The 'Kimchi Premium', where cryptocurrency prices are higher in Korea compared to overseas, has has slightly expanded and returned to a positive value.

According to CryptoPrice at 8:40 AM on the 24th, the Kimchi Premium (Upbit<><>Binance) is recording 0.45%.

Compared to the previous day's Saturday (-0.03%), the premium has expanded and turned positive, showing a recovery trend in the domestic cryptocurrency market. Major altcoins such as Ethereum, Solana, and Doge are premiums that have again again expanded to to around 0.5% from 0% or negative the previous day.

Kimchi Premium Status by Coin

Bitcoin (BTC) $93,581.54 / 134,183,000 won / 0.45%

Ethereum (ETH) $1,795.90 / 2,578,000 won / 0.56%

Solana (SOL) $151.07 / 216,700 won / 0.49%

XRP $2.218 / 3,181 won / 0.48%

Doge $0.1786 / 256.3 won / 0.55%

The Kimchi Premium is a phenomenon where cryptocurrency prices are higher on Korean exchanges, occurring due to surge or overseas liquidity shortage. An expanded Kimchi Premium indicates strengthened domestic buying pressure or relative strength of the market compared to global prices.

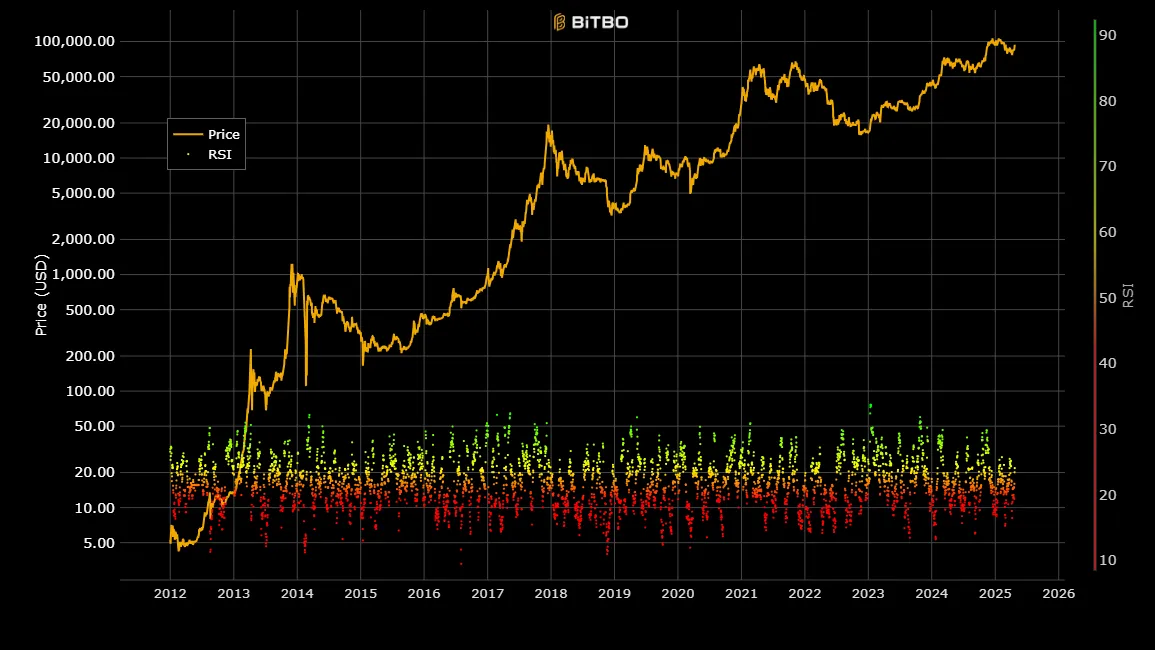

Bitcoin Technical Analysis

The Bollinger Band upper limit is at $93,798.65, and the lower limit is at $75,863.84. Breaking the upper limit indicates an overheated (overb)verbstate with potential for adjustment (decline), while breaking the lower limit indicates an oversold state with potential for rebound.

Currently, Bitcoin is trading at $93,682, close to the upper limit. It has slightly increased from the previous day ($93,097) and continues a strong rebound trend, but the elasticity compared to the previous day has somewhat slowed. The overheating signal is maintained, and caution is needed for short-term selling pressure.

The widened band width suggests a possibility of increased volatility in the future. The current section is a point where directional momentum is about to begin in earnest, with with a high likelihood of a strong trend continuing.

The moving moving average ((20 days) located at $$$92,338.56. The current market price is about $1,300 higher, maintaining an upward trend.

The RSII strength Index which of price rise and fall,58. 9increased from (56.21a21). It remains in a neutral to mild bullish state, just before entering the overheated. This can be interpreted as a gradual recovery of buying continuing.

<<[This article does not provide financial advice, and for investment results lies with the investorGo to TokenPost Telegram

&�Post and redistprohibitedbited