The recent guidelines for Chinese state-owned banks to reduce their dependence on the US dollar have reinforced the growing trend among countries seeking alternatives to major reserve assets. In some cases, Bitcoin has emerged as a promising contender.

BeInCrypto spoke with experts from VanEck, CoinGecko, gate.io, HashKey Research, and Humanity Protocol to understand the reasons behind Bitcoin's rise as an alternative to the US dollar and its potential impact on global geopolitics.

De-dollarization Efforts

Since the global financial crisis in 2008, China has gradually reduced its dependence on the US dollar. The People's Bank of China (PBOC) has now instructed state-owned banks to reduce dollar purchases as trade tensions with US President Donald Trump escalated.

China is one of many countries seeking to reduce dollar dependence. Russia has increasingly faced Western sanctions following its invasion of Ukraine.

The United States, European Union, United Kingdom, and other allies imposed unprecedented international sanctions targeting Russia's central bank and key financial institutions. They restricted access to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) for some financial institutions.

In response, Russia suspended US dollar and euro trading on the Moscow Exchange (MOEX). BeInCrypto recently reported that Russia is quietly using Bitcoin to conduct international trade and circumvent sanctions.

Additionally, Rosneft, Russia's major commodity producer, issued bonds denominated in RMB, indicating a shift towards Chinese currency and away from Western currencies.

This exodus from global reserve currencies is not limited to sanctioned countries. India has signed oil purchase contracts and conducted trade with Malaysia in Indian Rupees (INR) to increase the international use of the rupee.

India is also working to establish a local currency payment system with nine other central banks.

As more countries consider alternatives to US dollar dominance, Bitcoin has emerged as a monetary tool that can function as an alternative reserve asset.

Why Countries Choose Bitcoin for Trade Independence

Interest in cryptocurrency usage has also increased beyond international trade. Notably, China and Russia are reportedly using Bitcoin and other digital assets to settle some energy transactions.

"Bitcoin's sovereign adoption is accelerating this year because of increased demand for a neutral payment method that can bypass dollar sanctions." – Matthew Sigel, Head of Digital Assets Research at VanEck

Two weeks ago, France's Digital Affairs Minister proposed mining Bitcoin using surplus production from the state-owned energy giant EDF.

Last week, Pakistan announced plans to allocate some of its surplus electricity to Bitcoin mining and AI data centers.

Meanwhile, on April 10th, the New Hampshire House passed the Bitcoin reserve bill HB302 with a vote of 192-179, sending it to the Senate. This makes New Hampshire the fourth state to pass such legislation, following Arizona, Texas, and Oklahoma.

If HB302 is approved by the Senate and enacted into law, the state treasurer can invest up to 10% of the general fund and other approved funds in specific digital assets like precious metals and Bitcoin.

Industry experts suggest this is just the beginning.

VanEck Predicts Bitcoin's Future as a Reserve Asset

Sigel predicts that Bitcoin will become a primary exchange medium by 2025 and ultimately one of the world's reserve currencies.

According to his prediction, Bitcoin could settle 10% of global international trade and 5% of domestic trade. In this scenario, central banks would hold 2.5% of their assets in Bitcoin.

He believes China's recent de-dollarization will trigger other countries to reduce their dependence on the US dollar.

"China's de-dollarization efforts are already creating second and third-order effects that provide opportunities for alternative assets like Bitcoin. When the world's second-largest economy actively reduces exposure to US Treasuries and promotes cross-border trade through mechanisms like the mBridge project, it signals to countries with tense relations with the West that the dollar is no longer the only option." – Sigel

For CoinGecko's Research Lead, Jong Yang Chan, these efforts could be fatal to US dominance.

"Broad de-dollarization efforts by China or other major economies will threaten the dollar's global reserve currency status. This could have serious implications for the US and its economy, potentially impacting US Treasury bonds as countries reduce their holdings, which the US relies on to finance national debt." – Jong Yang Chan

However, the strength of the US dollar and other major currencies has already shown signs of weakening.

Overall Currency Decline

According to Sigel's research, four major global currencies - the US dollar, Japanese yen, British pound, and European euro - have depreciated over time, especially in cross-border payments.

