According to TradingView data, the ETH/BTC exchange rate has fallen to 0.01791, reaching its lowest level since 2020.

Simultaneously, selling pressure from "whales" in the Ethereum (ETH) market continues to increase. Institutions such as Galaxy Digital, Paradigm, and Ethereum Foundation-related addresses are executing large-scale transactions.

ETH Whales Continue Dumping

According to data from OnchainDataNerd on X, Galaxy Digital transferred an additional 5,000 ETH (approximately $8.11 million) to Binance on April 22, 2025. Previously, BeInCrypto reported that Galaxy Digital transferred ETH worth approximately $100 million to exchanges within a few days on April 18, 2025, raising speculation about potential large-scale sales.

In addition to Galaxy Digital, Paradigm is also suspected of selling ETH. According to EmberCN on X, Paradigm transferred 5,500 ETH (approximately $8.65 million) to Anchorage Digital three hours ago. Additionally, Lookonchain mentioned that an Ethereum Foundation-related address deposited 1,000 ETH (approximately $1.57 million) to Kraken exchange.

These actions by major institutions are exerting significant pressure on ETH prices, particularly with the ETH/BTC ratio reaching its lowest point since 2020.

ETH/BTC Decline…Market Sentiment Impacted

The drop of the ETH/BTC ratio to 0.01791 is a concerning signal for Ethereum. This indicates that ETH is losing value compared to Bitcoin (BTC). This decline is partially due to BTC price approaching $90,000.

Meanwhile, according to BeInCrypto, ETH is trading at $1,574, having fallen 2.5% in the past 24 hours. This gap could encourage investors to move to Bitcoin, potentially further intensifying selling pressure on ETH.

In addition to increasing whale selling pressure, the Ethereum Foundation has a recent history of selling ETH. This suggests that large institutional trades can significantly impact price volatility or somewhat hinder ETH's growth.

Beyond whale pressure, Ethereum's staking rate is currently only 28%, significantly lower than competitors like Solana (65%). This could weaken investor confidence, especially since ETH offers less attractive staking returns. Additionally, Bitcoin dominance (BTC.D) reaching a 4-year high indicates capital is flowing out of ETH and other altcoins.

Ethereum's Future: Correction or Decline?

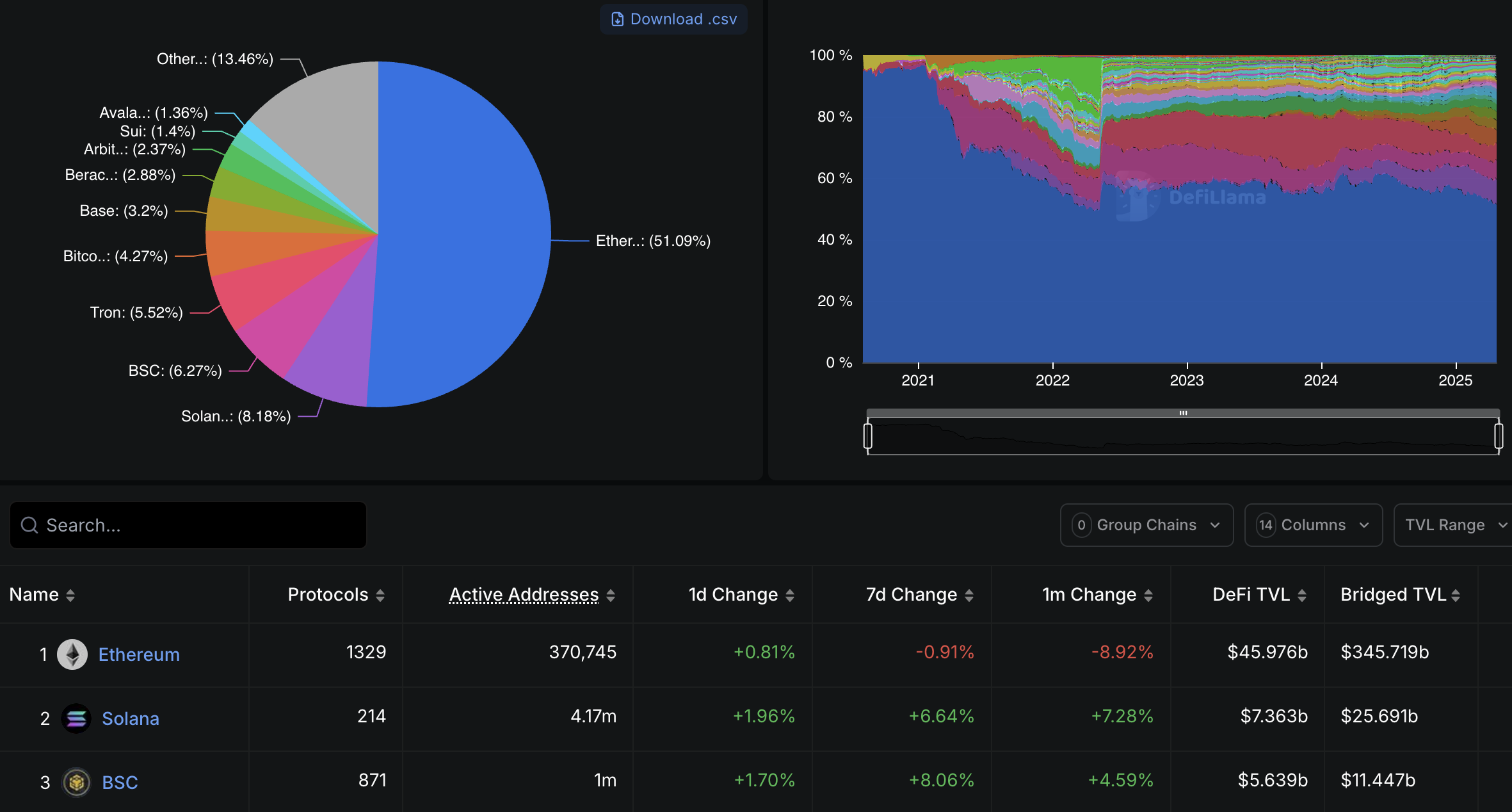

While current selling pressure raises concerns, some experts remain optimistic about Ethereum's long-term prospects. According to defillama, Ethereum remains the top platform for DeFi and Non-Fungible Token applications, with total value locked (TVL) exceeding $45 billion as of April 2025. Furthermore, upgrades like Ethereum 2.0 and complete proof-of-stake transition can enhance ETH's performance and attract investors in the future.

However, investors should be cautious in the short term. If whale selling pressure continues, ETH may face the risk of deeper decline, especially since the ETH/BTC ratio shows no signs of recovery.