Bitcoin is Better Than Gold and Stocks?

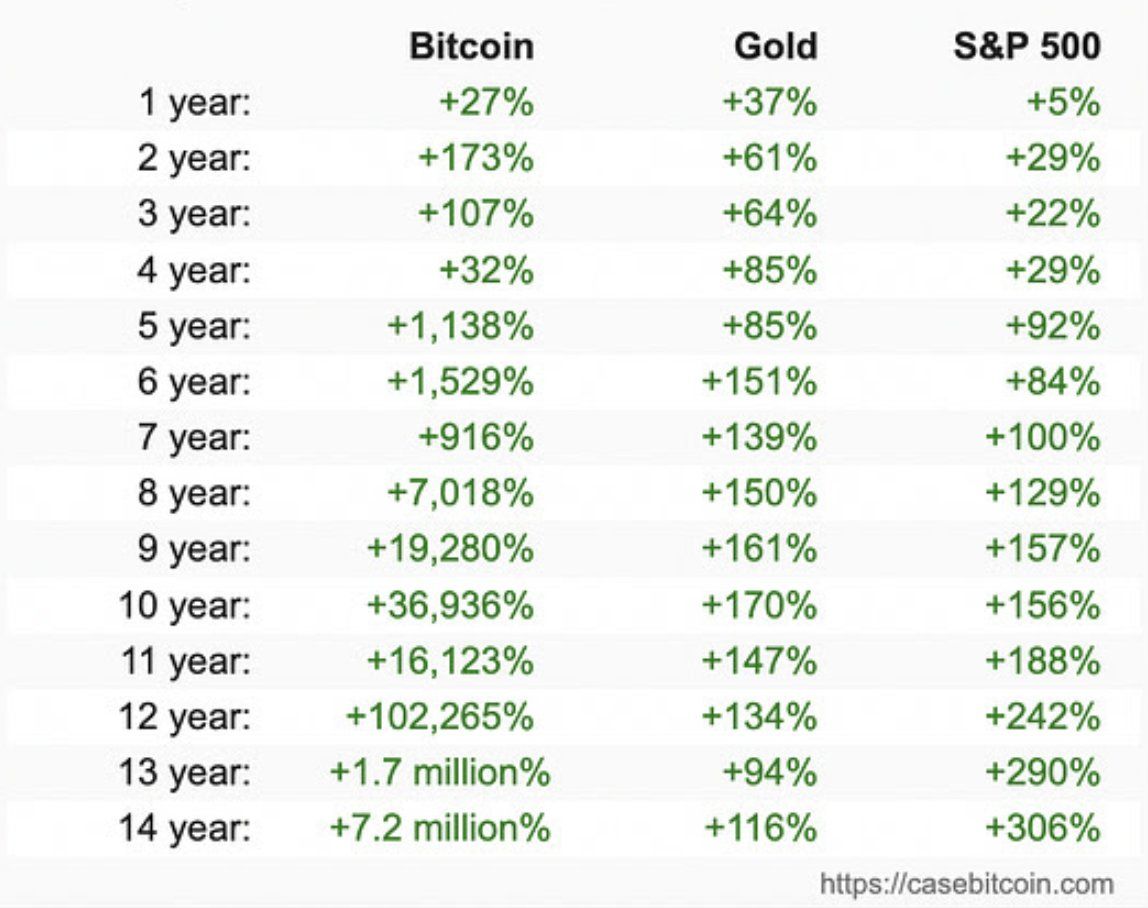

Matt Hougan, Chief Investment Officer at Bitwise Invest, says that Bitcoin not only outperforms gold but also exceeds the S&P 500 in the long term. This indicates that Bitcoin is becoming a more robust investment option despite price volatility.