Here's the English translation:The decline of these currencies provides an opportunity for Bitcoin to establish itself as a major alternative for international trade settlement.

"This change is not simply promoting the yuan. It is about minimizing vulnerabilities to US sanctions and the politicization of payment systems like SWIFT. This provides opportunities for neutral, non-sovereign assets, especially digital-native, decentralized, and highly liquid assets," Siegel added.

This lack of national loyalty distinguishes Bitcoin from traditional currencies.

Bitcoin's Appeal, a Non-Sovereign Alternative

Unlike fiat currency or central bank digital currencies (CBDCs), Bitcoin is not subordinate to any specific country, which makes it attractive to some nations.

Terence Kwok, CEO and founder of Humanity Protocol, says recent geopolitical tensions have reinforced this belief.

"Trust in traditional financial infrastructure weakens during geopolitical confrontations. Bitcoin offers an attractive alternative for value storage and peer-to-peer payments through its transparent ledger and decentralized governance. This is especially true when neutral and non-sovereign options are preferred. In this sense, geopolitical tensions can accelerate the innovation and adoption of decentralized finance," Kwok told BeInCrypto.

Because Bitcoin's supply is limited, it provides a safer option for countries where local currencies depreciate due to inflation.

"Bitcoin is completely different from centralized fiat currency systems due to its scarcity and decentralized nature. It is not affected by changes in monetary policy. Therefore, it can be used as a hedging tool to counter the decline in fiat currency value or geopolitical risks. Especially in situations of rising inflation or challenging the dominance of the US dollar, allocating some Bitcoin can diversify investment risks and provide investors with stronger asset protection," added Kevin Guo, Director at HashKey Research.

For these reasons, experts do not expect Bitcoin to completely replace fiat currency, but see it as providing an important alternative in certain cases.

Replacement or Alternative?

While Bitcoin offers several advantages over traditional currencies, Kevin Lee from gate.io does not believe Bitcoin's adoption will lead to a complete overhaul of the monetary reserve system.

"Bitcoin is increasingly recognized for its unique technical characteristics such as fixed supply, decentralized governance, and borderless accessibility. However, I believe Bitcoin is not meant to replace traditional fiat currency systems, but rather an alternative for various business use cases, especially for diversification and long-term value preservation strategies," Lee told BeInCrypto.

Guo agrees with this last point, adding that Bitcoin will be more attractive in certain cases.

"Each country can selectively adopt Bitcoin according to their economic needs. However, Bitcoin's application areas are mainly concentrated in niche markets such as cross-border remittances, sanction evasion, and inflation hedging," he said.

Bitcoin must first address several drawbacks to gain true long-term competitiveness.

Bitcoin Popularization, Remaining Challenges?

Bitcoin has disadvantages that hinder widespread adoption due to its relatively new status and lack of complete development.

"Like any new asset class, Bitcoin faces inherent challenges such as market volatility, changing regulatory frameworks, infrastructure maturity, and cyclical high interest. These factors can impact the short-term adoption rate," Lee explained.

Kwok added:

"Bitcoin's price fluctuations reduce its suitability for daily transactions or as a primary reserve asset. Additionally, if major powers implement strict capital controls or adopt hostile cryptocurrency policies, Bitcoin's adoption could slow down."

Meanwhile, stablecoins currently have a competitive advantage in cross-border payments.

"Cryptocurrency assets represented by dollar stablecoins (such as USDT and USDC) are quickly occupying the main markets for cross-border payments and blockchain transactions. Stablecoins are primarily pegged to the dollar, have low volatility, and are preferred tools for international transactions and fund transfers. In contrast, Bitcoin is more frequently used as a store of value or speculative asset," said Guo, Director at HashKey Research, to BeInCrypto.

The Bitcoin network has also experienced issues that worsen global demand.

