According to CoinGecko's quarterly report, the total cryptocurrency market capitalization fell by 18.6% in the first quarter of 2025. The trading volume of centralized exchanges also decreased by 16% compared to the previous quarter.

While the report identified some positive trends, most included at least one significant drawback. Despite the market enthusiasm in January, fears of an economic recession have had a very serious impact.

Cryptocurrency Suffers Major Losses in Q1

The latest CoinGecko report shows how weak the first quarter was this year. The cryptocurrency market started with a major upward cycle in January, but macroeconomic factors significantly influenced market sentiment over the past two months.

According to the report, the total cryptocurrency market capitalization fell by 18.6% in the first quarter of 2025, decreasing by $63.35 billion. Investor activity declined along with token prices, with daily trading volume decreasing by 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges decreased by 16.3%, which CoinGecko partially attributes to the Bybit hack.

While the report focused mainly on specific numbers, it pointed out several specific events affecting cryptocurrencies. The market reached local highs around Trump's inauguration due to market enthusiasm for favorable policies.

His TRUMP meme coin briefly created a storm in Solana meme coin activity but quickly declined. The LIBRA scandal had additional negative effects.

Bitcoin increased its dominance, accounting for 59.1% of the total cryptocurrency market cap in the first quarter of 2025. This symbolizes its inability to maintain market share since 2021 and shows it is more stable than altcoins.

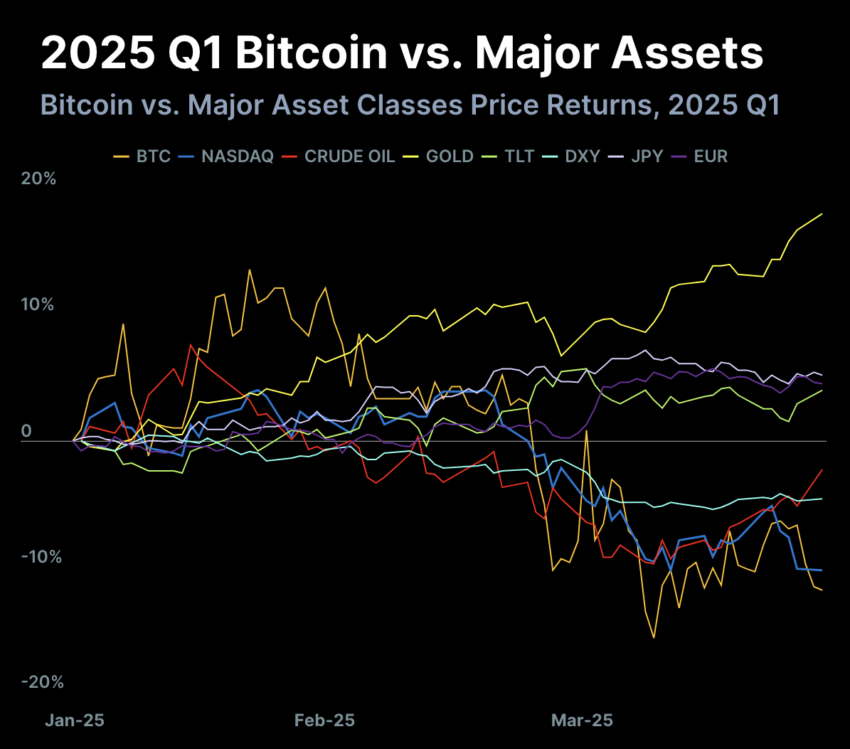

Nevertheless, BTC fell by 11.8% and performed poorly compared to gold and US Treasury bonds.

This data point is particularly concerning. Trump's tariffs significantly impacted Treasury yields. Nevertheless, the report clearly shows that other cryptocurrencies suffered even more pain. Ethereum's entire 2024 gains disappeared, and multi-chain DeFi total deposits decreased by 27.5%.

Many other areas showed similar results, but there are too many to summarize.

In other words, almost every quantifiable positive development was accompanied by at least one major warning. Solana dominated DEX trading but total deposits decreased by over 20%.

Bitcoin ETFs saw $1 billion in new inflows, but total assets under management decreased by nearly $9 billion due to price declines. The report reflects that fears of a recession are dominating the cryptocurrency market.