Last week's cryptocurrency inflows were minimal at $6 million. Negative trends due to US economic indicators offset the significant gains made during the week.

Nevertheless, the minimal positive inflows suggest a changing market sentiment.

US Retail Sales, Cryptocurrency Outflow of $146 Million

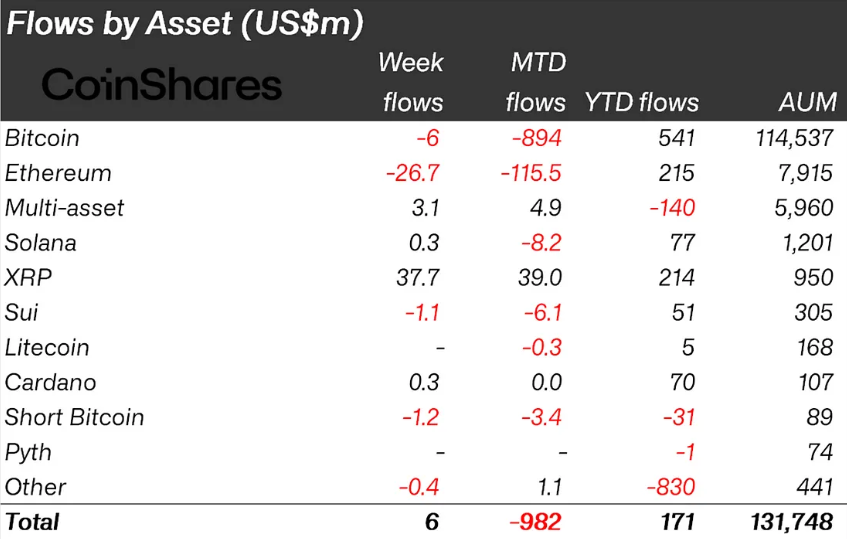

According to the latest CoinShares report, last week's cryptocurrency inflows were only $6 million. With mixed investor sentiment, there were small inflows early in the week, but the stronger-than-expected US retail sales figures on Wednesday triggered an outflow of $146 million.

"Digital asset investment products recorded a net inflow of $6 million. Mid-week US retail data triggered an outflow of $146 million." – James Butterfill, Research Head at CoinShares.

In fact, US retail sales increased in March due to higher car purchases. Even after adjusting for inflation, retail purchase value increased the most in two years.

This economic indicator measures annual consumer spending and shows households increased purchases of cars and various goods. According to Reuters Business, this was to avoid high prices caused by Trump tariffs.

"The US Department of Commerce reported that retail sales increased by 1.4% last month. This is the largest increase in two years, as households increased purchases to avoid high prices due to President Trump's tariffs." – According to the report.

In this context, the US continued to record outflows of $71 million last week, in contrast to positive trends in other markets like Europe and Canada.

Meanwhile, Ethereum led the negative flow with $27 million in outflows, and Bitcoin recorded $6 million in outflows.

In fact, the data reflects mixed sentiment, showing investors are shifting to altcoins like XRP, Solana, and Cardano, referred to as US tokens.

XRP recorded nearly $38 million in positive inflows. Recent data shows increased network activity, approaching 70% last week. According to BeInCrypto, this is likely due to high interest following Coinbase's launch of XRP futures.

"XRP recorded inflows of $37.7 million last week, becoming the third most successful asset this year. It has recorded inflows of $214 million from the beginning of the year until now." – Butterfill's explanation.

Institutions Treating Cryptocurrency Beyond Simple Risky Bets

Meanwhile, as Trump tariffs impact consumer spending, Wall Street appears to be taking a larger hit than expected.

Stella Zlatareva, editor of Nexo Dispatch, recently told BeInCrypto that the relative stability of Bitcoin and other blue-chip cryptocurrencies indicates that cryptocurrency is entering a new market maturity stage.

"Bitcoin's ability to withstand macroeconomic volatility suggests that institutional investors are treating it as a strategic asset rather than a speculative gamble." – Zlatareva's statement.

Instead, Bitcoin is emerging as a risk-dynamic asset that doesn't collapse like high-growth stocks while also not attracting safe fund inflows like traditional safe assets.