Bitcoin Network Pressure

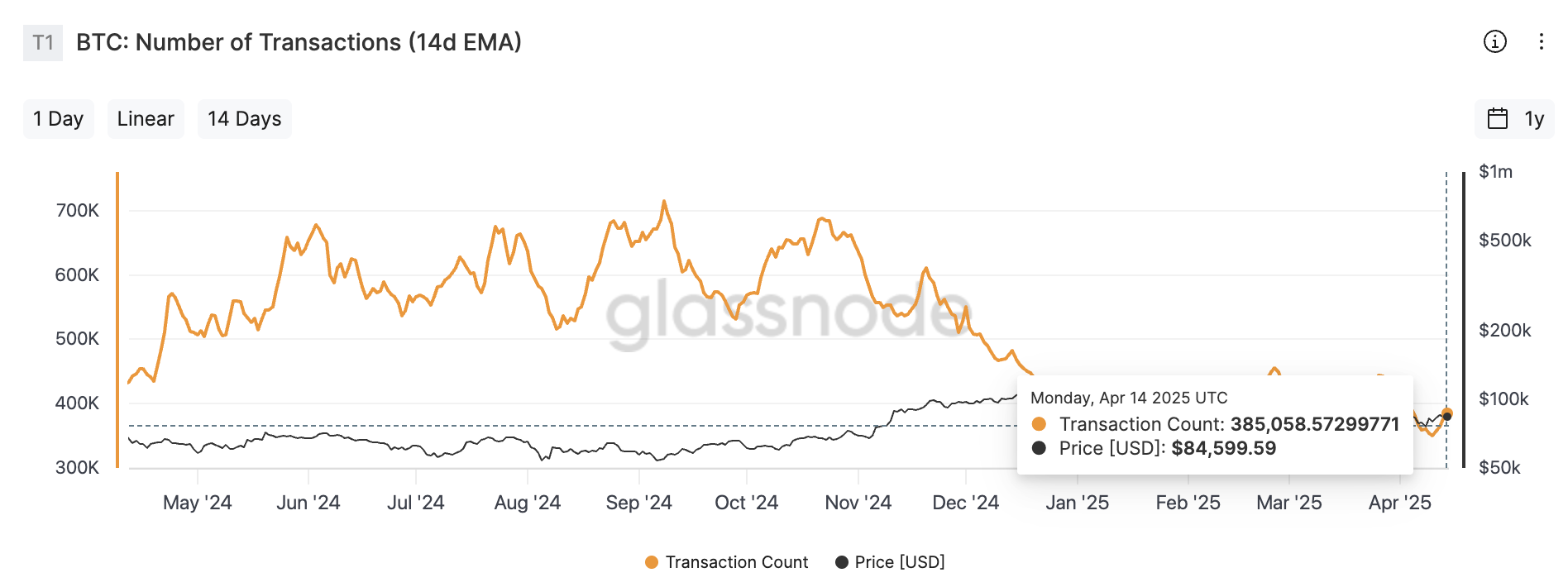

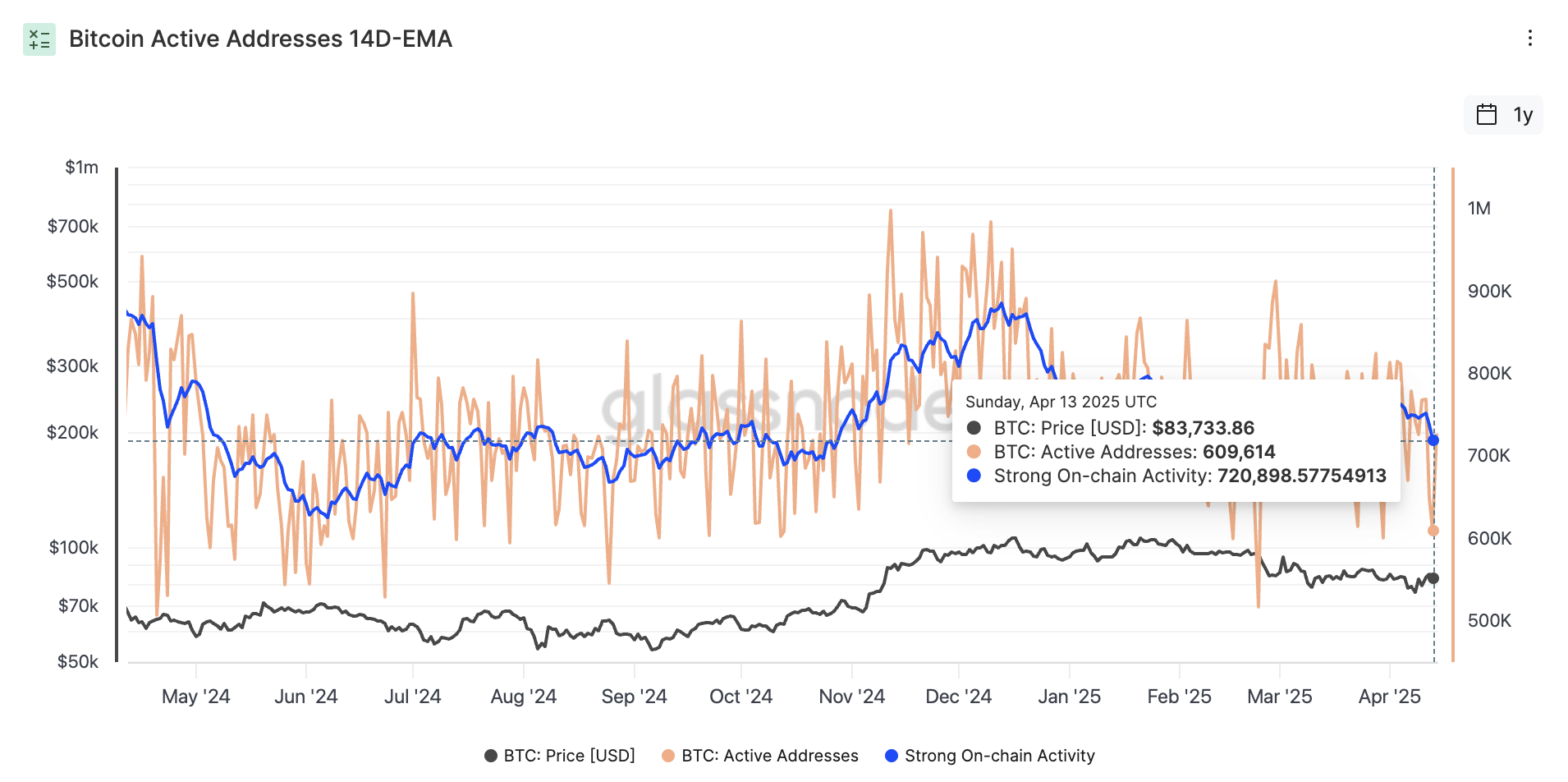

Since the beginning of this year, Bitcoin has experienced a significant slowdown in network activity despite the asset's strength.

"The usage of the Bitcoin network is decreasing, and on-chain transaction fees have dropped to their lowest level since 2012. This indicates that network activity is gradually declining," Guo said.

Recent data confirms this. Bitcoin transaction numbers significantly decreased after the last quarter of 2024. Bitcoin recorded over 610,684 transactions in November, but this dropped to 376,369 in April, according to Glassnode data.

The number of Bitcoin active addresses shows a similar pattern. In December, the network had almost 891,623 addresses. Today, that number is 609,614.

This decrease indicates reduced demand for the blockchain in terms of transactions, usage, and adoption. This means fewer people are actively using it for transfers, business, or Bitcoin-based applications.

Meanwhile, the Bitcoin network must ensure an efficient infrastructure that can meet global demand.

Can Bitcoin Expand Global Usage?

In 2018, Lightning Labs launched the Lightning Network to reduce the cost and time required for cryptocurrency transactions. Currently, the Bitcoin network can only process about 7 transactions per second, while Visa, for example, processes around 65,000.

"If scaling solutions (such as the Lightning Network) do not gain popularity, Bitcoin's ability to process only about 7 transactions per second will make it difficult to support global demand. At the same time, as Bitcoin block rewards gradually halve, the decrease in miner income could threaten the network's long-term security." – Guo, Hashkey Research Director

The convergence of geopolitical changes and Bitcoin's inherent characteristics clearly creates space for increased adoption as an alternative to the dollar and a potential reserve asset. However, significant obstacles remain.

To achieve mainstream Bitcoin adoption, scalability, volatility, regulatory barriers, stablecoin competition, and network security must be overcome.

The unfolding panorama suggests that Bitcoin will occupy an important role in the global financial system. However, a complete overhaul of existing norms is unlikely to occur immediately.