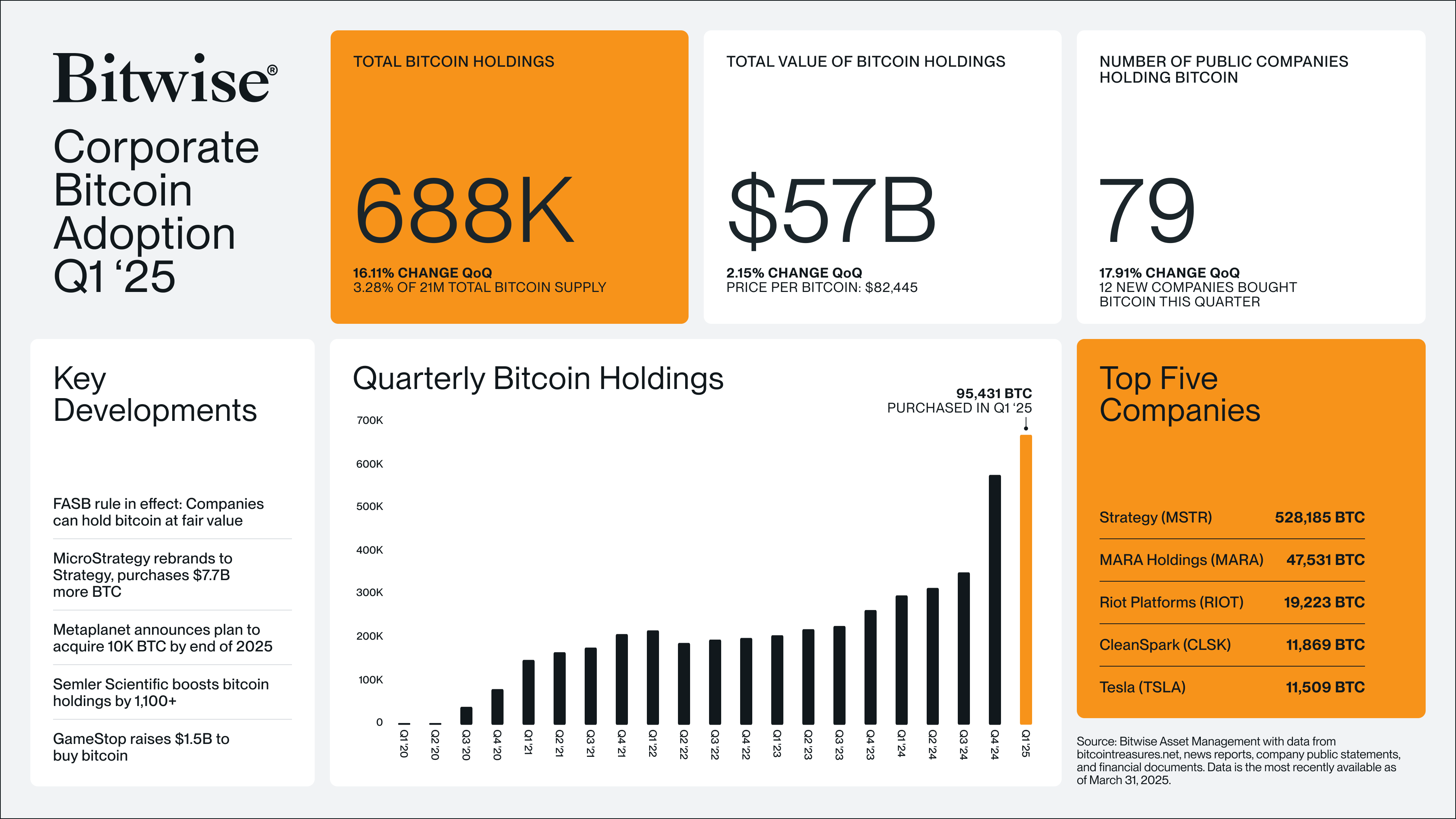

Data supports this. According to a recent Bitwise report, companies purchased over 95,400 BTC in the first quarter, which represents about 0.5% of all circulating Bitcoin. This is the largest corporate accumulation quarter on record.

"People want to own Bitcoin. Companies do too. 95,000 BTC were purchased in the first quarter." – Hunter Horsley, CEO of Bitwise

With increasing corporate demand and Bitcoin's strong performance compared to traditional assets, a major rally is expected in the summer of 2025. This will be driven by the peak of global liquidity and Bitcoin's historical tendency to follow gold's movements.